Weekly Market Recap 20240304

99 problems, earnings ain’t one : Rising equity valuations means investors should focus on market were earnings quality is highest and companies can defend profit margins.

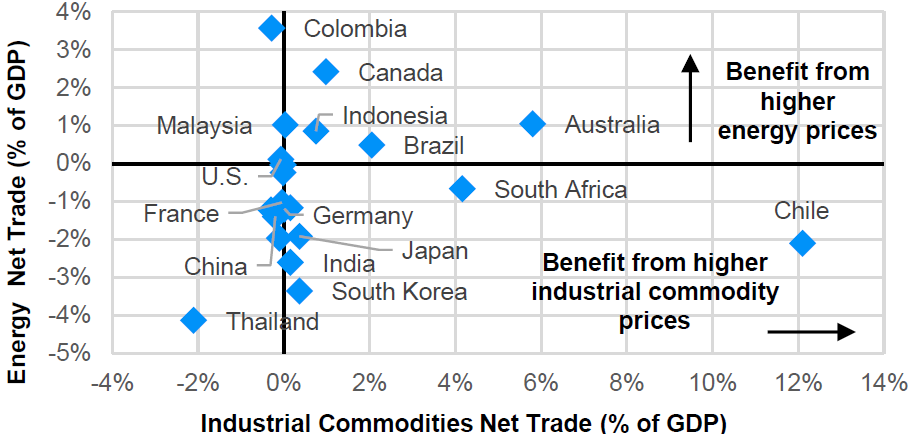

Uneven impact of rising commodity prices

14/03/2022

No one wins in war, but some may benefit. The rise in commodity prices on fears of supply disruptions creates an economic headwind for many economies, especially those that are net energy importers. It’s been said that the solution to high prices is high prices. That is that rising prices create an investment response which increases supply eventually leading to balance in the market. A fiscal response in some nations may take place to increase energy independence whether through fossil or renewable energy production. Given the type of commodity inputs required for the electrification of many industries, certain commodity exporters stand to benefit if this shift is accelerated. The chart below shows where countries sit on the spectrum of net energy trade and net industrial commodity trade. There are some clear beneficiaries of what is currently transpiring in commodity markets. Chile, and South Africa have higher net exports of industrial commodities as a share of GDP. The U.S. is also largely self-sufficient in the industrial commodities and energy.

% of GDP

Source: US comtrade, IMF , J.P. Morgan Asset Management.

Data reflect most recently available as of 12/03/22.

