Volatility in perspective

Global market swings and heightened uncertainty can be unsettling. Still, there are ways to help investors achieve their long-term investment objectives.

These principles can help investors stay calm and rational in a volatile environment.

In challenging times, it is always useful to keep a few things in perspective.

First, volatility is normal, and market declines are part and parcel of investing.

The urge to exit can be overwhelming when markets are falling, but doing so may mean selling at the most inopportune time and missing potential market rebounds. This can be costly for portfolios in the long run.

While periodic pull-backs are not uncommon, 26 of the last 36 years have ended with positive returns for the MSCI All Country World Index.

This underscores the importance of patience and perseverance to ride out choppy markets. Investors should not let short-term volatility derail their long-term investment plans and stay focused on their end goal.

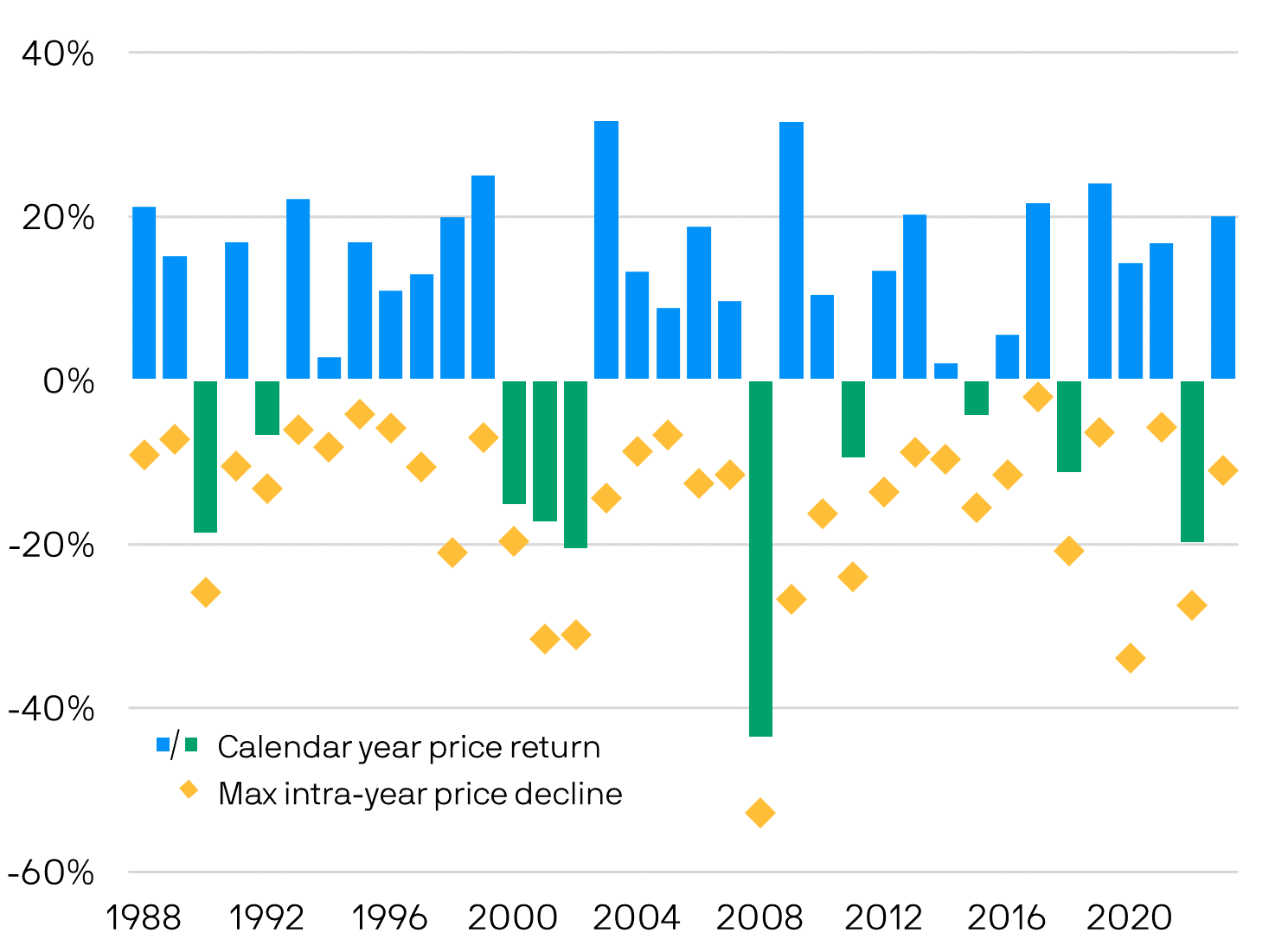

Volatility is normal. As a general macro trend, annual returns of the MSCI All Country World Index were positive in 26 of the last 36 years despite average intra-year drops of 15.3%.

MSCI All Country World Index annual price return and intra-year declines (1988 – 2023)

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.12.2023. Max intra-year price declines refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Past performance is not a reliable indicator of current and future results. Average annual return between 1988 to 2023 was 7.2%.

Second, investing is about time in the market, not timing the market.

