Week in review

- RBA raises interest rates by 25bps to 3.10%

- Australian economy expands 0.6% q/q or 5.9% y/y in 3Q

- China PMI services falls to 46.7

Week ahead

- Australia business confidence

- U.S. CPI inflation

- FOMC meeting

Thought of the week

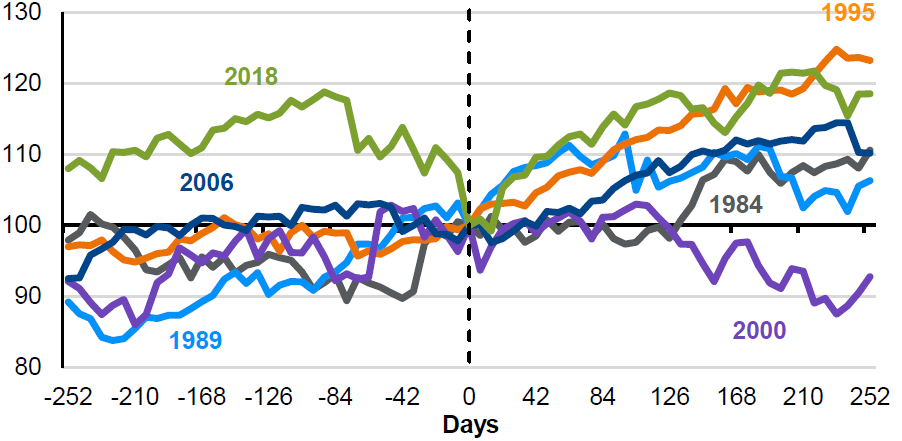

On Thursday morning the U.S. Fed will most likely announce a 50bps rate hike but more importantly signal how high they think rates will go next year. This information is contained in the infamous ‘dot plot’. These quarterly forecasts show the median view of the committee members. In September, the median view was a peak of 4.6% on the fed funds rate in 2023, this may increase to 5% (or more) in the December update. The market has priced in such an outcome, but the risk for an upside surprise remains. This information may guide markets on how far the Fed is from the end of its rate hiking cycle. Our view is that the Fed will enter an extended pause once rates get to around 5%, as it assesses the impact on the economy of the tighter policy settings. For markets however, the end of the hike cycle may be enough to spur a rally. The chart shows the performance of the S&P 500 after the last rate hike. The outcome can vary by cycle, but the general trend is higher – with the outlier being 2000, when the tech bubble burst.

S&P 500 performance from date of last rate hike

Indexed to 100 at date of last rate hike

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management.

Data reflect most recently available as of 9/12/22.

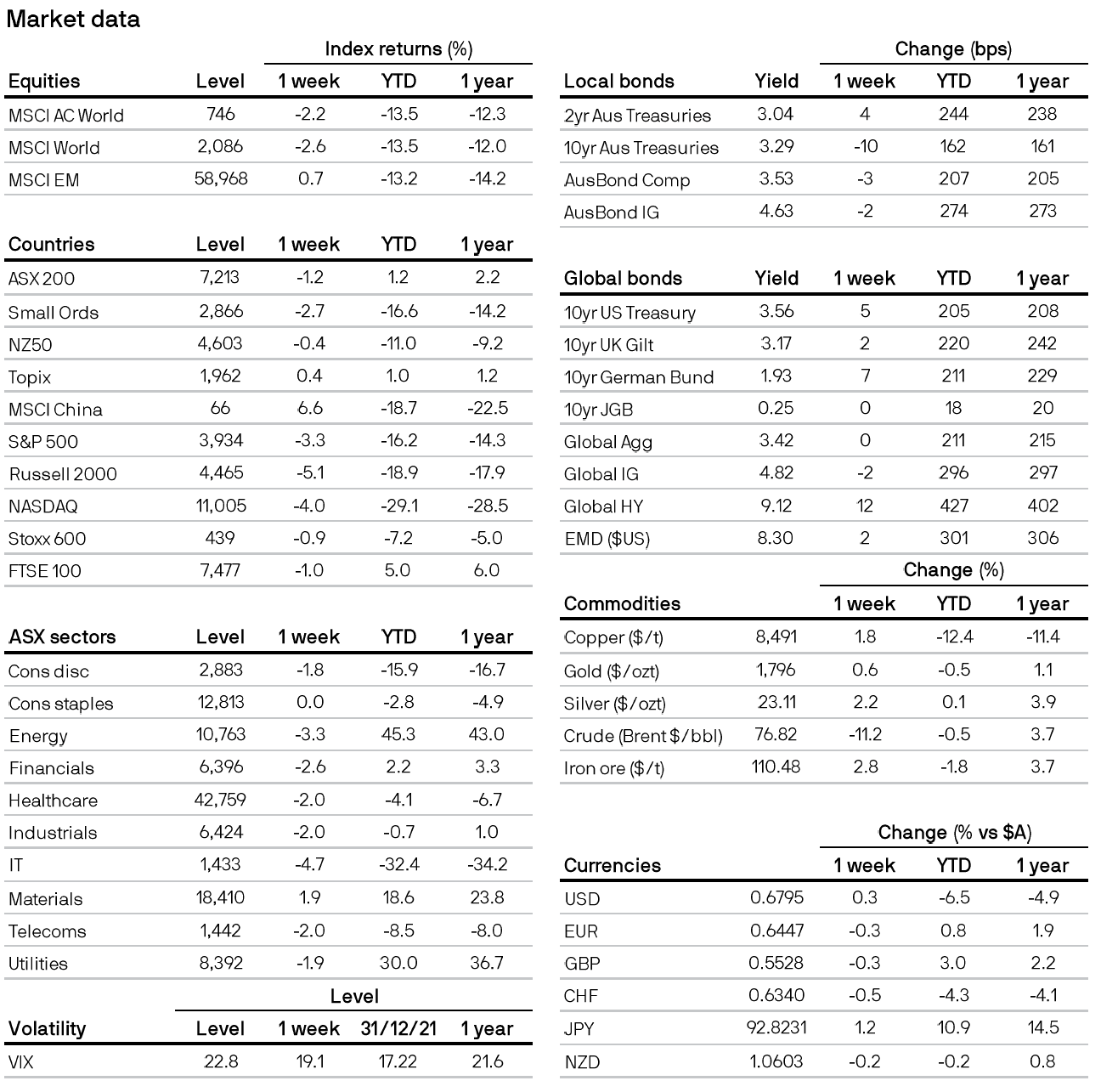

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5