Week in review

- Australian unemployment rate rises to 3.7%

- Australian consumer confidence drops to 79 (from 85.8)

- Australian wage rise 3.6% y/y

Week ahead

- Eurozone and U.S. PMIs

- U.S. FOMC meeting minutes

- Australia retail sales

Thought of the week

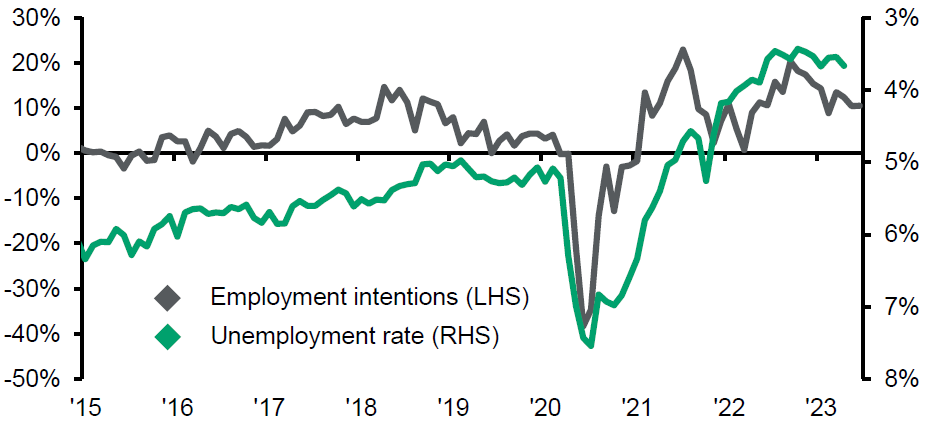

The jobs data for Australia released last week may be a sign of things to come. The unemployment rate rose to 3.7% in April with 4,000 jobs lost over the month. The drop is consistent with the decline that has been emerging in forward labour market indicators such as the NAB employment intentions survey (see chart). Despite the increase in unemployment the jobs market remains very tight given the economic backdrop. When combined with the moderate rise in wage growth in the past year there is little evidence of the feared wage price spiral emerging in Australia. This should give the RBA some comfort that the pressures around the rise in services driven inflation may not be persistent and that the lagged impact of the nearly 400 basis point rise in the last year is having an impact. This all points to a limited chance of a rate hike by the RBA at their next meeting. While further jobs gains may be harder to come by, there is little evidence of a surge in the unemployment rate given labour demand has not collapsed even though it has softened. The RBA expects the unemployment rate to rise to 4% this year and the trend so far is in line with their view.

Further weakness to come in Aussie jobs

Employment intentions and the unemployment rate (inverted)

Source: ABS, NAB, J.P. Morgan Asset Management.

Data reflect most recently available as of 19/05/23.

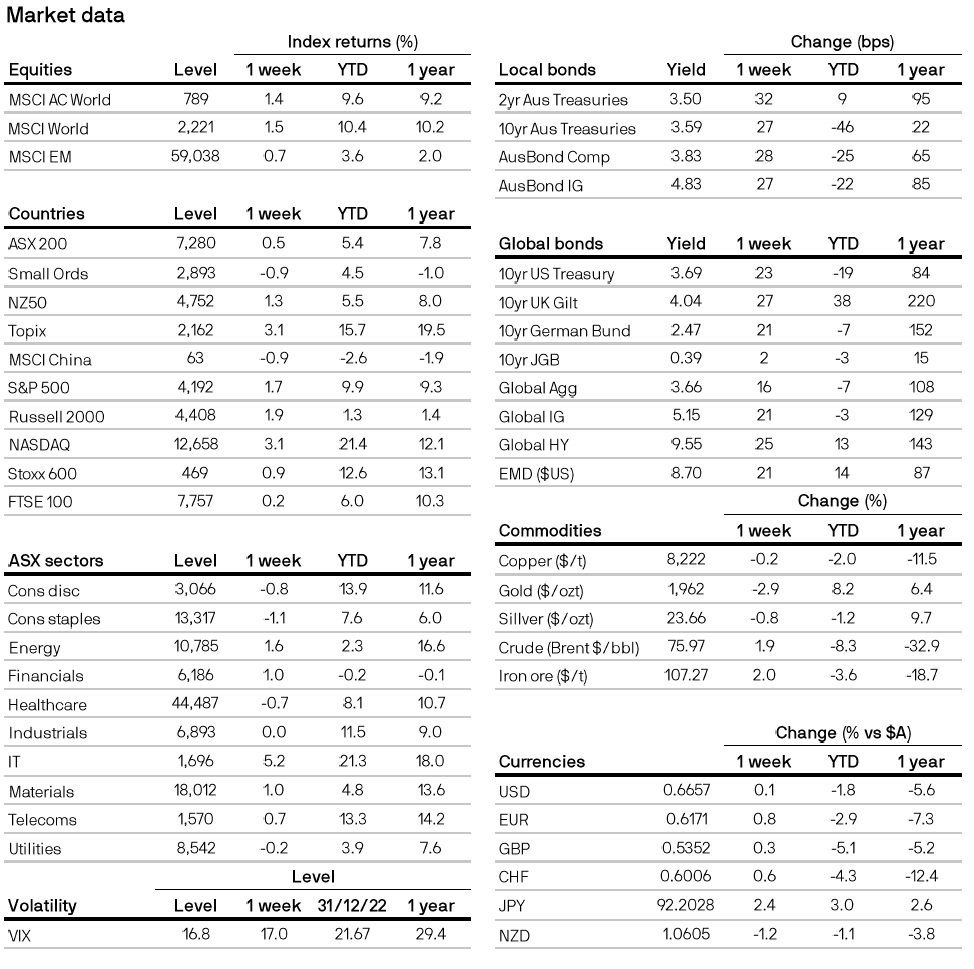

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5