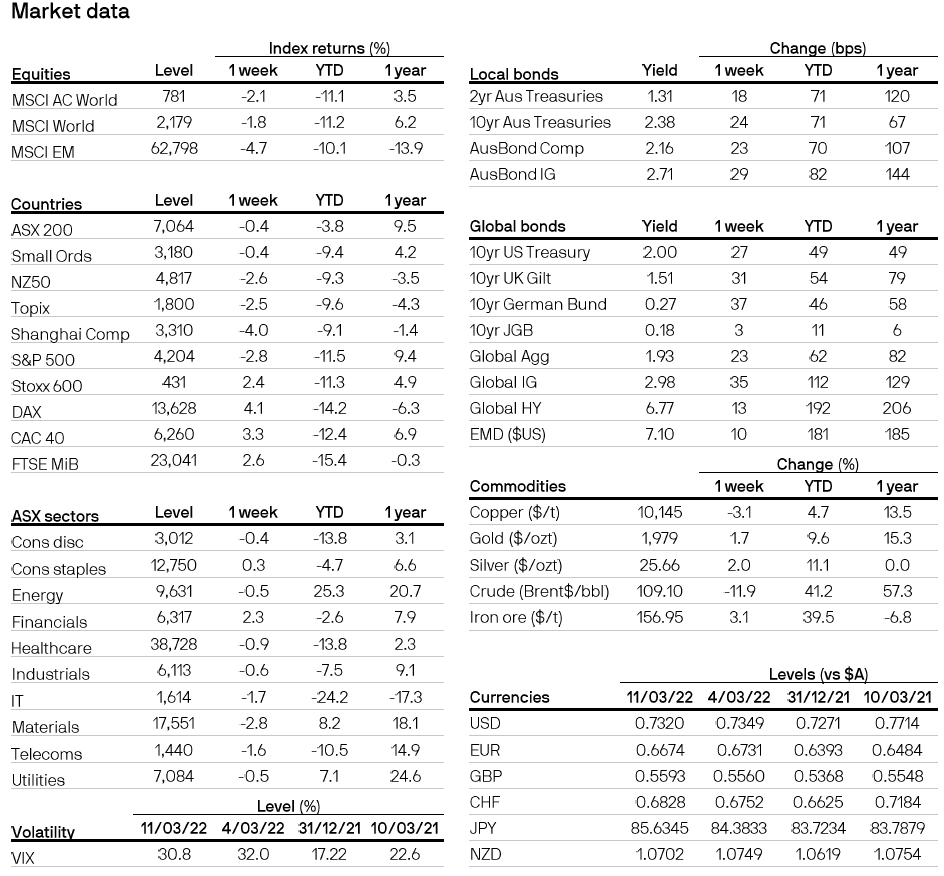

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5

99 problems, earnings ain’t one : Rising equity valuations means investors should focus on market were earnings quality is highest and companies can defend profit margins.

Gold on the ceiling: The rally in the gold price has defied the increase in real rates, but a rising USD may take some of the lustre off the strong performance.

More people, less problems: A boost to the U.S. labour supply creating a softer and wider landing for the U.S. economy.

A hike, a hold and a hesitation: A big week for central banks in Japan, the U.S. and Australia with three very different outcomes.

Taxing times: Political uncertainty may create near term market uncertainty, but the economic cycle matters more for long-term returns.

Buffering: The squeeze on Australian household finances should start to ease, while a rise in the savings rate creates more of buffer to shocks

Hold my sake : Japanese equities break through a record higher, are market expectations dislocated from economic reality?

Smoke and mirrors : The Australian unemployment rate is the highest in two years driven by seasonality rather than real weakness.

Simply the best, for now : A quality bias in equities means leaning into U.S. large caps and diversifying exposure beyond the magnificent seven.

Singing the same ol’ tune : Falling inflation in Australia will not change the RBA’s tune this week, but lower rates in the long over hope to bond investors.

Never going to give you up : Central banks are adamant that rates will not move until inflation is lower, a message likely to be reinforced by the U.S. Fed this week.

Pushing Back : Expectations barely budging despite Fed speakers’ pushbacks

Slowly but surely : Is the fight against inflation over?

New year, old risks: Could supply chains and risings goods prices upset the inflation optimism?

Who let the doves out: Markets have rapidly priced looser monetary policy in 2024, but have they gone too far?

All the small things: The widening valuation gap between large and small cap stocks is gaining investor attention, but they are not without risk

Hold on for one more day: Weaker monthly inflation figure in Australia reinforces an RBA on hold.

Part-time lover: Softer demand for labour and rising supply should lead to a steady rise in the unemployment rate.

Part-time lover: Softer demand for labour and rising supply should lead to a steady rise in the unemployment rate.

Bad news is good news until it isn’t : The decline in bond yields could unwind the Fed’s reliance on tighter financial conditions unwinding positive sentiment in markets

YCC yeah you know me : The Bank of Japan continues to go its own way taking steps to move away from ultra-loose policies and yield curve control

Our house : Higher interest rates in the U.S. are staring to have an impact, just look at the housing market.

A November hike : The low unemployment rate and inflation being too slow to fall is setting the RBA for a November rate hike

Work smarter not harder : Higher yields have tightening financial conditions doing the Fed’s job for them, but will it last.

Under pressure : Market focus will soon rotation from macro to micro as the U.S. earnings season gets underway.

Under pressure : Market focus will soon rotation from macro to micro as the U.S. earnings season gets underway.

Higher for even longer? : Markets were hoping for rate cuts in 2024, but central banks are signalling higher for longer.

Throwing a lifeline : China’s government faces the tough job of balancing between preventing a moral hazard and defusing systematic risks when it comes to the local government debt problem.

