Week in review

- U.S. Federal Reserve leave rates unchanged but with dovish message

- Australia retail sales 0.9% m/m

- Eurozone economy contracts by 0.1% q/q in third quarter

Week ahead

- RBA official cash rate decision

- Australia building approvals

- China CPI inflation

Thought of the week

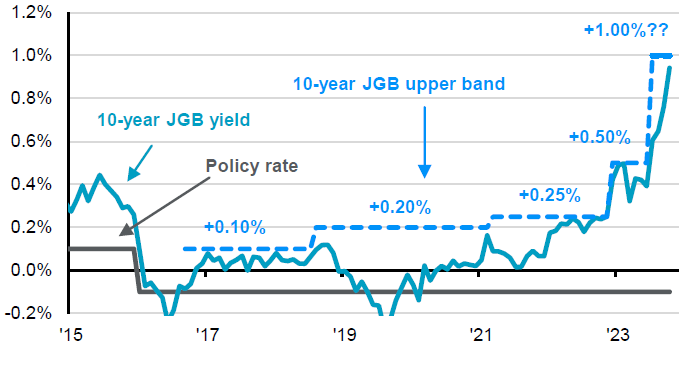

Government bonds were falling everywhere last week. The market interpreted the U.S. Federal Reserve decision to keep rates on hold and their use phrases like ‘cautious’ as a signal that they may be done with hike and will let the tightness in financial conditions cool the economy. Similarly the on hold message from the Bank of England led to a big step down in UK bond yields. While the possible peak in policy rates was the dominant theme in markets last week, the Bank of Japan (BoJ) was moving the other way as it took another step away from the yield curve control (YCC) policy that has been in place since 2016. The BoJ shifted the target on the 10-year Japanese government bond again, this time the move was to only use the 1% yield on the 10-year bond as a ‘reference’ implying it may be comfortable with a higher yield. We expect the BoJ to start to lift the policy rate in 2024 after formally removing YCC policy.

The Bank of Japan's de-facto removal of yield curve control

Source: FactSet, Mortgage Bankers Association, U.S. National Association of Realtors, J.P. Morgan Asset Management. Data reflect most recently available as of 03/11/23.

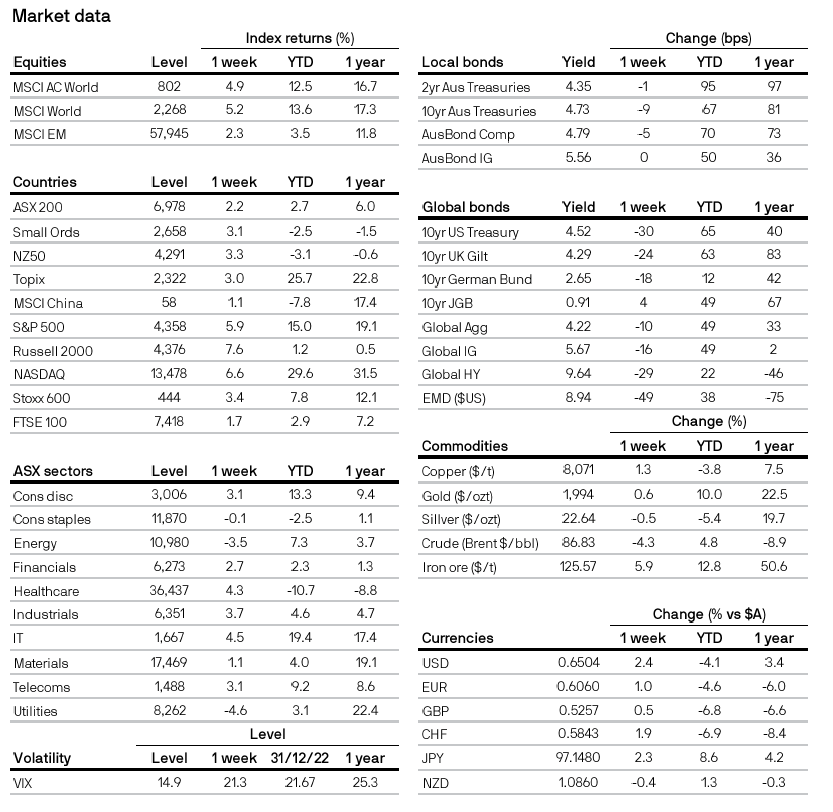

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5