Week in review

- Australia consumer confidence flat, business confidence falls

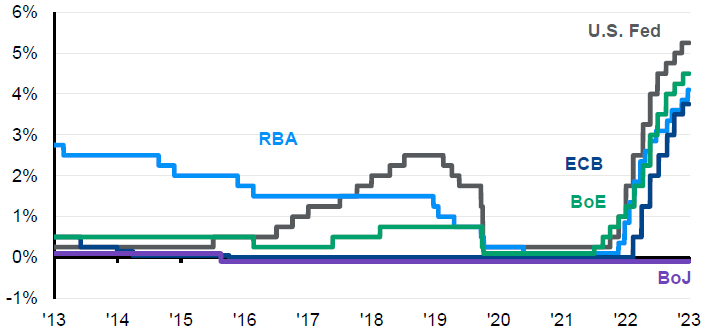

- ECB raises rate by 25bps to 4.0%

- Australia’s unemployment rate falls to 3.6%

Week ahead

- RBA policy meeting minutes

- U.S and European PMI surveys

- Bank of England policy rate decision

Thought of the week

As widely expected, the U.S. Federal Reserve held rates at its June meeting. This skip follows last month’s hop and the message was that there is still a jump to come. The triple jump is a tricky field event to master, and we are not certain the Fed will pull it off. Neither does the market. The unexpected news from the Fed meeting was the increase in growth and inflation forecasts for this year and the increase in where Fed committee members now see the cash rate peaking. The growth expectations were revised upwards from 0.4% to 1.0% and core PCE inflation from 3.6% to 3.9%. If the Fed believes that both growth and inflation will be higher in the coming months, then it also believes that it will need higher rates to rein that inflation in. As such the median dot rose 50bos to 5.6% suggesting two more 25bps rate hikes this year. Our view remains that inflation will come down faster than the Fed’s forecasts and that growth will be weaker and that another 50bps of rate tightening will not be required. However, the Fed leaned heavily into a July rate hike and the risk is that Fed oversteps the mark on policy tightening.

Take me higher, all major central banks set to hike again

Central bank policy rates

Source: BoE, BoJ, ECB, FactSet, Federal Reserve, RBA, J.P. Morgan Asset Management. Data reflect most recently available as of 16/06/23.

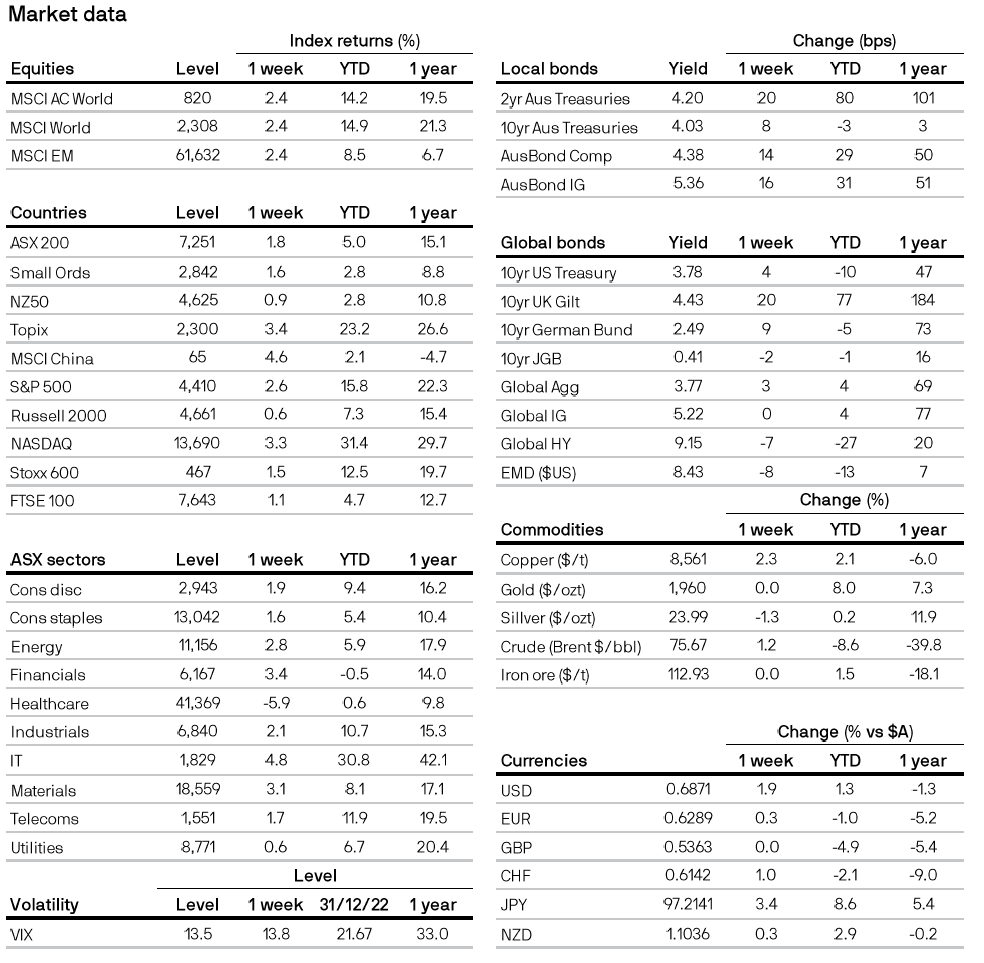

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.