Week in review

- Australia unemployment rate falls to 3.6%

- China’s economy expands by 4.9% y/y

- U.S. retail sales stronger at 0.7% m/m

Week ahead

- U.S and Eurozone PMI for manufacturing and services

- ECB policy rate decision

- Australia CPI inflation m/m

Thought of the week

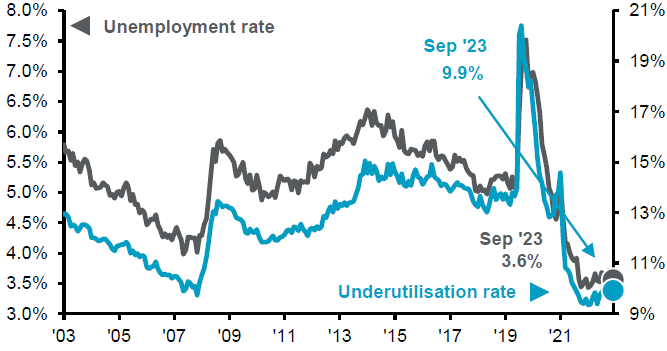

Bond yields continued to rise last week as markets increased the odds of central banks hiking rates again this year. Data continues to suggest economic resilience in the face of higher rates. It seems unlikely that the U.S. Federal Reserve will hike rates in November, but the RBA might. Stronger than expected growth in the first half of the year and inflation that has ticked higher on a monthly basis may lead them to revise up their economic forecasts, including inflation, in the November Statement of Monetary Policy. The latest labour market figures suggest the labour market remains tight as the unemployment rate dipped to 3.6%. The data comes on the back of more hawkish minutes from the last policy meeting where the board was deemed to have a low tolerance for a slow return to the inflation target. This week’s monthly inflation figures may sway the RBA to hike again in November.

Australian unemployment rate doesn’t want to budge

Unemployment and underutilization rate

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 20/10/23.

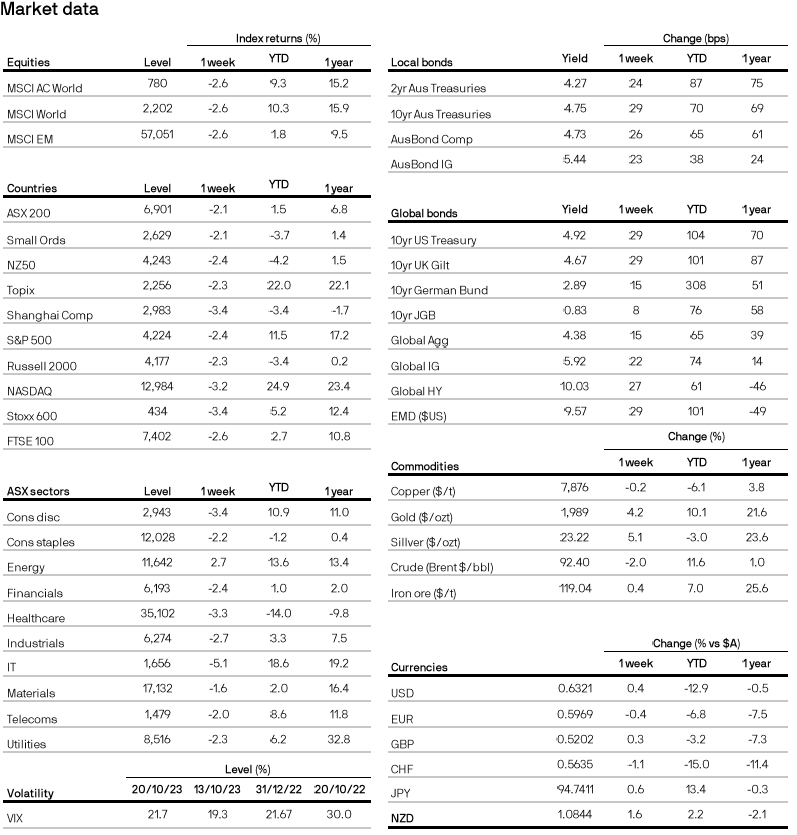

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5