Week in review

- Eurozone CPI inflation rises to 9.1% y/y

- China PMI manufacturing fell to 49.5

- Australia housing finance -8.5% m/m

Week ahead

- RBA official cash rate announcement

- Australia 2Q real GDP

- European Central Bank cash rate

Thought of the week

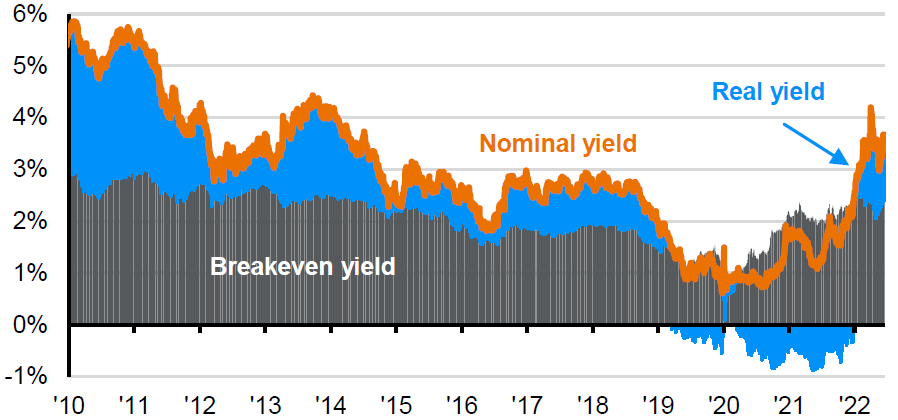

Central bankers are not backing down from the inflation challenge. In the past week the message from both the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) is that rates will have to go higher and remain there longer to curb price pressures. Prices rose by 9.1% in the eurozone in August and we expect this figure to be higher by year end. This should see the ECB hikes rates by 75bps at this month’s meeting despite the very clear headwinds that higher energy costs are having on the economy. Whether the Fed lift rates by 50 or 75bps this month will largely depend on the next inflation report, but 75bps seems more likely. The market is also pricing in more action from the RBA and bond yields moved steadily higher during August. This week’s chart decomposes the Australian 10-year yield into real and inflation breakeven components and illustrates how real yields (or the pricing of the policy rate) has been driving the nominal yield higher. However, will so much in the price, we don’t expect bond yields to move much higher from here.

Australia 10-year government bond yield

Nominal and real yield composition

Source: Bloomberg J.P. Morgan Asset Management.

Data reflect most recently available as of 02/09/22.

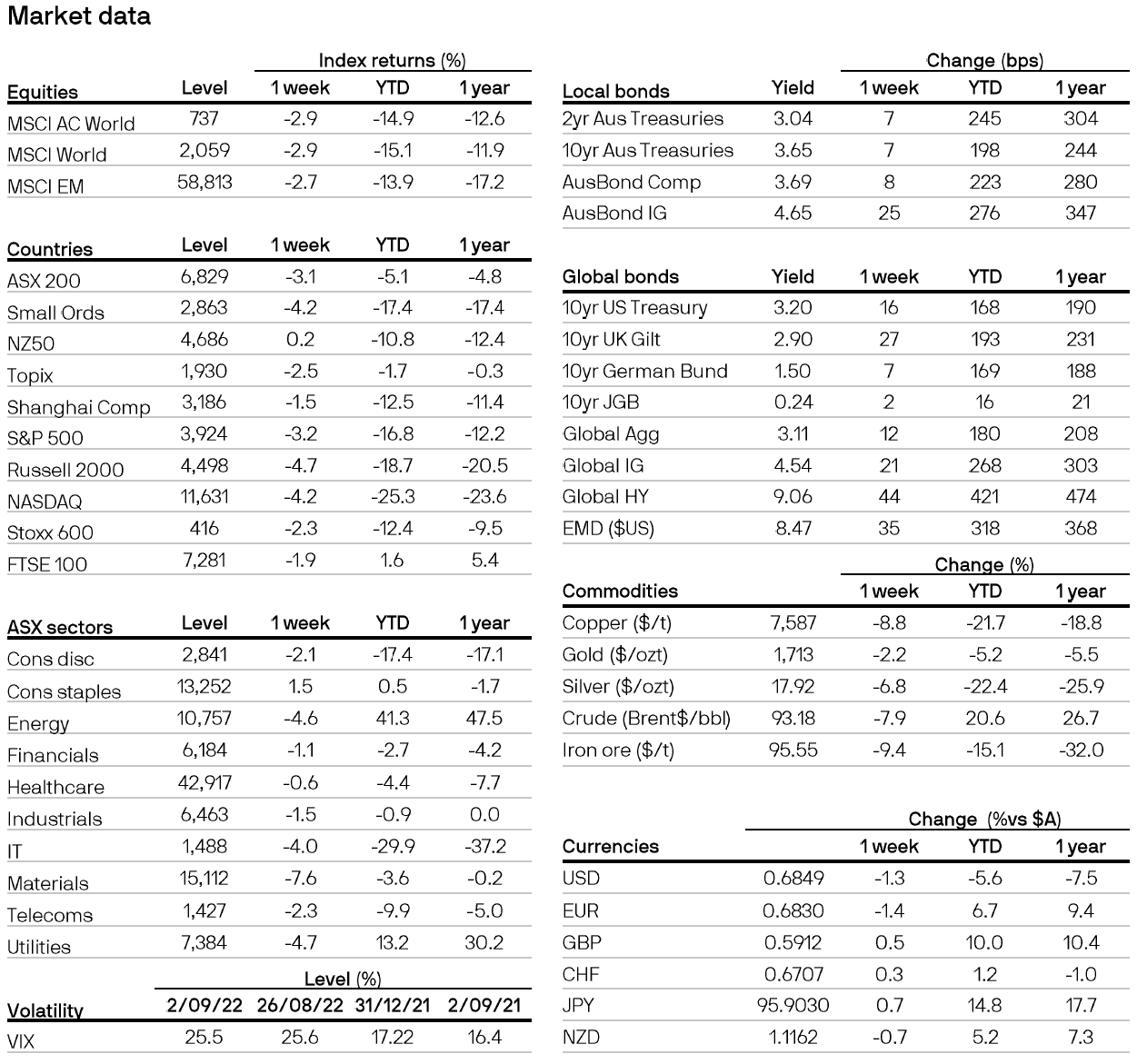

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5