Week in review

- Australian unemployment rate steady at 4.1%

- China 3Q real GDP 4.6%

- ECB cuts rates 25bps to 3.25%

Week ahead

- U.S. PMI for manufacturing and services

- Eurozone PMI for manufacturing and services

- Bank of Canada interest rate decision

Thought of the week

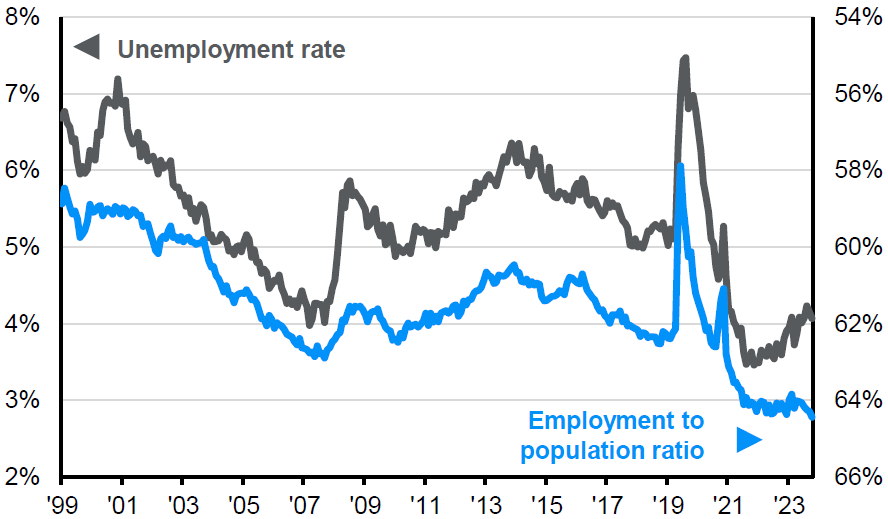

Australia’s labour market report showed surprising strength, with a record high participation rate, a further 64,100 jobs added and an unemployment rate of 4.1%. Increasing population growth and the rise in labour force participation helped drive employment gains, but the cost-of-living may also be inciting workers back. The better jobs news should greatly reduce expectations of the cut by Christmas that some were looking for. The RBA forecast of an unemployment rate of 4.3% by year end is still possible, but without further weakness there is little need for them to deviate from the current on-hold setting. The impact of government subsidies on the 3Q CPI figure means the RBA will likely place less weight on it when formulating policy. February 2025 still appears the most likely timing for the start of the easing cycle.

Little spare capacity in the Australian labour market Unemployment rate and employment to population ratio (inverted)

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 18/10/24.

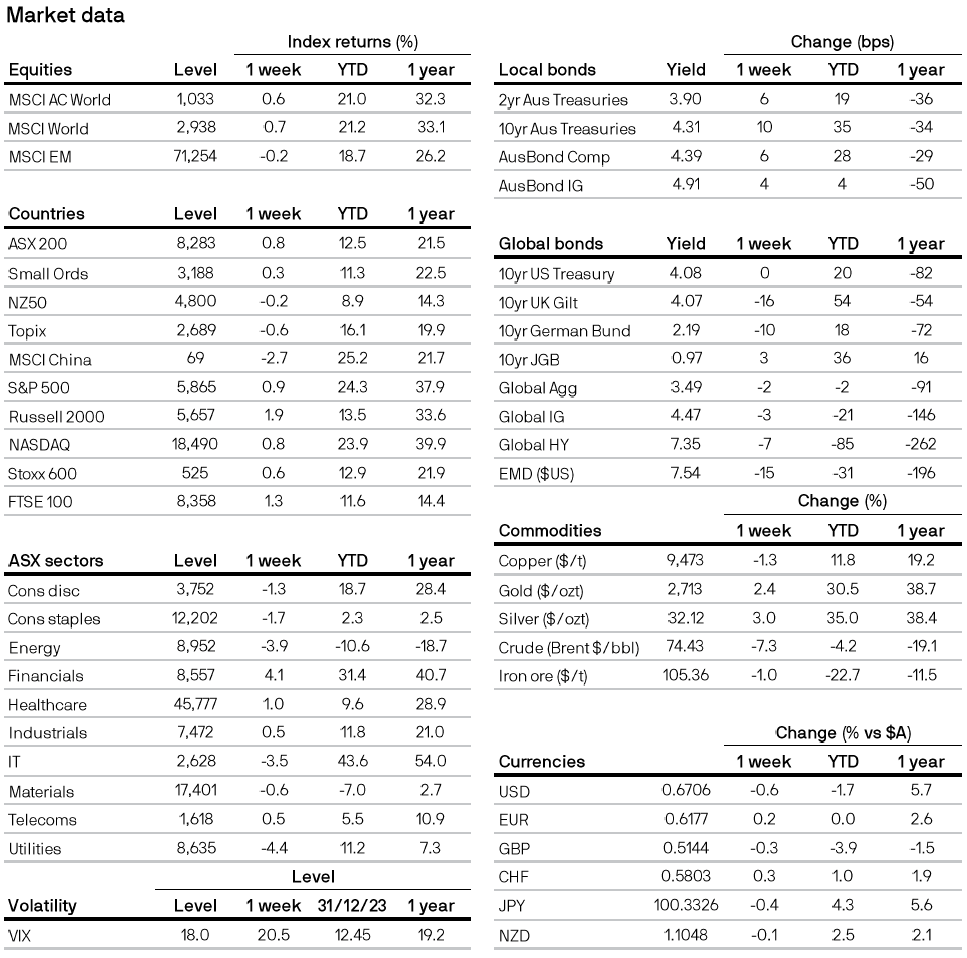

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5