Week in review

- Australia retail sales slumped 2.7% m/m for December

- Australia CPI inflation 0.6% q/q or 4.1% y/y

- U.S. Fed keeps policy rate 5.25-5.50% range

Week ahead

- RBA policy meeting and press conference

- China CPI inflation

- NZ unemployment rate

Thought of the week

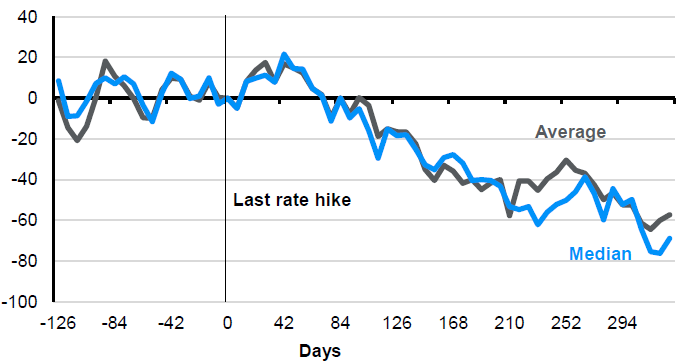

It’s the RBA’s time to shine this week with the first meeting of 2024. The revised schedule means eight policy meetings this year, with a press conference following each. The Central Bank’s communication can be vague, however one thing the RBA will be clear on is, don’t bank on rate cuts this year. Even if the market thinks differently and inflation data out last week showed further easing in price pressures in the last quarter. An easing in policy should be good for bonds. Looking back at the prior four rate cycles the 10-year Australian government bond yield fell 57bps on average in the 12 months following the last rate hike. The 10-year yield has already declined by this amount since the November 2023 rate hike. Investors may think they have missed the rally but clipping a 4% coupon still provides an attractive income with downside protection should the economy weaken.

Australian 10-year yield path after the last rate hike

Basis points, average of past four rate cycles

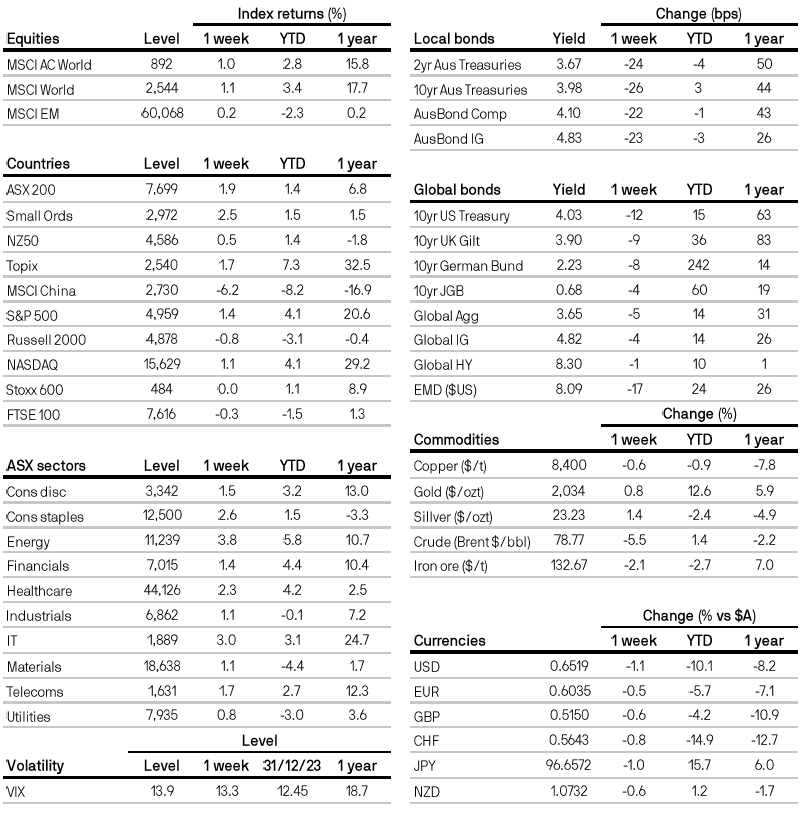

Market data

Source: FactSet, RBA, J.P. Morgan Asset Management. Data reflect most recently available as of 02/02/24.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5