Weekly Market Recap

Don’t step on the crack

23/05/2022

Week in review

- Australian wage growth 2.4% y/y

- Australian unemployment rate

- UK inflation hits 9.0% y/y

Week ahead

- U.S. and Eurozone PMIs for May

- Australia capital spending 1Q 2022

- Australia retail sales

Thought of the week

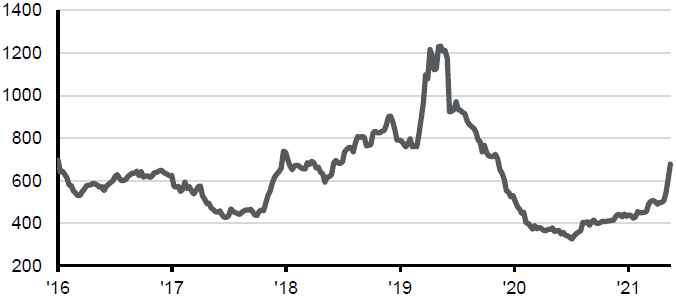

Growth fears are hanging heavy over markets at the moment fueled by concerns over a policy errors by central banks zealous tightening of interest rates to curb inflation. But increasingly because of the economic slowdown in China and knock-on impact to global supply chains. Our view is that while the probability of a recession has risen based on many market and economic indicators, that probability is not yet high enough to dissuade from a still constructive view on risk assets. However, the rising risks do mean that a greater focus on quality is more important as economically sensitive assets are feeling the pressure. The chart below illustrates the spread between the yield on the lowest and highest rated parts of the U.S. high yield bond market. This spread has widened sharply in recent weeks. Credit markets have been relatively well behaved compared to the selling pressure in equities, but investors may want to start looking at increasing the quality in fixed income, as these cracks start to appear.

Some cracks in the high yield credit market

Spread between CCC and BB high yield bonds, bps

Source: Bloomberg Barclays, FactSet, J.P. Morgan Asset Management.

Data reflect most recently available as of 20/05/22.

All returns in local currency unless otherwise stated.

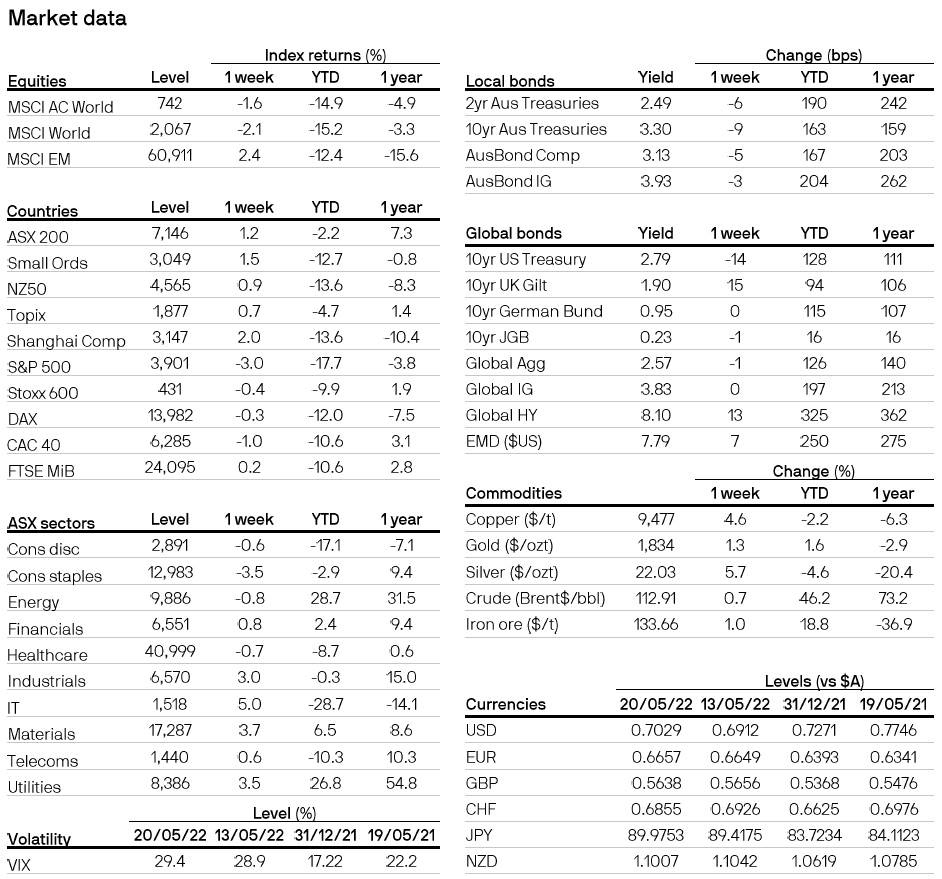

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5