Week in review

- China Markit PMI for manufacturing rises to 51.1

- U.S. job openings rise to 8.756 million in February

- Eurozone inflation falls to 2.4% y/y for March

Week ahead

- Australia consumer confidence and business conditions

- U.S. CPI inflation

- RBNZ official cash rate

Thought of the week

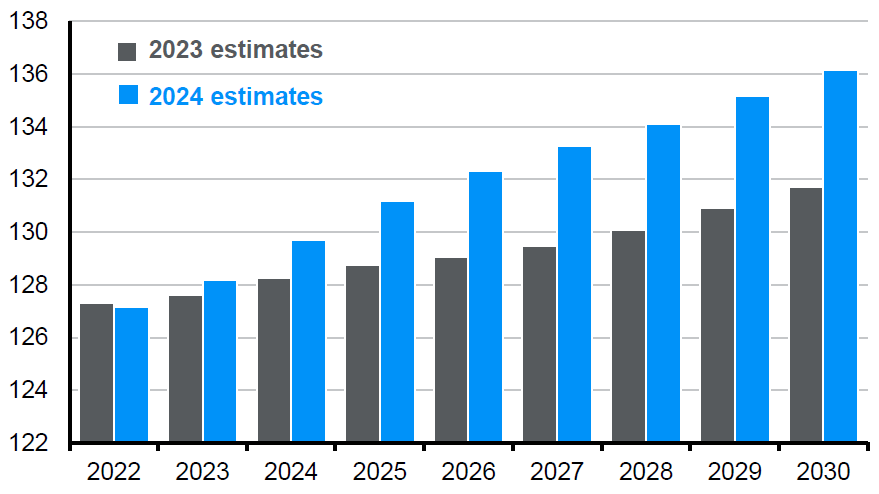

The pandemic highlighted the dramatic impact on inflation when supply is restricted, as goods prices surged and workers were increasingly hard to find. However, the reversal of these supply constraints is a key reason why inflation pressures are easing in the U.S. even as the economy expands at a faster-than-expected pace and growth estimates are being revised higher. The supply of labour has become central to the outlook for the U.S. economy, the path for inflation and for the policy rate. The boost to the U.S. labour supply from an increase in net migration is helping to offset high levels of labour demand (there are still 8.8 million job openings in the U.S.) while holding down average wage growth. The chart illustrates the magnitude of the shift in population growth estimates, which is nearly all driven by foreign-born workers. This could lead to a softer and wider landing for the U.S. economy.

Improving supply of labour should ease U.S. inflation concerns

CBO prime-age population estimates, millions

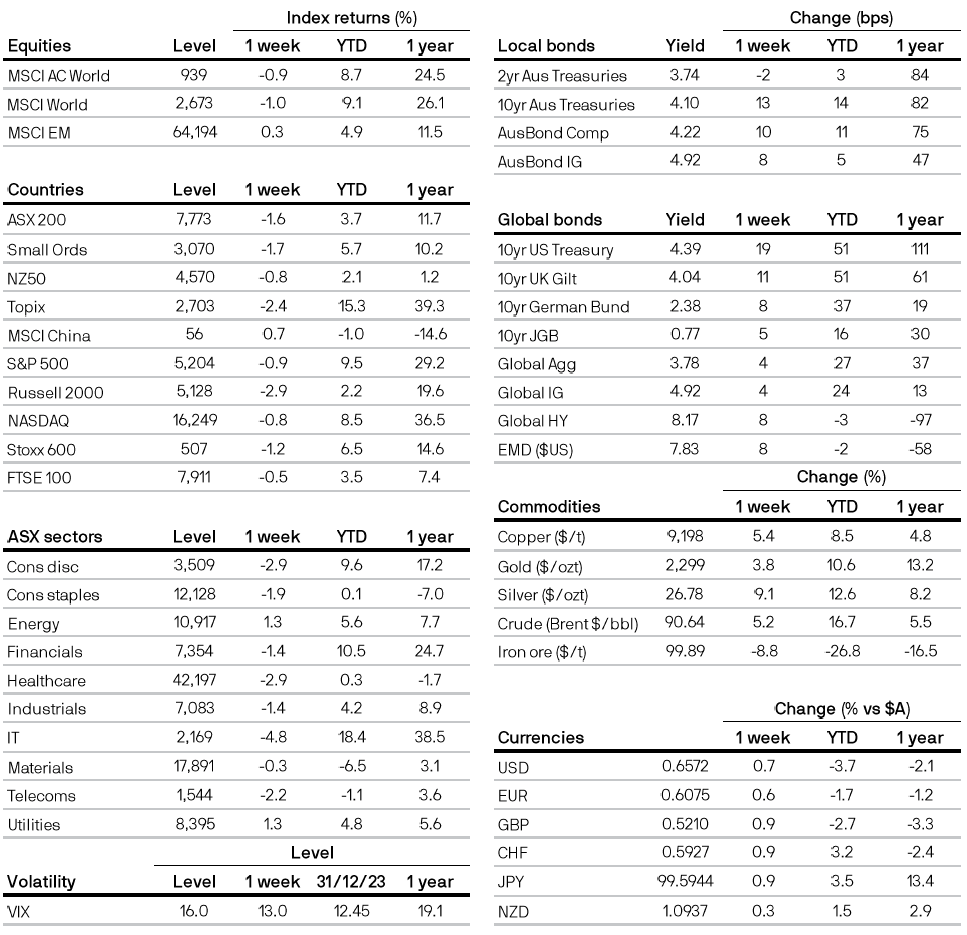

Market data

Source: CBO, J.P. Morgan Asset Management. Data reflect most recently available as of 05/04/24.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5