Week in review

- Australian monthly inflation steady at 3.4% y/y

- Australia retail sales 1.1% m/m in January

- RBNZ hold rates at 5.5%

Week ahead

- Australia 4Q ‘23 real GDP

- ECB policy meeting

- U.S. Nonfarm payrolls

Thought of the week

Earnings in Australia have been beating analyst expectations, but the bar was low heading into this earnings season, as it often is. Companies reporting better than expected earnings have been higher outside of Australia given the boost from the AI related names in global equity indices. This stronger earnings outlook is one way to justify the rise in equity valuations, while any fall in bond yields will help ease valuation pressure as discount rates applied to future earnings fall. Expectations are high that these earnings can be delivered which leaves investors open to disappointment, especially if the balance of risk on the economic backdrop shifts again towards stickier inflation and the ‘soft landing’ narrative is further tested. Our view of lower growth, lower inflation and easier monetary policy remains. This is a positive environment for both stock and bonds, with a bias towards equities and markets with higher quality in earnings.

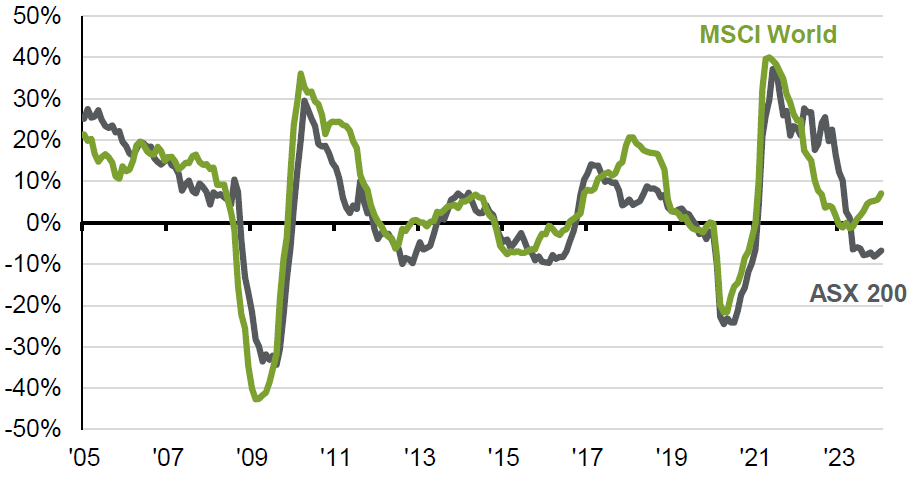

Growing divergence between the World and Australia’s earning expectations

Year-on-year change in consensus next 12 months earnings per share estimates

Source: FactSet, TOPIX, J.P. Morgan Asset Management. Data reflect most recently available as of 01/03/24.

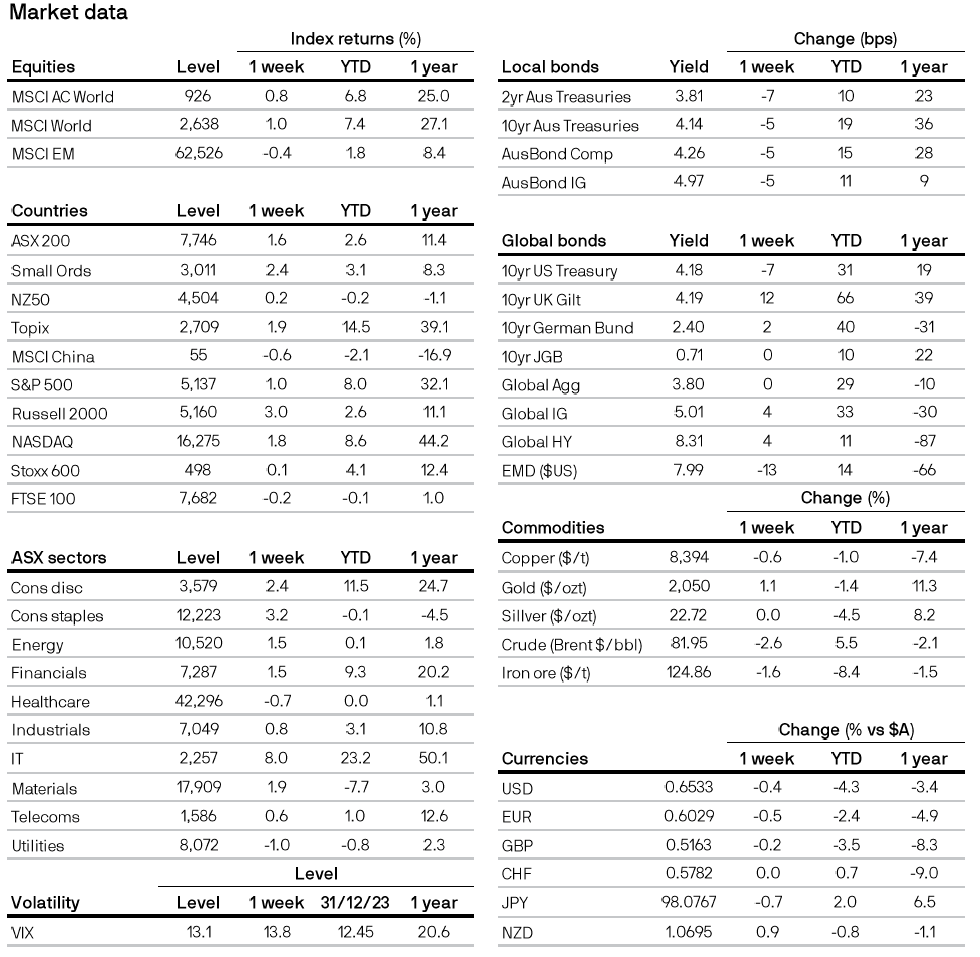

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5