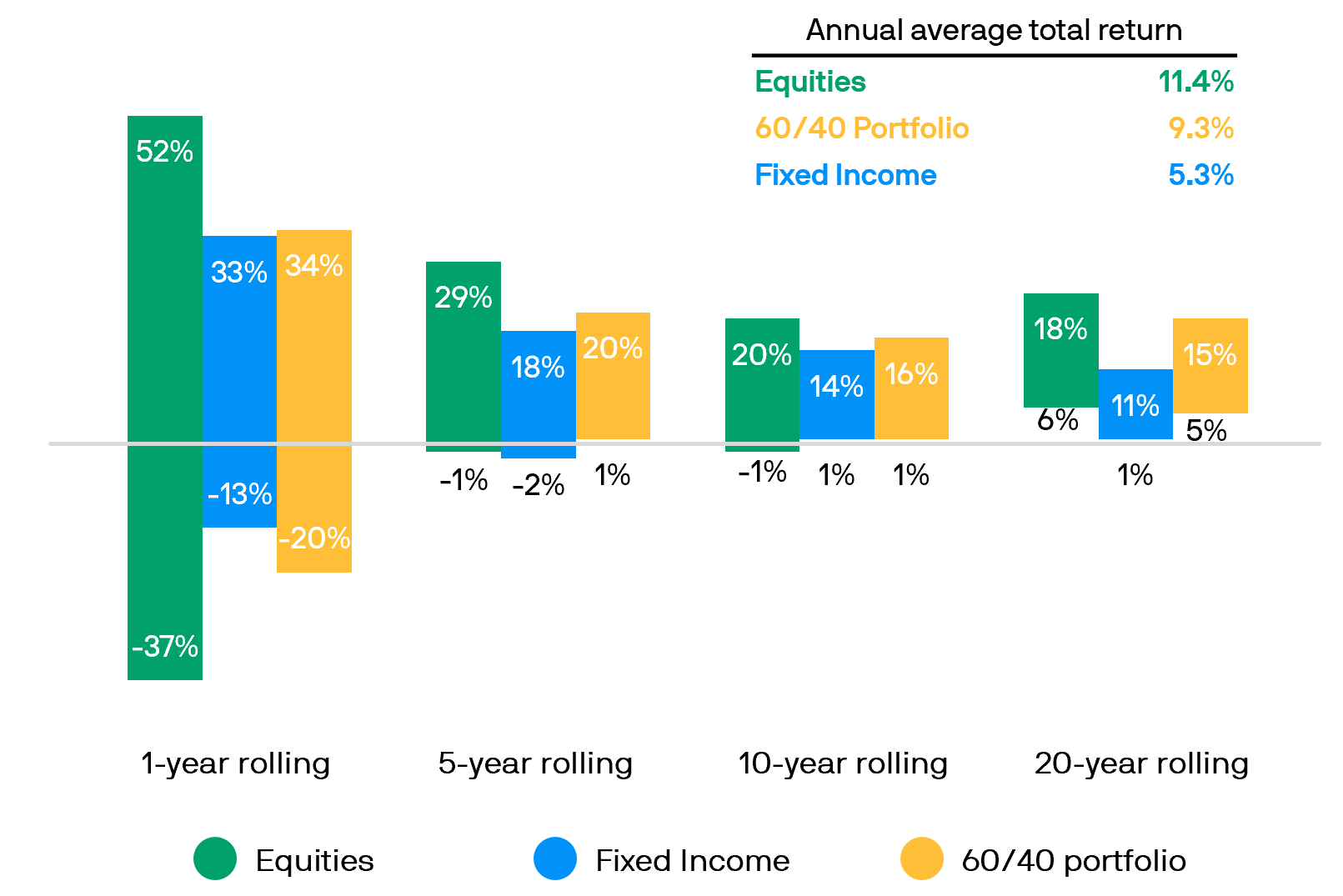

For one, the range of return outcomes narrows considerably and skews positive over longer time horizons.

It is also worth noting that over the last 73 years ending December 2023, a 60/40 portfolio of US equities and fixed income has not posted negative returns over a rolling 5-year, 10-year or 20-year investment horizon1.

While there is no guarantee of future returns, the data demonstrates the importance of staying invested and focusing on the long term.

The longer the holding period, the higher the chances of opportunities for positive returns as the range of potential outcomes narrows.

Range of equity, fixed income and 60/40 portfolio annualised total returns, 1950-2023

Source: Bloomberg, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management. Data as of 31.12.2023. Returns shown are based on calendar year returns from 1950 to 2023. Equity represented by the S&P 500 Shiller Composite. Fixed income represented by the Strategas/Ibbotson index for periods from 1950 to 2010 and Bloomberg Aggregate index thereafter.

Third, diversification can be useful to ease the journey through choppy markets.

Diversifying portfolios across a variety of negatively correlated and/or uncorrelated asset classes can help manage the risks during a market downturn.

