Week in review

- RBA increase cash rates by 50bps to 2.35%

- Australian economy expanded by 3.6% y/y in 2Q

- European Central Bank hikes rates by 75bp to 1.25%

Week ahead

- Australia consumer and business confidence

- U.S. CPI inflation

- Australia labour market report

Thought of the week

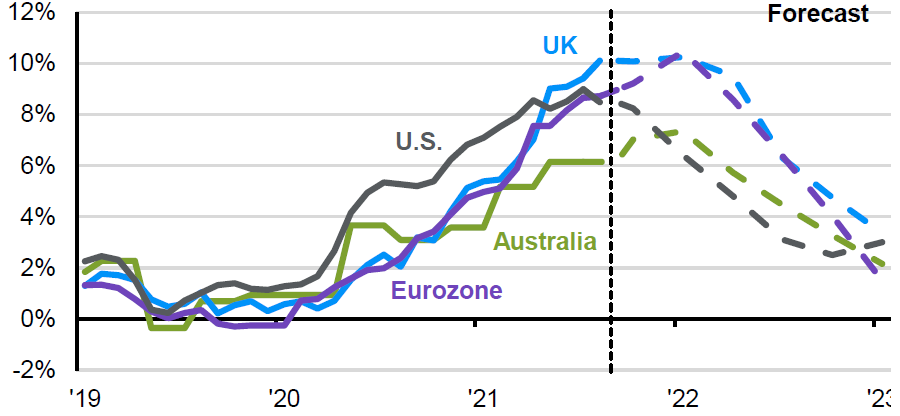

Another week, another round of hawkish messages from central bank land. Last week the European Central Bank increased interest rates by 75bps even as the economic outlook weakened further. U.S. Federal Reserve spokespeople stated they were ‘in this for as long as it takes’ and the RBA was ‘committed’ to bringing inflation back to target. This raises two questions for investors. First, how long will this take? Inflation is measured by the change in prices from one year to the next, the forces that are inflationary in one year can become disinflationary in the next and this will see inflation fall back towards central bank targets by the end of 2023. It’s important to note that we expect inflation to be closer to those inflation targets but have not reached them. Two, how close is close enough? As this week’s chart shows, we expect inflation to be around the 3% level for most major central banks by the end of next year, but based on today’s narrative from central banks, close is not good enough. Expectations of any rate cuts next year should be pushed to one side even if growth has weakened materially over this period.

Inflations slow track back to target

Headline CPI inflation y/y

Source: J.P. Morgan Securities, ABS, BLS, Eurostat, ONS, J.P. Morgan Asset Management.

Data reflect most recently available as of 09/09/22.

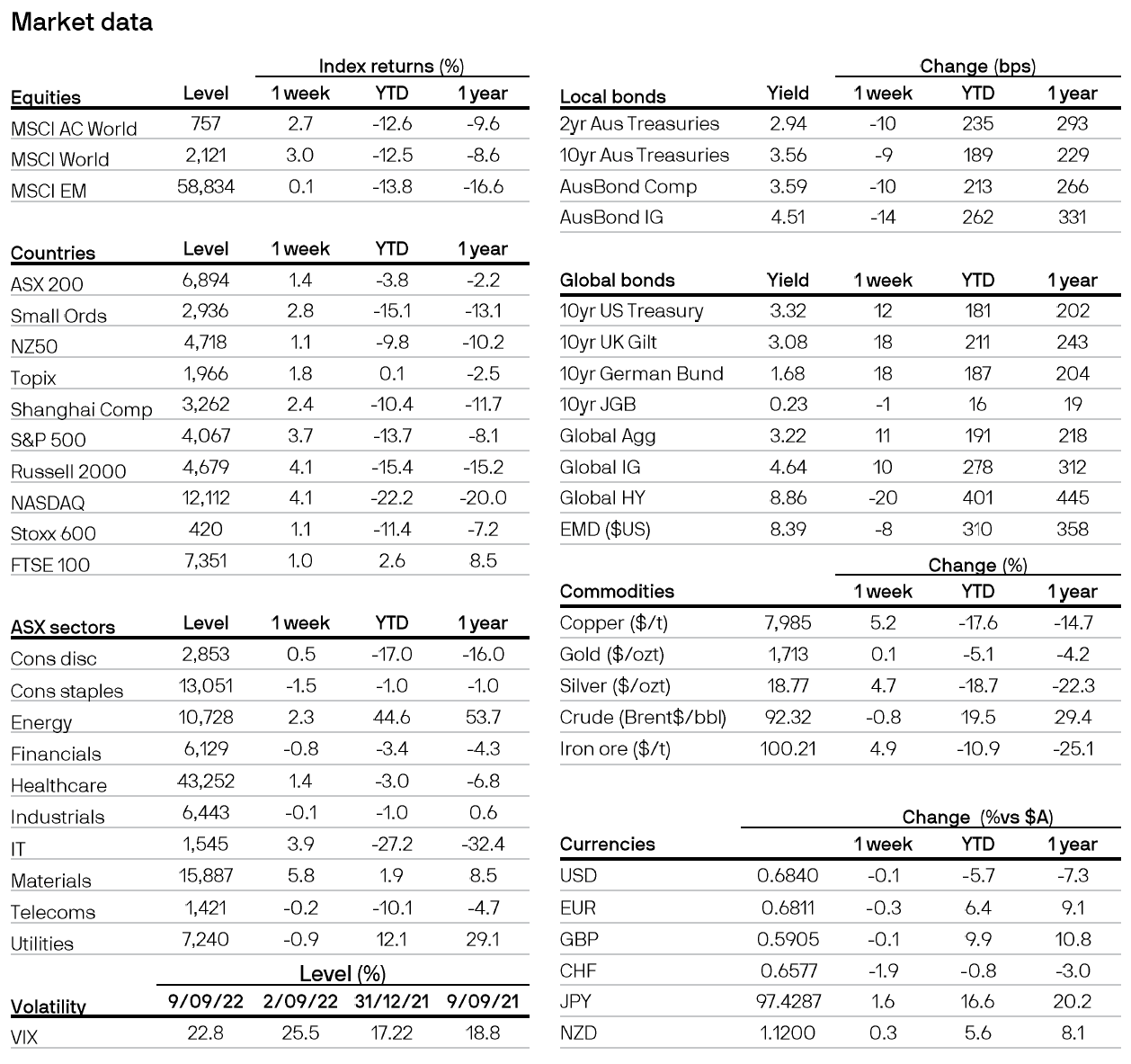

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5