Week in review

- RBA holds rate for second meeting at 4.1%

- Eurozone economy expanded by 0.6% y/y in 2Q

- China PMI for manufacturing declines to 49.2

Week ahead

- Australia business and consumer confidence

- Chinese CPI inflation

- U.S. CPI inflation

Thought of the week

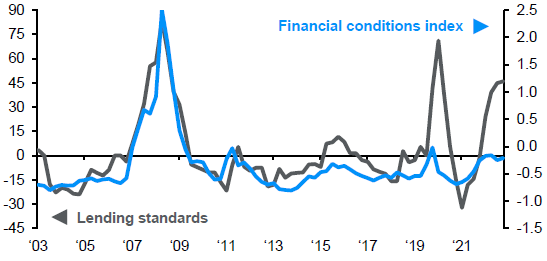

Earlier in the year when the market was fretting over the regional banks in the U.S. the quarterly senior loan official opinion survey (SLOOS) was sharply in focus. The risk was that tighter lending conditions would curb credit growth potentially causing a deeper downturn in the U.S. economy. The latest SLOOS update last week showed that lending conditions got marginally tighter which is to be expected as the Federal Reserve continued to hike rates over the second quarter of the year. The SLOOS survey remains at a level not usually seen unless the economy is in recession, but equity markets performed strongly in July downplaying the risks. This is perhaps because while lending conditions have become more restrictive, the broader financial risks to the economy remain muted. The Chicago Fed’s U.S. Financial Conditions Index (blue line in chart) usually tracks lending conditions more closely but in the most recent episode the lines have deviated suggesting less stress even as lending conditions have tightened. This disconnect could help explain why economic activity in the U.S. has remained resilient despite the evidence from surveys such as the SLOOS.

Lending conditions and financial conditions continue to diverge

Index

Source: Federal Reserve of Chicago, U.S. Federal Reserve, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 04/08/23.

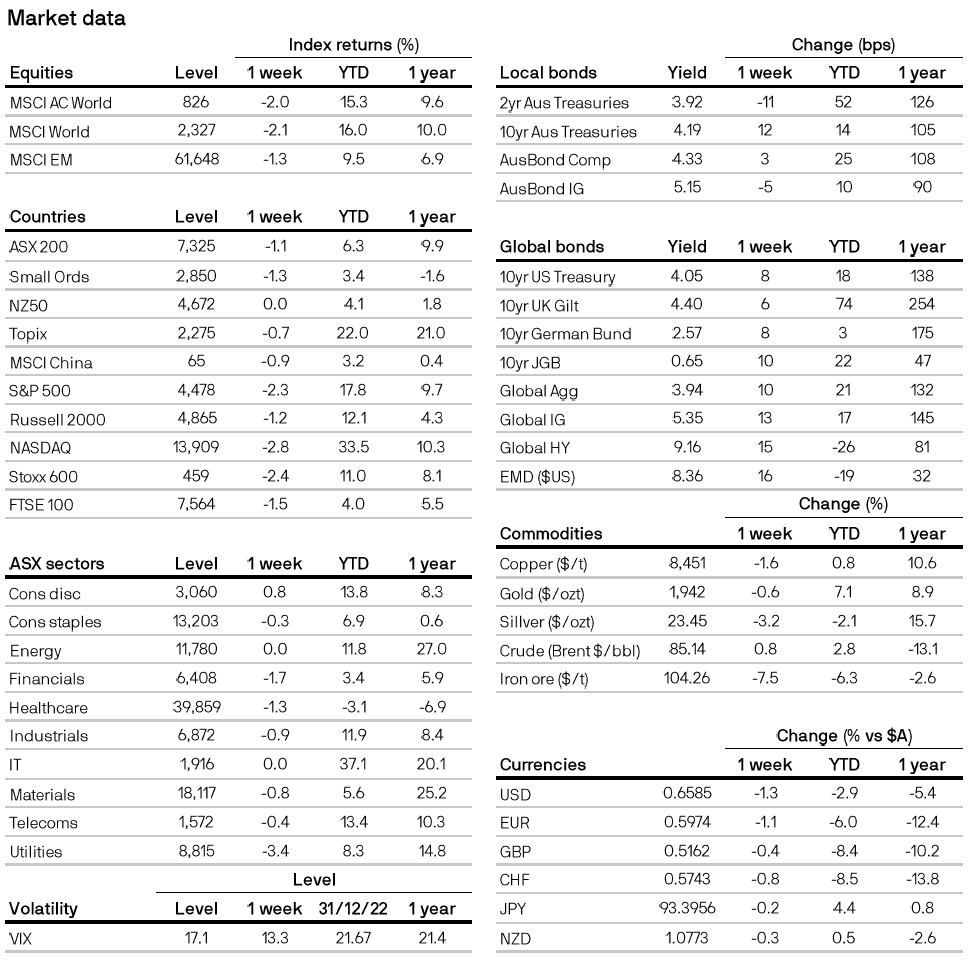

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5