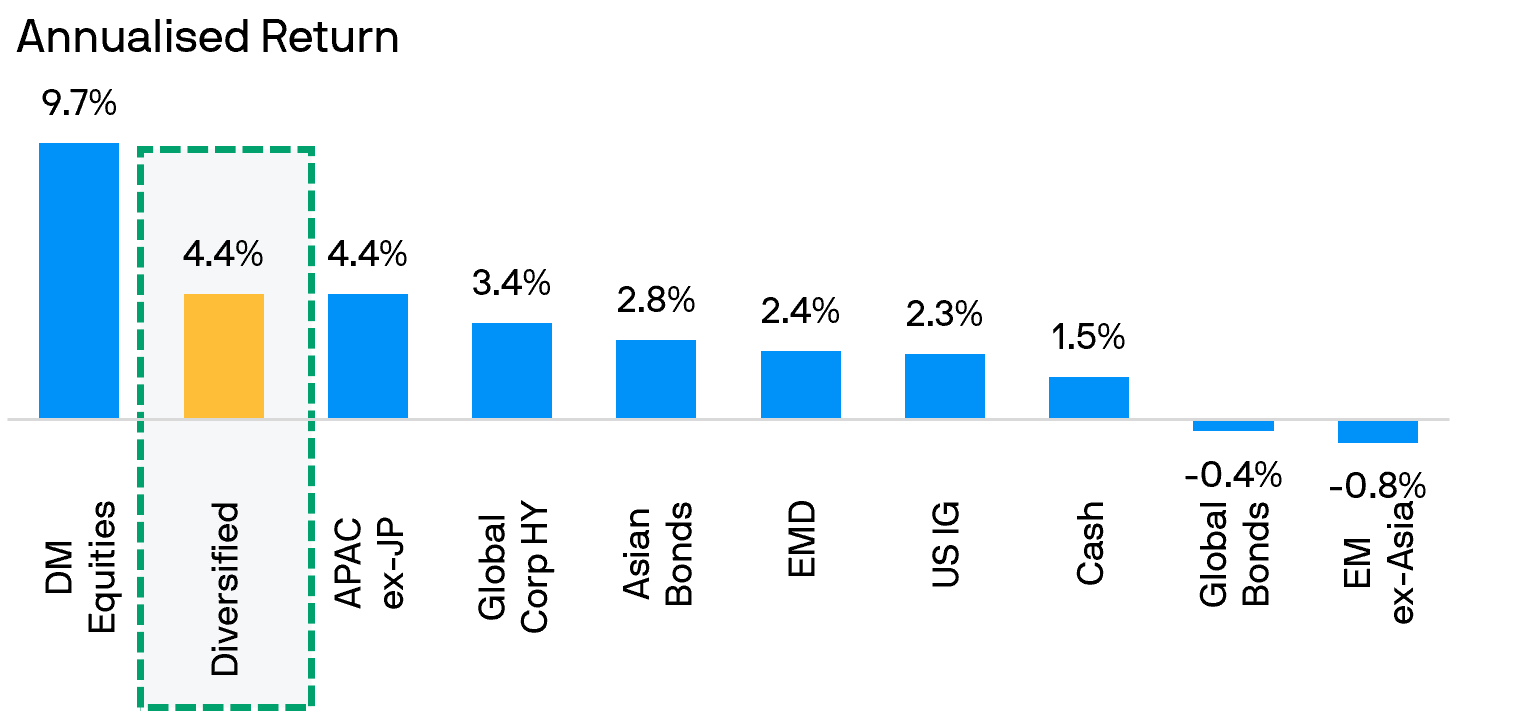

As an illustration of the macro trend, a well-diversified portfolio2 has recorded average returns of around 4.4% annually over the last decade, comparing favourably with other individual asset classes.

