Week in review

- Australia monthly CPI inflation 5.2% y/y in August

- Australia retails sales rise 0.2% m/m

- U.S. durable goods rise 0.2% m/m%

Week ahead

- RBA policy meeting and official cash rate

- Australia building approvals and housing financing

- U.S. nonfarm payrolls

Thought of the week

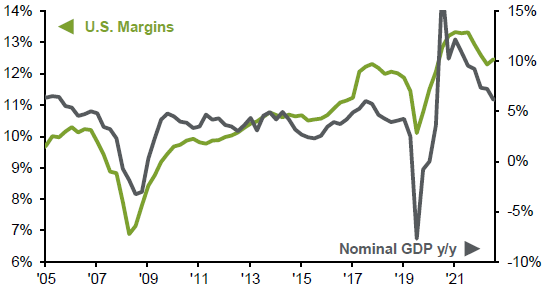

The macro outlook and rates view has dominated the market narrative in recent weeks but the third quarter U.S. earnings season means the micro will be back in focus. Key to the outlook for U.S. earnings are margins and the extent to which margins can be maintained in the face of topline growth pressures. As this week’s chart shows, margins are pro-cyclical moving with the change in nominal GDP in the U.S. The slowing, yet resilient, U.S. economy poses a risk to topline revenue growth, while rising input costs from a higher wage bill and rising financing costs may add to the squeeze on margins and corporate profitability. U.S. equities have rallied on a narrow base and expectations of corporate profitability holding up even as economic momentum has weakened had supported the market earlier in the year. A soft landing in the U.S. economy may be on the cards, but a soft landing is not always a safe one.

U.S. corporate margins track nominal GDP growth

U.S. S&P 500 net margins and year-over-year change in nominal GDP

Source: BEA, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Data reflect most recently available as of 29/09/23.

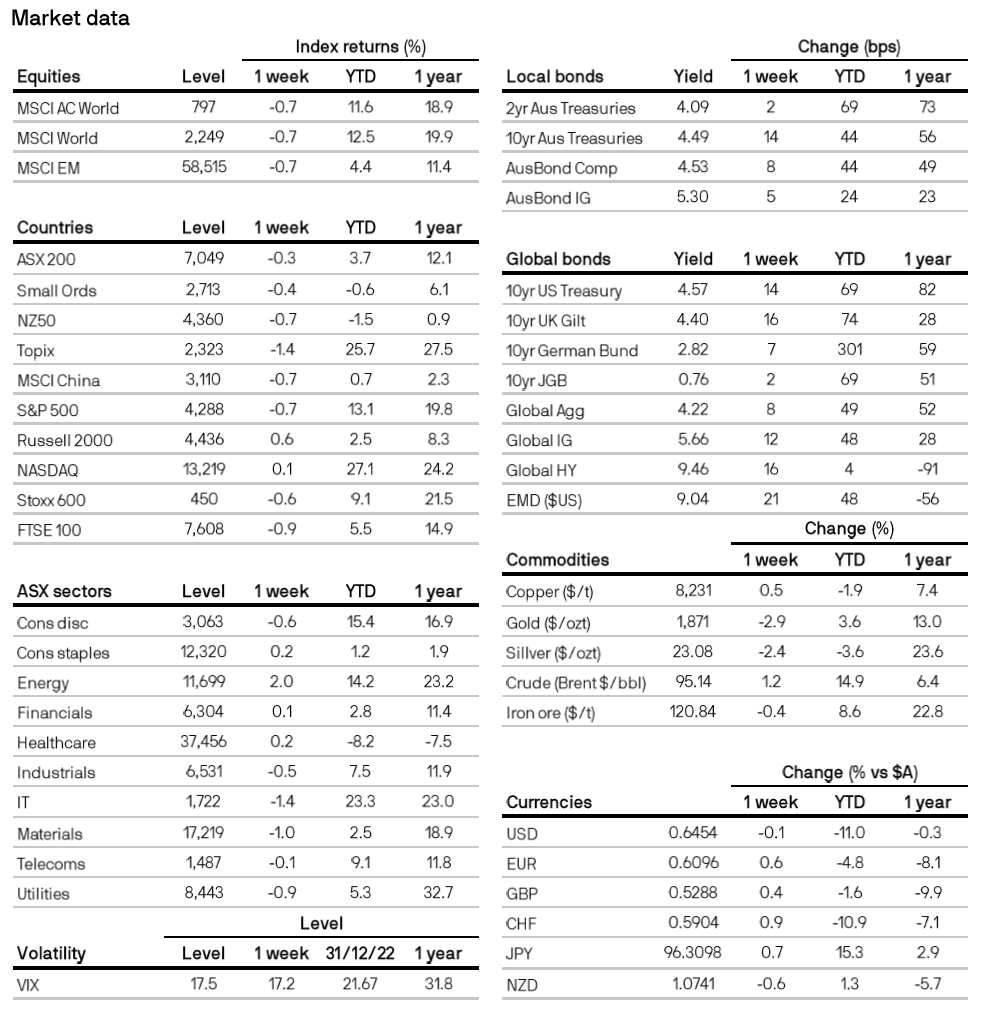

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5