Working hard, or hardly working: Australia’s economy is chugging along, but productivity needs to rise to improve the growth outlook.

JOLT out of the blue: A less imbalanced U.S. labour market diminishes the risk of further Fed rate hikes

Sliding into a September pause: Sliding economic data outlast week suggest central banks will pause on rate hikes come September

The Aussie dollar decline: There is more than on force weighing on the Aussie dollar, but they won’t all last

The inflation trend is your friend: U.S. inflation continues to trend down, but a resilient economy may slow the downward trend

What matters more, lending or financial conditions? : Lending conditions continue to tighten at a time financial conditions have loosened. This may explain some of the resilience in the U.S. economy.

China is getting ready to spend : China is finally taking action to stabilise a fragile economy, but will it matter?

The price is not yet right : Softer inflation reports globally suggest disinflation pressures are building. Will Australia follow suit this week?

Car trouble : U.S. ‘super-core’ inflation isn’t being pushed higher by wages, but car prices.

Better than all the rest : The concentration of the rally in U.S. equities creates both risk and opportunity.

Recession was the case that they gave me : Better economic data from the U.S. doesn’t fade the recession risk, rather pushes it into the future

Debt servicing squeeze : Households are both payers and earners of interest, unfortunately the balance is tilted towards payments and squeezing consumption

Fed enters the triple jump : After the May hop, the June skip, the Fed is poised for a jump in rates in the coming meetings.

I quit : The U.S. labour market is looser, but only if you look at the right numbers

I quit : The U.S. labour market is looser, but only if you look at the right numbers

Bending not breaking (yet) : Economic data paints a picture of a resilient economy, but how far can it bend?

Tide’s is turning on employment : The surprise jump in the unemployment rate maybe a signal of things to come

SLOOS you lose : Evidence of further tightening in lending conditions part of a losing formula for the U.S. economy

Are they done? : That may have been the last hike from the U.S. Fed and RBA.

Shifting sands of Australian inflation : Australian inflation has peaked but the path downward will still be gradual

What does the 1Q23 economic data mean for China? : This week’s CHART and THOUGHT look at China’s 1Q23 economic data and implications on China’s upcoming earnings.

No loosening in the labour market : Australia’s labour market is very tight, but leading indicators suggest softening ahead.

What’s my rate again?: Markets are debating whether the Fed will push the policy rate over 5%, but the actually policy rate may already be over 6%.

Lending standards and the Fed: Credit is oxygen to the economy, restrict it and growth will suffocate

Sticky shelter costs: Slow moving property market means U.S. will not hit inflation target this year

Blowing through the buffer: The savings rate has fallen to pre-pandemic levels increasing the pressure on household spending habits.

Blowing through the buffer: The savings rate has fallen to pre-pandemic levels increasing the pressure on household spending habits.

Good news is bad news : A resilient economy comes at a cost, higher rates

Not bothered : Australian business conditions ticked higher in January, but will it last?

Take me higher : Rates are going higher but just how much is still up for debate.

Looking for the bright side : Equities have a romantic view of the outlook but may not love corporate earnings.

Hard vs soft landing : The rally in equities suggests the market is discounting the chance of a U.S. recession. Is this time really different?

Sticky vs flexible inflation : Falling inflation is helping markets to rally, but the sticky parts of the inflation basket are yet to move

Margin call : How far will companies go to protect margins?

Higher ground : Waiting on the U.S. Fed to signal where they think rates will go in 2023.

Second hand news : The monthly inflation series suggests inflation is peaking, but this won’t change the outlook for the RBA this week.

Recession is coming: The recession is coming, but not everywhere and not all at once.

Takin’ care of business : Inflation may be starting to roll-over but unemployment rates really yet to rise, central banks have more to do

My own two hands : The size of U.S. rate hikes may be about to get smaller, but the ending policy rate may be higher.

My own two hands : The size of U.S. rate hikes may be about to get smaller, but the ending policy rate may be higher.

Under pressure : Domestic inflation pressures rose sharply in the third quarter, but it’s a case of slower not lower for the RBA.