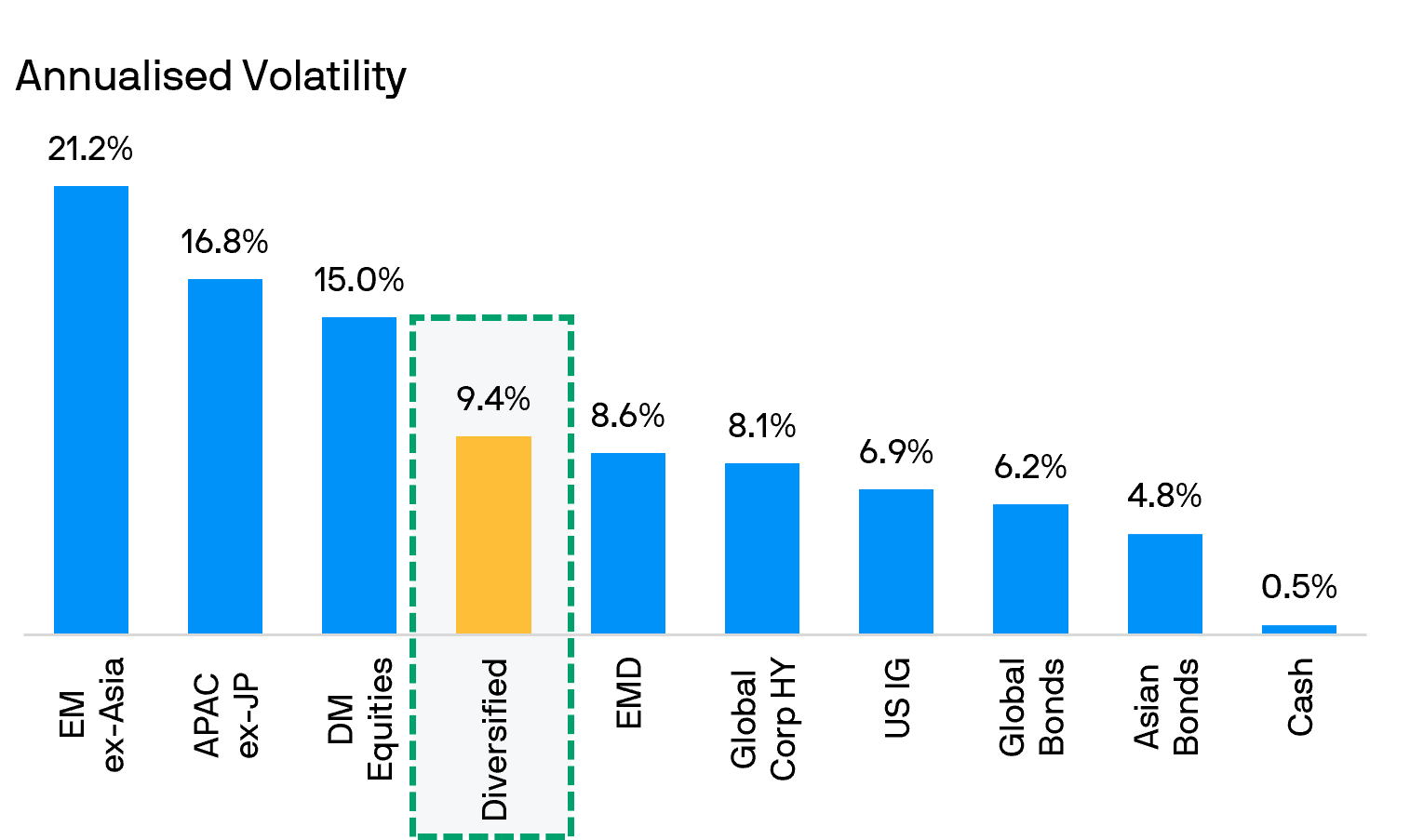

Such a portfolio also experienced just two-thirds of the volatility of developed market equities and less than half of the volatility of emerging market equities.

As such, diversification can help mitigate volatility and harness opportunities across various asset classes.

A diversified portfolio has posted reasonable returns with meaningfully lower volatility versus equities over the last decade.

Annualised performance and annualised volatility (2014 June-2024 June)

Source: Bloomberg L.P., Dow Jones, FactSet, J.P. Morgan Economic Research, MSCI, J.P. Morgan Asset Management. Data as of 30.06.2024. The “Diversified” portfolio assumes the following weights: 20% in the MSCI World Index (DM Equities), 20% in the MSCI AC Asia Pacific ex-Japan (APAC ex-JP), 5% in the MSCI EM ex-Asia (EM ex-Asia), 10% in the J.P. Morgan EMBIG Index (EMD), 10% in the Bloomberg Aggregate (Global Bonds), 10% in the Bloomberg Global Corporate High Yield Index (Global Corporate High Yield), 15% in J.P. Morgan Asia Credit Index (Asian Bonds), 5% in Bloomberg US Aggregate Credit–Corporate Investment Grade Index (US IG) and 5% in Bloomberg US Treasury –Bills (1-3 months) (Cash). Diversified portfolio assumes annual rebalancing. All data represent total return in US dollar terms for the stated period. Past performance is not a reliable indicator of current and future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Our Latest Insights

On Investors' Minds - APAC Edition

Listen to the latest insights from Tai Hui to better understand what is happening in the financial markets from our

Asia Pacific headquarters in Hong Kong

Our actionable ideas on income & growth

You can’t be a step ahead of the market, but you can be ahead in your investing. Access our investment ideas.

Seeking attractive income opportunities

Tapping into viable long-term trends

Navigating market highs and lows

Webconference Replays

Featured solutions

Multi-asset Solutions

Fixed Income Solutions

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research, investment recommendation or advice. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met. Indices do not include fees or operating expenses and are not available for actual investment.

Diversification does not guarantee investment return and does not eliminate the risk of loss.