Week in review

- Australia unemployment rate rises to 3.7%

- Australia quarterly wage growth rises to 4.1% y/y

- U.S. CPI inflation falls to 3.2% y/y

Week ahead

- RBA policy meeting minutes

- Eurozone consumer confidence

- PMI composite indices for Eurozone and U.S.

Thought of the week

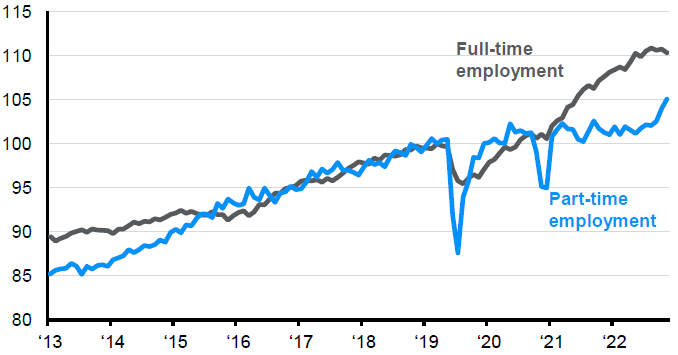

The Australian unemployment rate ticked higher to 3.7% keeping within the narrow range it’s been moving in since January of this year. Employment increased by 55,000 in October but the supply of labour has increased by more and is a positive given the supply side issues that have impacted the economy in prior years. However, the composition of employment growth has changed. Recently there has been a much larger increase in part-time employment than full-time employment (see chart). In fact, part-time employment growth is running at twice the pace of full-time employment growth. This suggests that instead of laying off workers, employers are managing a softer demand outlook by opting for more flexible working conditions. This view is supported by the decline in hours worked. A softening in demand for labour and an increase in supply should lead to a rising unemployment rate.

Signs of easing in the Australian labour market

Rebased to January 2020

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 17/11/23.

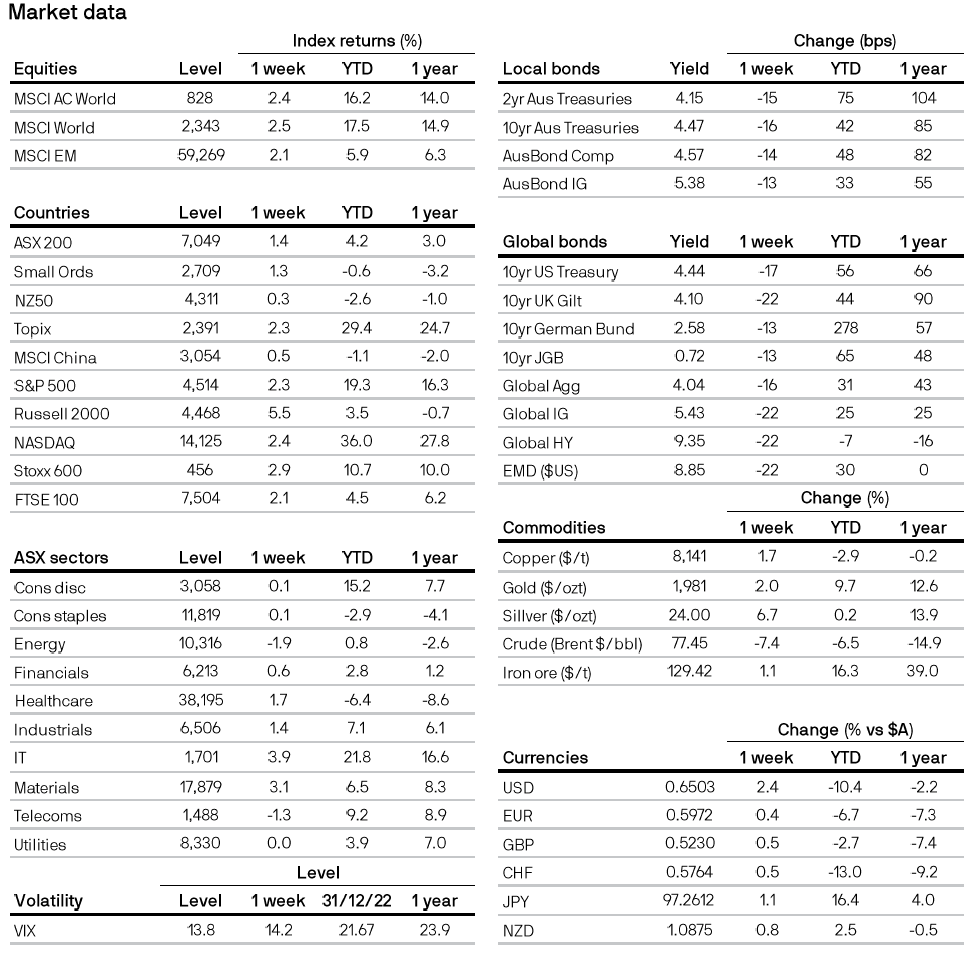

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period. Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5