Week in review

- Australian retail sales

- U.S. PMI for services (55.1) and manufacturing (48.5)

- Eurozone PMIs for services (55.9) and manufacturing (44.6)

Week ahead

- Australia CPI monthly inflation

- China PMI for manufacturing and non-manufacturing

- U.S. nonfarm payrolls and unemployment rate

Thought of the week

During the first three months of the year the global economy was starting to crack as the aggressive policy tightening by central banks gained traction. However, the second quarter has illustrated the resilience of the economy as it bends rather than breaks in the face of these stresses. Most recently the PMI figures for major developed economies surprised to the upside. This has led markets to second guess the outlook for rates and growth heading into the second half of the year. Better growth could mean inflation is slower to fall and central banks potentially squeezing in a few more hikes. This would negatively impact re-rating in equity markets this year placing downward pressure on stocks. Conversely, it could be that the worst is still to come, and the lagged impact of policy tightening is still to materialize. If this is the case, then the current consensus view on earnings for 2023 and 2024 may be more ‘hope’ than reality with further earnings downgrades expected. Neither scenario supports a strongly bullish case for equities but does suggest more downside protection in portfolios. The path to lower inflation and resilient growth looks remarkably narrow to us.

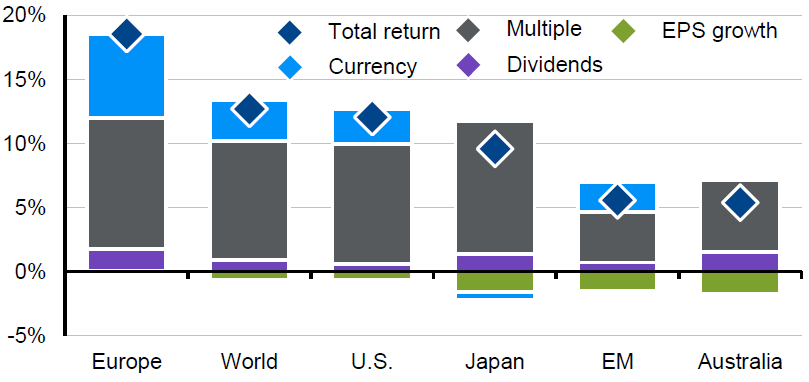

A valuation driven rally is at risk from rates and earnings

Year-to-date decomposition of equity market returns

Source: ABS, NAB, J.P. Morgan Asset Management. Data reflect most recently available as of 26/05/23.

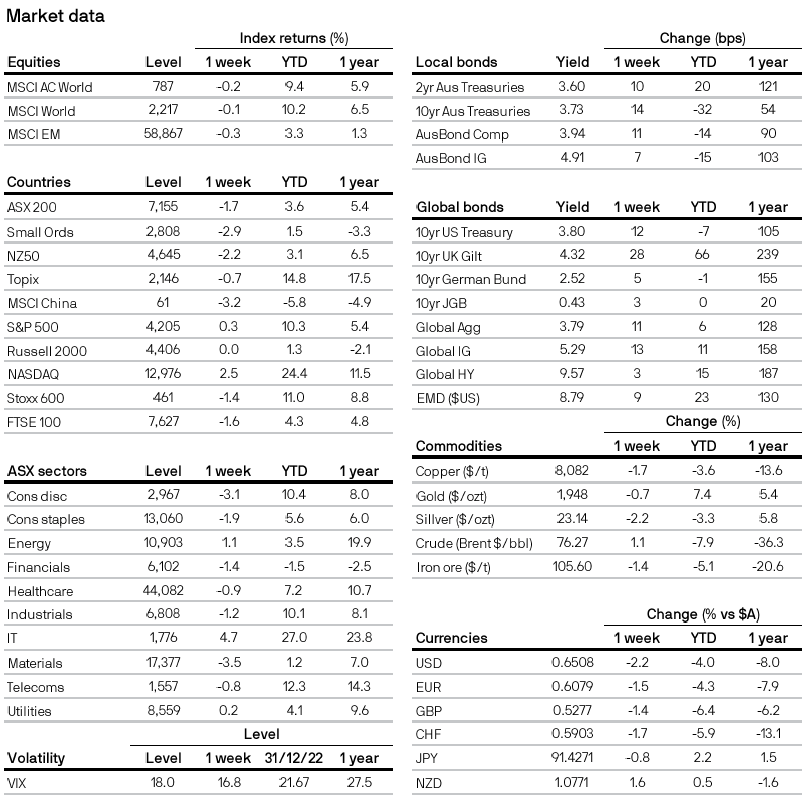

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5