Week in review

- RBA keeps rates on hold at 4.35%

- Chinese inflation falls to -0.8% y/y

- NZ unemployment rate rises to 4.0%

Week ahead

- Australia consumer and business confidence

- Australia unemployment rate

- U.S. CPI inflation

Thought of the week

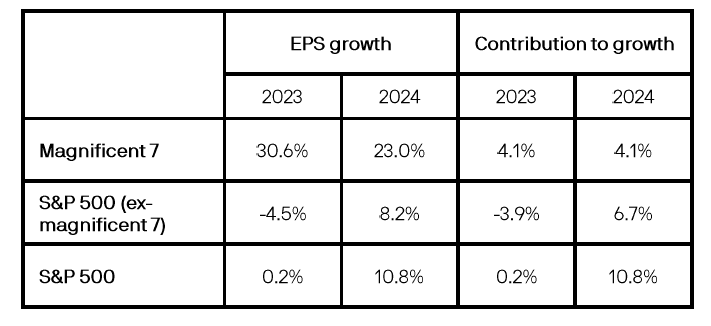

A big question for investors in the U.S. equity market is whether the rally will broaden out beyond the mega-cap ‘magnificent seven’. The ‘magnificent seven’ were responsible for nearly all the earnings growth and return on the S&P 500 in 2023. However, repeating the 31% profit growth these companies experienced last year will be a tough ask and the bar to surprise the market is now higher. Meanwhile the hurdle for the remaining 493 companies is lower. These companies could see a turn in earnings growth from negative to positive, contributing more to the 11% consensus earnings estimate for 2024. That double-digit earnings growth could be at risk as the economy slows moderating expected equity returns in 2024. However, quality companies can still make a profit in a weak economy and investors should diversify their exposure in U.S. large cap as they seek out higher quality earnings.

Magnificent seven, better than the rest in 2023

Year-over-year earnings growth and contribution to expected earnings

Source: FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 09/02/24.

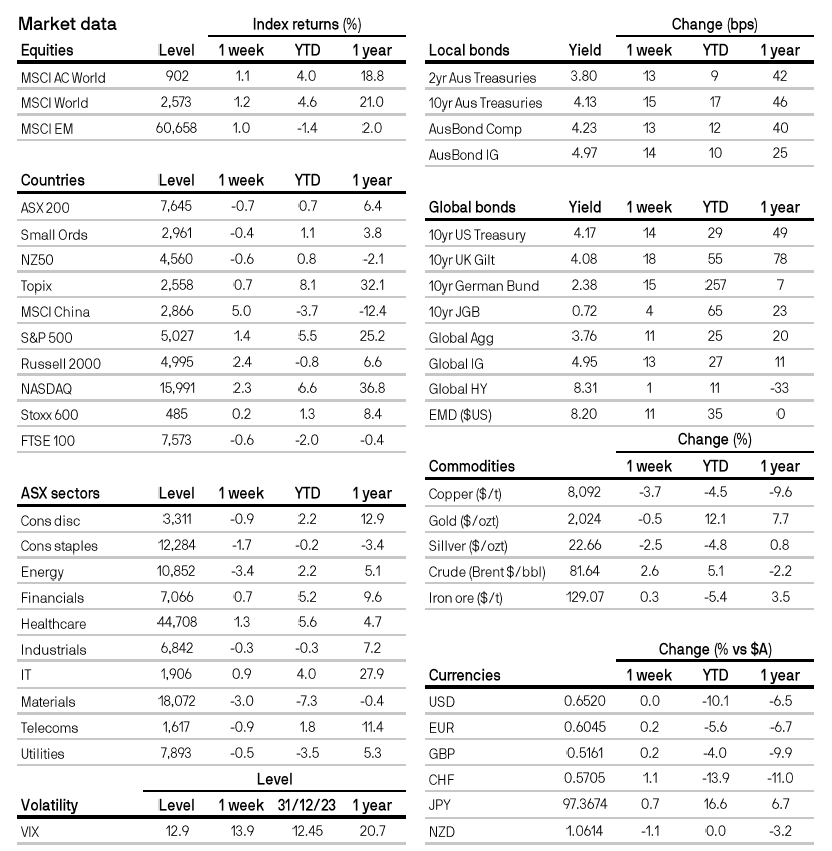

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5