Week in review

- Australian unemployment rate rises to 3.7%

- China retail sales fall to 2.5% y/y

- U.S. retail sales rise to 3.2% y/y

Week ahead

- Eurozone PMI manufacturing and services

- U.S. PMI manufacturing and services

- NZ retail sales

Thought of the week

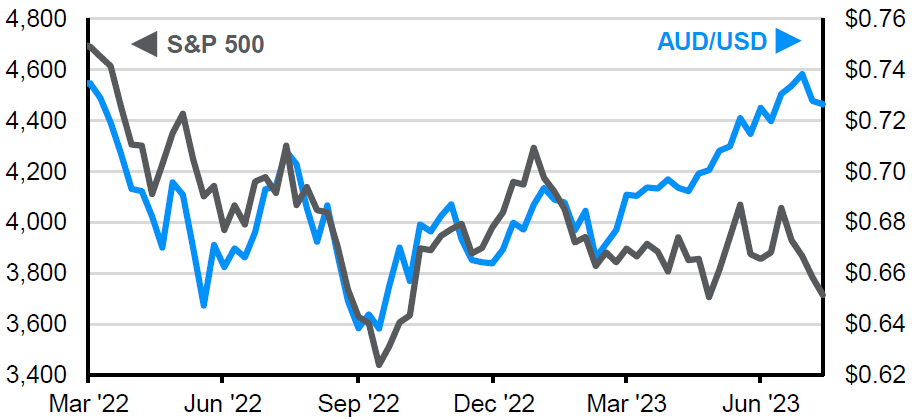

Trying to forecast the outlook for currencies has often been referred to as a ‘mugs game’ given the number of factors that determine the direction and magnitude of currency movements on any given day. However, the persistent weakness in the Australian dollar in recent weeks calls for a reminder of what matters for the Aussie – risk, rates and commodities. The Australian dollar is a ‘beta’ currency that should move with broader risk sentiment and has historically tracked the performance of the S&P 500 equity index. Next is rates, and specifically the rate spread between Australia and the rest of the world. A wider spread should, all else being equal, lead to an appreciation in the currency as money flows to where it can earn the highest rate of return. Finally, commodity prices are also a factor given the economic reliance on coal and iron ore exports. Higher commodity demand means increased demand for Australian dollars and should also translate to a stronger government fiscal position and greater reinvestment in the economy. These three influences suggest that the AUD is currently undervalued and should appreciate in the coming quarters.

A ‘risk-on’ currency, the AUD usually tracks the S&P 500 equity index

AUD/USD cross rate and the S&P 500

Source: FactSet, Standard & Poors, J.P. Morgan Asset Management. Data reflect most recently available as of 18/08/23.

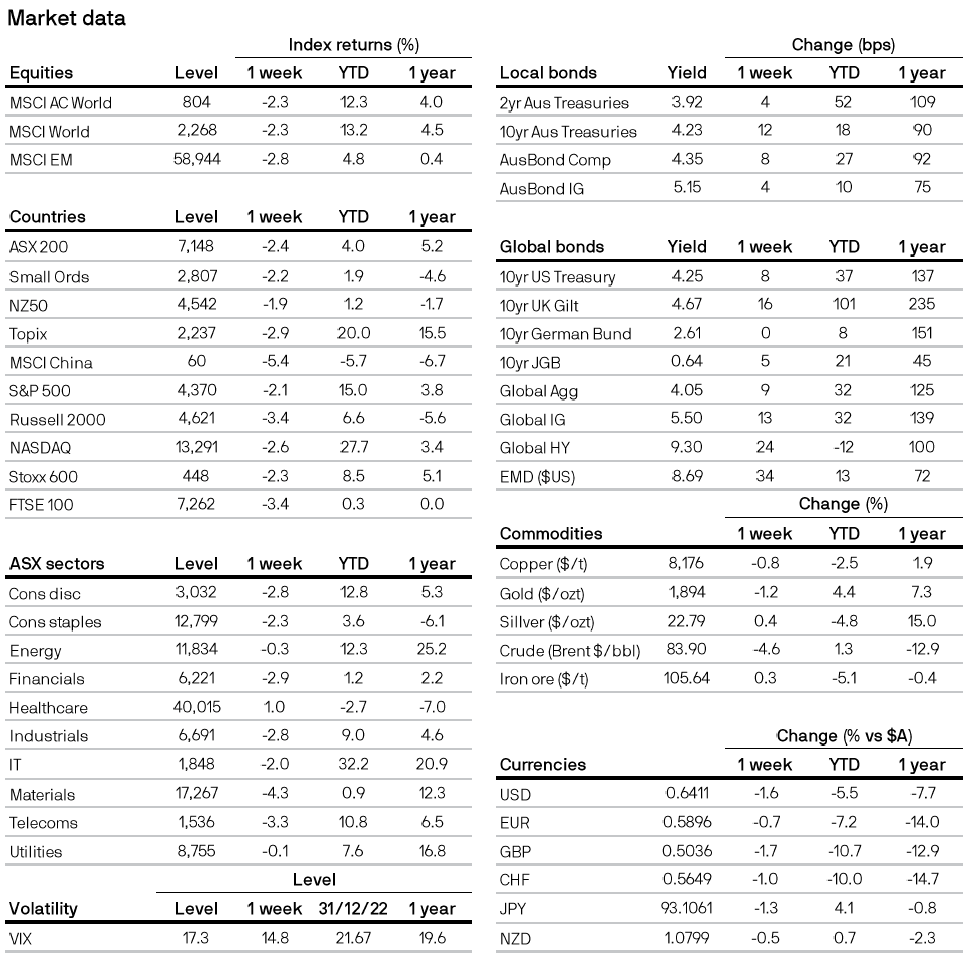

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5