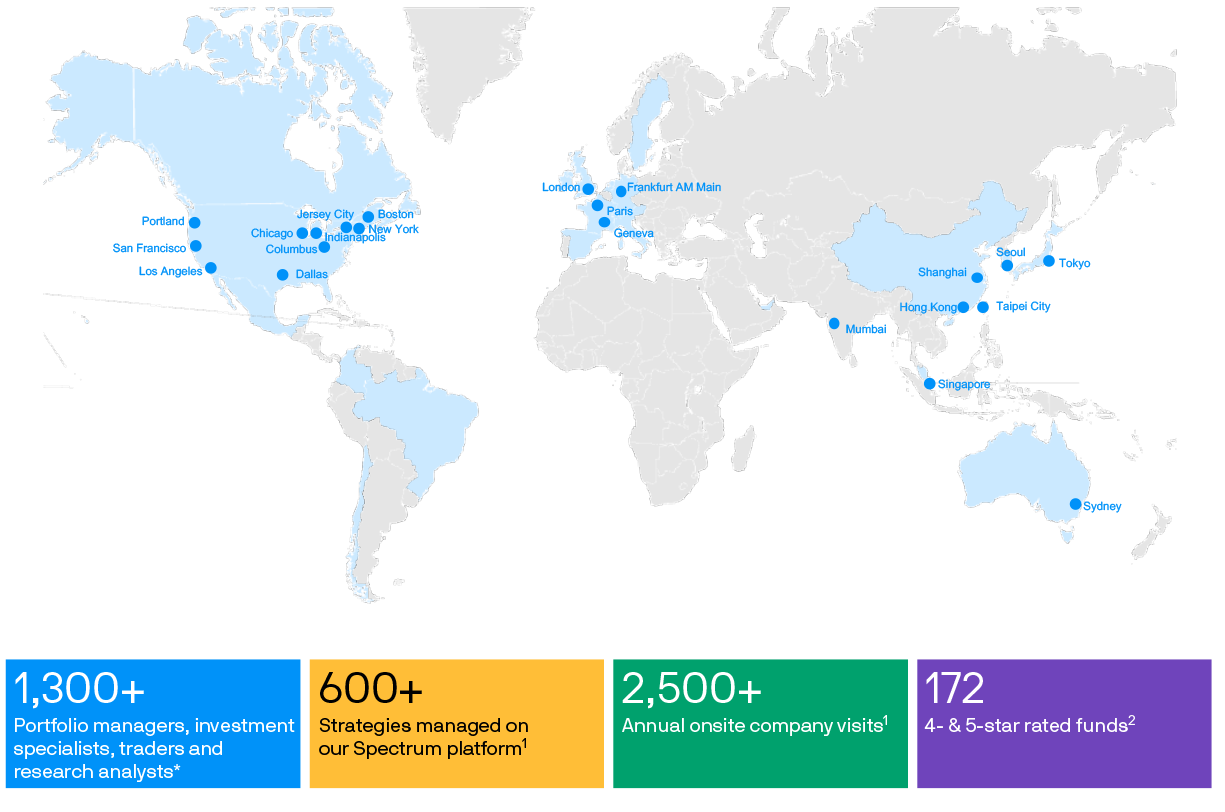

Investors deserve an expert global partner they can trust to deliver strong outcomes

The power of perspective that only a global, connected view can deliver

*JPMAM employees in location.

1. Data is updated annually, as of 31.12.2023.

2. Morningstar, as of 31.03.2024.

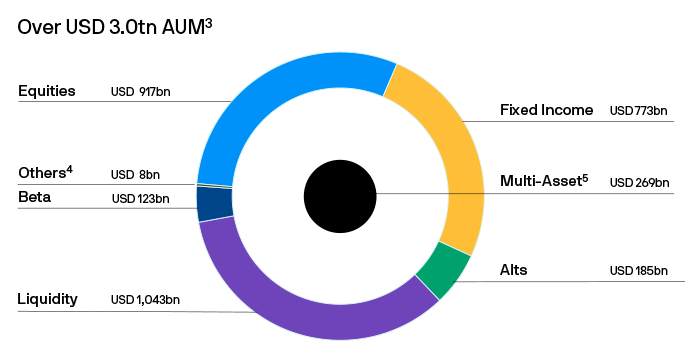

Source: J.P. Morgan Asset Management; as of March 31, 2024. Due to rounding, data may not always add up to the total AUM. AUMs shown do not include custom glide path and retail advisory assets.

3. AUM by asset class includes AUM managed on behalf of other investment teams.

4. Others represent 55ip, Derivatives.

5. Includes USD 7bn of Solutions Direct AUM.