Week in review

- U.S. CPI inflation steady at 3.2% y/y for July

- China CPI inflation falls to -0.3% y/y in July

- Australia consumer confidence steady at 81.0

Week ahead

- RBA minutes of August policy meeting

- Australia labour market report

- China retail sales and fixed asset investment

Thought of the week

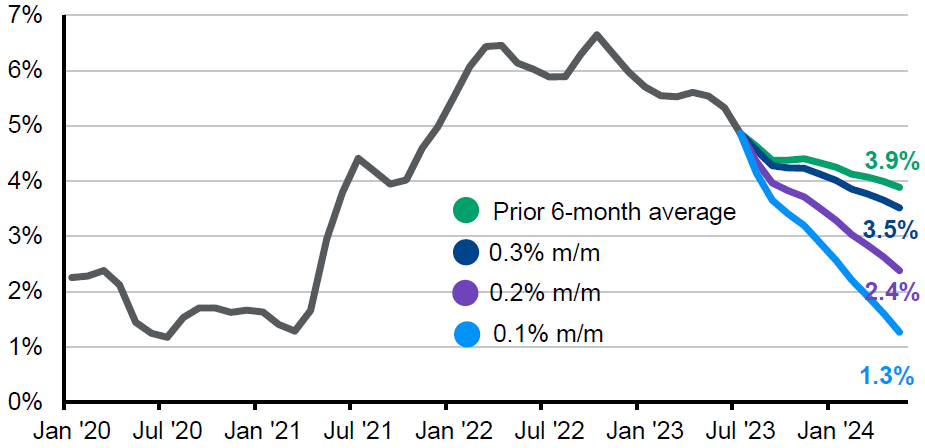

The softer labour market data and inflation in July for the U.S. has increased the likelihood that the U.S. Fed will hold off on hiking rates in September. The breakdown of the U.S. inflation suggests a slow path to a more normal level is underway. However, the question is whether this slow path is too slow for the Fed? The better levels of economic activity and continued tightness in labour market may still not be enough for the Fed to give up on rate hikes, or at least see prospects for rate cuts being pushed further into 2024. The downside risk to the soft-landing narrative remains further policy tightening that creates a stronger downdraft on the economy. Markets seem to take the alternate view and that there may be more upside risk to the U.S. economic outlook, given the stronger equity performance and re-rating in equity markets this year. While we see increasing probability that the Fed is done hiking rates and that the U.S. is likely to avoid a recession the growth outlook remains challenged. As such, investors should temper both their expectations for equity returns and just how far longer dated bond yields will fall in a higher for longer rate environment.

U.S. core inflation on the path to normalisation

Scenarios for core inflation based on various monthly inflation rates

Source: BLS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 11/08/23.

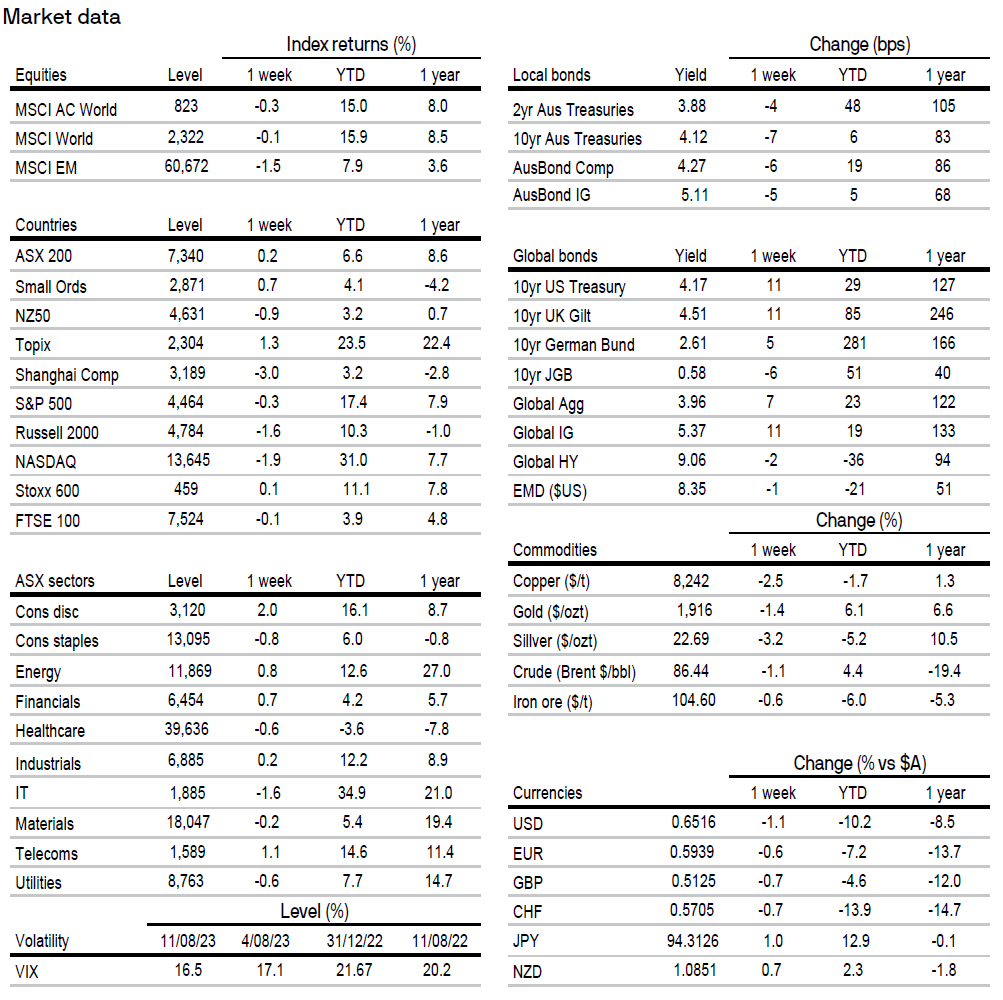

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5