Week in review

- Federal Reserve held rates steady at 5.25%-5.50%

- Japan core CPI rose 3.1% y/y, Bank of Japan stayed unchanged

- Bank of England kept rates unchanged at 5.25%

Week ahead

- U.S. consumer confidence and personal consumption expenditure

- China Markit Caixin manufacturing and services PMI

- Japan unemployment rate

Thought of the week

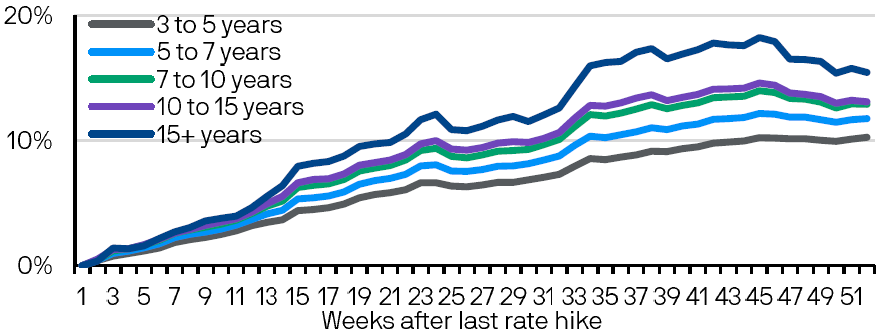

The summary of economic projections (SEP) from the September Federal Open Market Committee (FOMC) meeting suggests that the Federal Reserve (the Fed) may be seeking an even more restrictive rate environment in 2024. Gross domestic product (GDP) forecasts for both 2023 and 2024 were revised up to 2.1% and 1.5%, while headline personal consumption expenditure (PCE) inflation for 2023 was raise by 0.1% to 3.3%. Although core PCE inflation was trimmed slightly to 3.7% for 2023, the still robust U.S. growth environment means the committee may intend to keep rates higher for longer. This was reflected in the median dot plot for both 2024 and 2025, as both were both revised upwards by 50 basis points to 5.1% and 3.9% respectively. This means rate cuts are likely to pushed further and further into the future. Investors may well expect some further upside to yields in the near team in response to the Fed’s hawkish position. That said, as higher rates eventually begin to slowdown the economy, yields should gradually move lower. In addition, history suggests that U.S. Treasury yield tend to move lower prior to a peak in policy rate. For investors, positioning in long-tenor government bonds or investment grade credit may be beneficial given the falling rate environment and slowing macroeconomic backdrop.

Long duration fixed income tend to outperform following the Fed’s final rate hike

Average cumulative return for U.S. Treasuries of various tenors

Source: Wind, Citi Research, J.P. Morgan Asset Management. Data reflect most recently available as of 23/09/23.

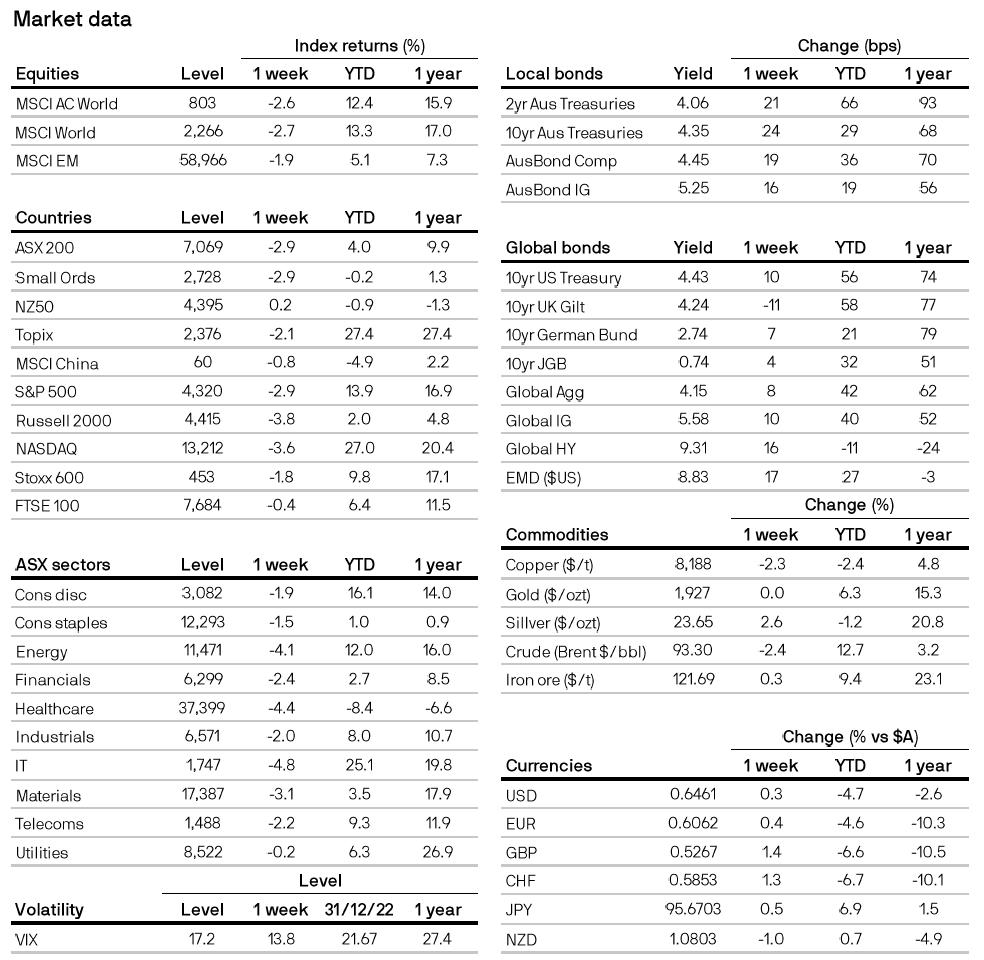

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5