Hey now, you’re an all-star : Restrained supply may be one reason credit spreads are not wider, but this won’t last.

Ready for the fall : Earnings expectations are yet to catch up to the market, this may change in the current U.S. earnings season

sLOWEly does it : Pivot and pivot again, a smaller than expected RBA rate hike last week raised markets hopes for the peak in hawkish central banks.

Times like these : The aggressive repricing of rates is tightening financial conditions much faster than prior rate hike cycles

Fasten your seatbelt for a bumpy ride: Looking at the Fed’s recent rate hike and the current economic outlook.

I’ve got the power : Fiscal support is picking up in Europe as governments try to keep the lights on

Nothing comes close : How close is close enough for central banks when it comes to getting inflation back to target

The heat is on : A big week for central banks as the market grapples with higher for longer when it comes to interest rates

That don’t impress me much : The U.S. may avoid recession, but don’t expect a lot of growth from the world’s largest economy.

Castles made of sand : Chinese stocks have been left out of the bear market rally, when will sentiment turn for the better?

Castles made of sand : Chinese stocks have been left out of the bear market rally, when will sentiment turn for the better?

Are you gonna go my way : Up or down? Business surveys are providing conflicting messages on the health of the U.S. economy.

Is this it? : Growth is taking over from inflation has driving force for yields. Is this it for higher yields or just a pause?

Some don’t like it hot : Inflation continues to run ahead of forecasts, keeping pressure on central banks to deliver outsized rate hikes.

Are we there yet?: U.S. inflation is rising, but bond yields are falling. Do recession risks mean that we’ve passed the peak in yields?

What to expect when you’re expecting : Market based measures of inflation expectations are softening, but may not be enough for rate setters

When the spending stops : Consumers not confident, but still spending

Not yet the house of pain: Housing activity in the U.S. is slowing but lack of inventory will support prices and household wealth.

Rumour has it : The leaked guidance by the U.S. Federal Reserve pushed up rate expectations, and suggests a more aggressive pace of rate hikes to come.

A show of wealth : A cooling housing market and rising rates may lead to many Australian feeling less wealthy.

Stuttering not stopping : Economic data out last week points to a slide in activity in developed economies rather than a stall.

Don’t step on the crack : Markets are pricing for a recession which may not come, but some cracks are starting to appear in the riskier parts of the credit market.

Rocky mountain high : U.S. inflation is still running hot, rocking markets last week, but we may be passing the peak in both inflation and central bank hawkishness.

Higher ground : Central banks are acting to catch up to the inflation outlook and willing to front load rate hikes, but this may not lead to a soft landing for the economy.

The heat is on : The strong inflation reading for Australia should be enough to spur the RBA into action this week, but only slowly.

Off target : Inflation pressures are building more slowly across Asia, and some central banks are responding, but the normalisation path will be relatively gradual.

Tired of waiting for you : The RBA has signaled that higher rates are coming, but the market remains far ahead of what may be delivered.

Dealing with distortion : Rising yields hide the very negative real yields underneath as the distortion in bond markets grows

Fighting back with fiscal : Europe’s probability of recession is predicated by governments willingness to spend.

False start for recession : Flattening yield curves and falling sentiment gaps maybe signaling a false start to a recession.

The impact of Russian default on global banking system should have limited effects on the global financial system.

Wind of change: Business sentiment surveys picked up in February as omicron fades, but higher oil price brings a new headwind to the global economy.

Under pressure: Core rates of inflation continue to rise in many developed markets, will central banks come out fighting with big rate hikes?

The de-rating of equities in the face of tighter monetary policy is weighing on markets, but valuations should find a footing once this recalibration process is complete.

Not as bad as you think.

Turn it around: This week’s thought and chart look at the improving sentiment in the manufacturing sector and why the momentum in the economy shouldn’t be underestimated.

Diversification does not guarantee positive returns or eliminate risk of loss.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be. In Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only.

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2026 JPMorgan Chase & Co. All rights reserved.

For more information, please call or email us. You can also contact your J.P. Morgan representative.

1800 576 100 (Application enquiries)