Week in review

- U.S Federal Reserve holds rates, but signals three cuts this year

- Australia’s unemployment rate falls sharply to 3.7%

- Bank of Japan raises the cash rate for first time in 17 years to 0.0-0.10%

Week ahead

- Australia consumer confidence

- Australia monthly CPI inflation

- U.S. PCE deflator

Thought of the week

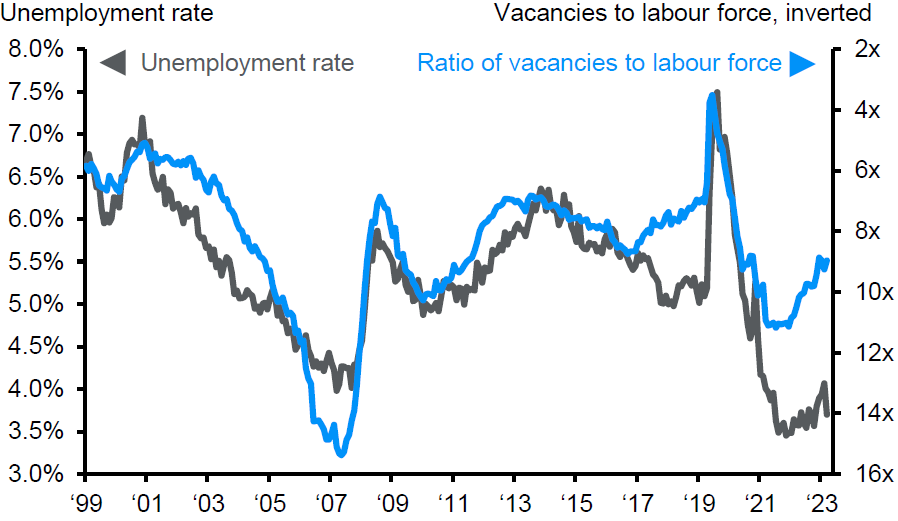

Last week was a big one in the land of central banks. The Bank of Japan raised its policy rate for the first time in 17 years and abandoned its yield curve control policy. The U.S. Fed still expects to cut rates three times this year, but anticipates fewer cuts in 2025. Meanwhile, the RBA held the neutral line towards policy and would not be drawn on forward guidance preferring to assess incoming data. The February employment report reinforced the wait and see approach of the RBA. The unemployment rate unexpectedly fell to 3.7% and employment surged by 116,000. The labour market is a key area of focus for the RBA and the unemployment rate just moved further away from their forecast of 4.2% by June. The tightness in the labour market should abate, but possibly not as fast as the RBA would like, suggesting the market pricing for a rate cut in the second half of the year may turn out to be wrong, with early 2025 being more likely.

A softer labour market ahead, but how fast matters to the RBA

Source: ABS, NAB, J.P. Morgan Asset Management. Data reflect most recently available as of 22/03/24.

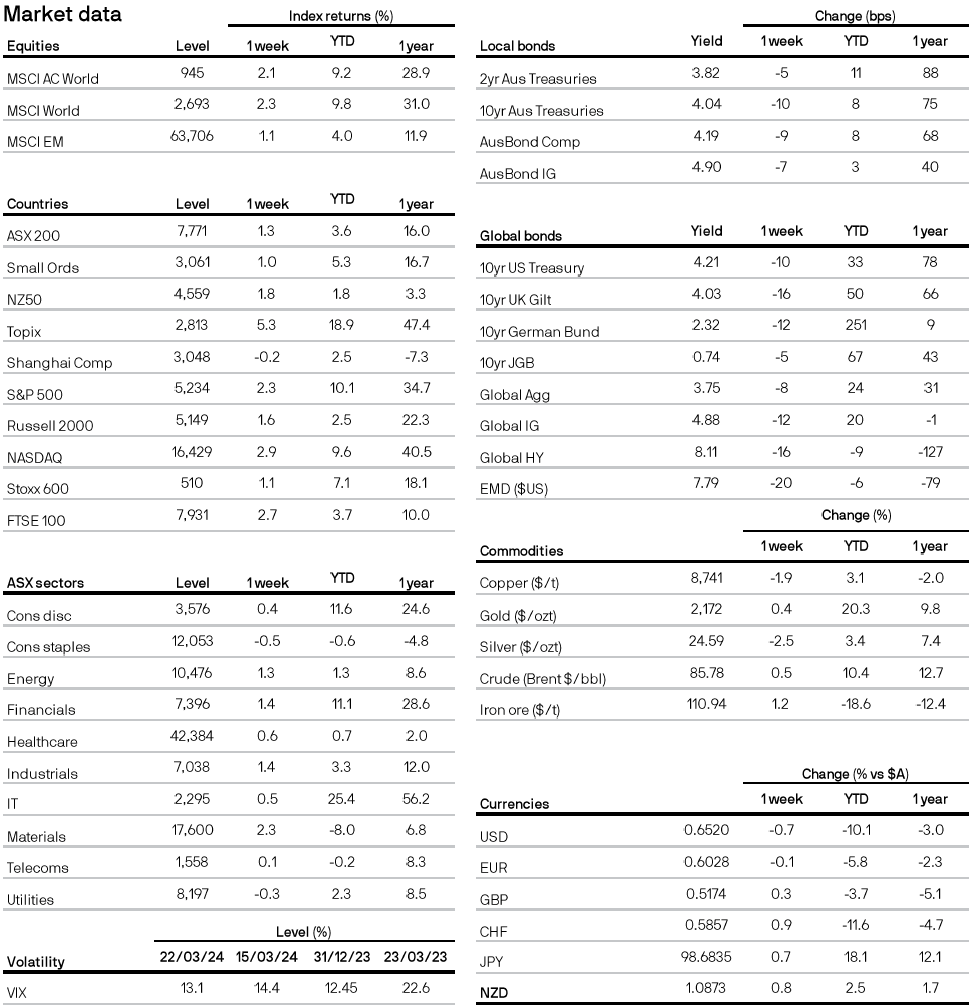

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.