Week in review

- RBA leave policy rate unchanged at 4.1%

- Eurozone retail sales -2.1% y/y for August

- U.S. job openings increases to 9.6 million

Week ahead

- Australia consumer and business confidence

- U.S. FOMC minutes of September meeting

- U.S. CPI inflation

Thought of the week

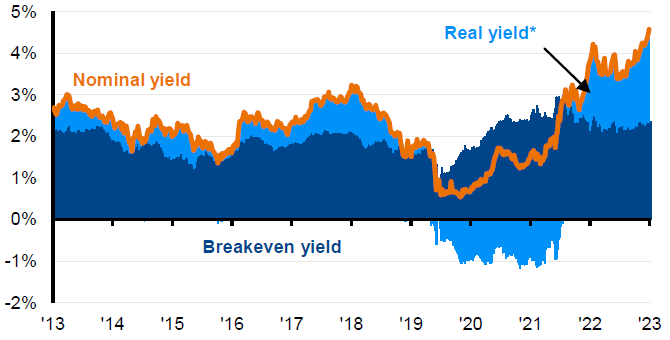

This is not the first time the bond market has created the excitement usually associated with more risky assets. In the past bond yields rose as fears of runaway inflation spooked investors. Since then inflation rates in most economies have declined and the growth outlook surprised to the upside promoting the safe land narrative. This economic resilience comes at a cost, as it implies a protracted decline in inflation and higher interest rates for a longer period of time. Bears would say higher cash rates will eventually cripple the economy and cause recession and falling yields. Bulls argue that economies can deal with higher rates and resilient economies mean a better outcome for equities. This range of economic outcomes suggests a defensive asset allocation that leans into duration as real yields have risen to multi-year highs when the strength in the U.S. economy may be overstated.

Real yields are driving nominal yields higher, not rising inflation expectations

Nominal and real yield composition of U.S. 10-year Treasury yield.

Source: Bloomberg L.P., FactSet, J.P. Morgan Asset Management. *Real yield calculated using 10-year breakeven, which represents the difference in yield between nominal and inflation-protected government bonds and is a market-based measure of average inflation expectations over the next 10 years. Data reflect most recently available as of 06/10/23.

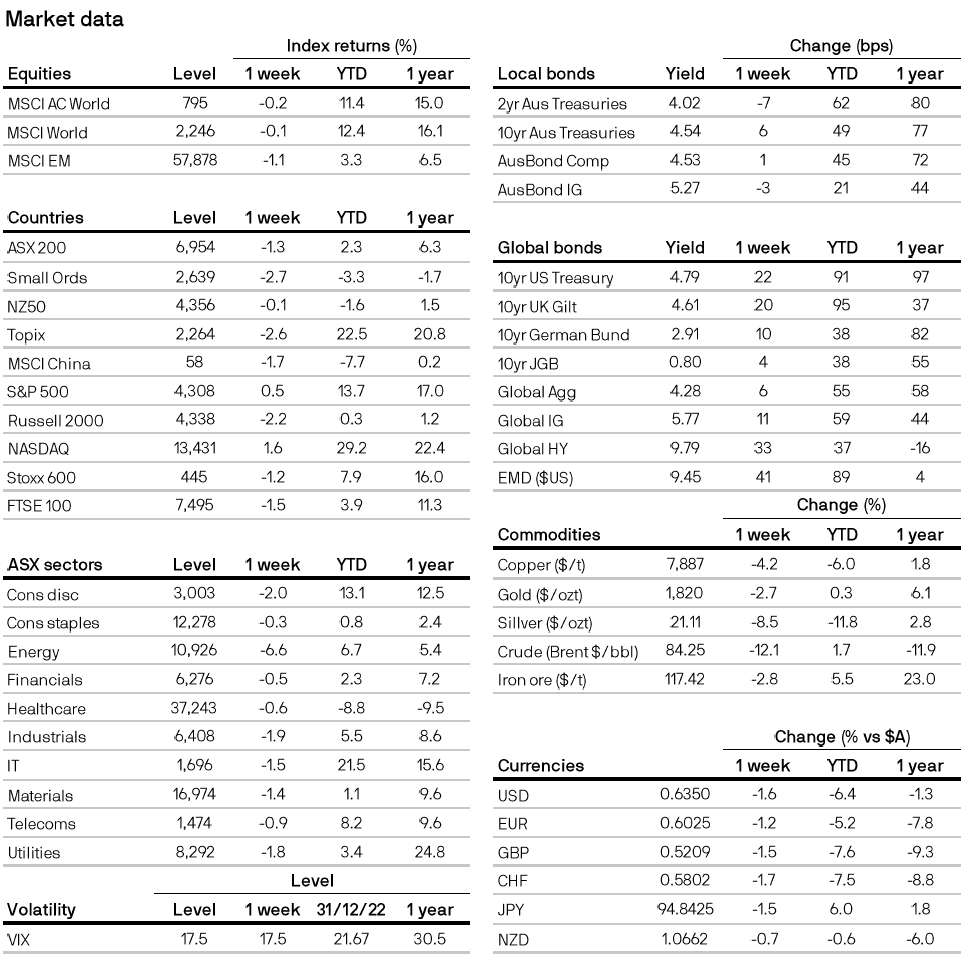

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5