Week in review

- RBA holds cash rate at 4.35%

- Australia real GDP increases 0.2% q/q and 2.1% y/y

- U.S. nonfarm payrolls rises by 199,000

Week ahead

- Australia labour market report

- U.S. CPI inflation

- U.S. Federal Reserve and ECB meetings

Thought of the week

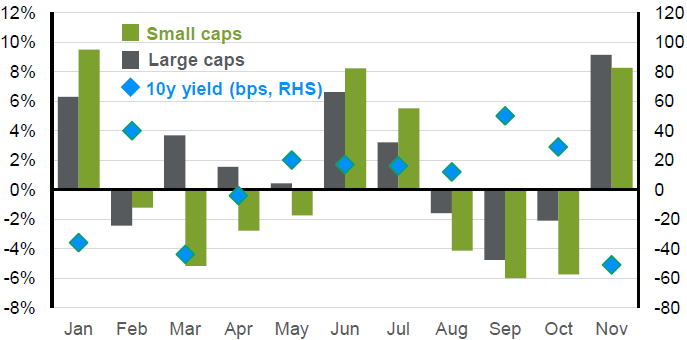

The positive stock-bond correlation has been a headwind to equity returns at points this year. As yields have risen on inflation and rate concerns the equity market has generally suffered. Large cap has done better than small cap at points given the quality bias in large cap names. Small cap stocks are also more sensitive to rates given a larger cost of their funding is based on variable rate lending than longer dated bond issuance. Approximately 38% of lending is variable for U.S. small caps compared to just 7% for large caps (excluding financials). More recently, however, the large valuation gap between large and small cap stocks has peaked investor interest and more of the risk is already reflected in the price. While the soft-landing narrative has gained traction there are still risks to the economic outlook that could impact the more economically sensitive smaller end of the equity market.

U.S. small cap stocks have rallied hard, but remain more sensitive to rates outlook

U.S. S&P 500 and S&P small cap monthly performance and change in 10y yield

Source: FactSet, Standard & Poor’s, U.S. Federal Reserve, J.P. Morgan Asset Management. Data reflect most recently available as of 08/12/23.

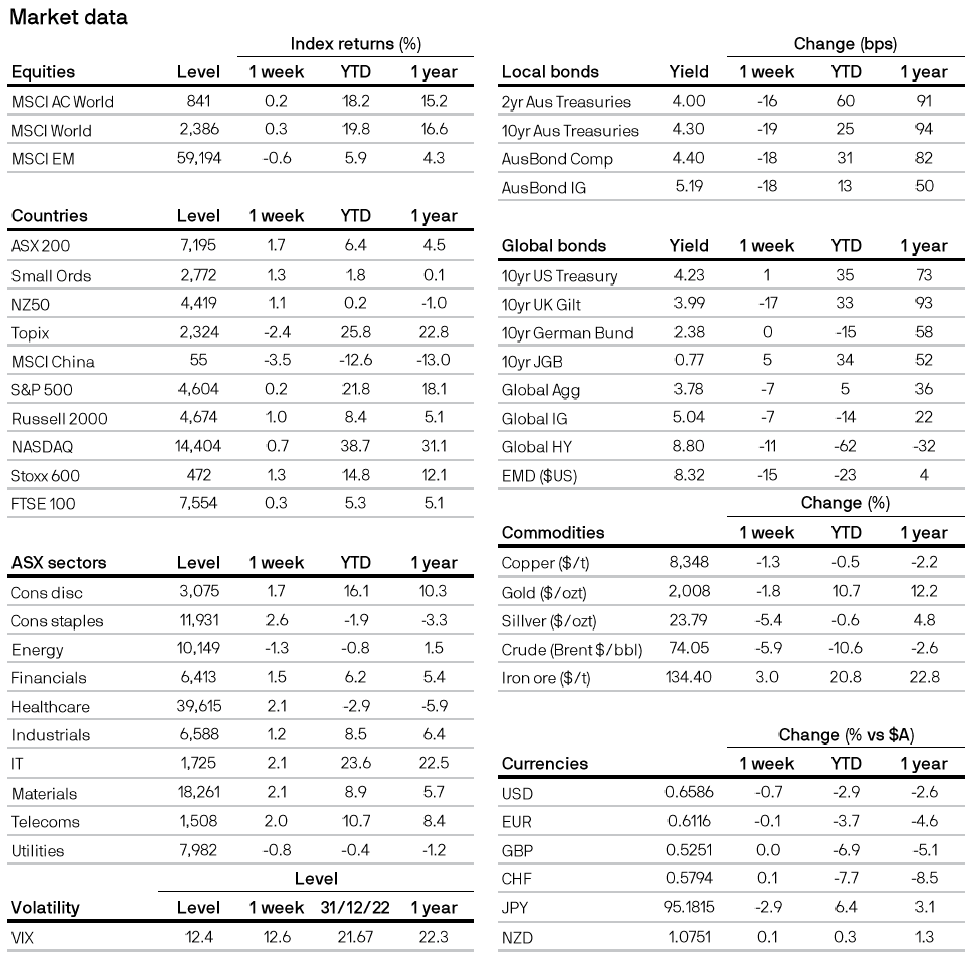

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5