Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information

JPMorgan China A-Share Opportunities Fund

1. The Fund invests primarily (at least 70%) in equity securities issued in the People’s Republic of China (“PRC”) including but not limited to China A-Shares listed on the PRC stock exchanges (e.g. Shanghai Stock Exchange, Shenzhen Stock Exchange and Beijing Stock Exchange). The Fund may also invest in derivative for investment and hedging purposes.

2. The Fund is therefore exposed to risks related to equity, emerging markets, concentration, smaller companies, PRC tax, liquidity and derivatives. The Fund has exposure to the China A-Share market via the Shanghai-Hong Kong Stock Connect and/or Shenzhen-Hong Kong Stock Connect (collectively, the “China Connect”) and/or Qualified Foreign Investor (“QFI”) status. Investors will be subject to the risks associated with QFI, China market, application of QFI rules, RMB currency, China Connect and investments in stocks listed on the Beijing Stock Exchange and/or the ChiNext Board of the Shenzhen Stock Exchange and/or the Science and Technology Innovation Board of the Shanghai Stock Exchange risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point.

Read More

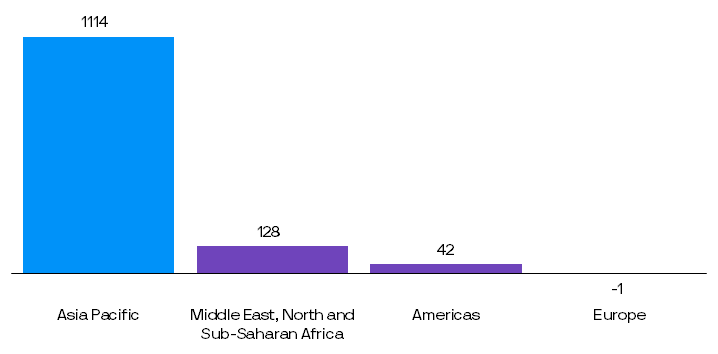

With 60% of the world’s population – over 4.5 billion people – living in Asia, the rapid rise of the middle class is a powerful engine for long-term growth. As illustrated below, almost all future growth in the global middle class over the next 7 years is projected to come from Asia1.

Asia is projected to drive nearly all future growth in the global middle class.

Regional contribution to middle class growth: 2023 to 2030 (Millions of people)1

Source: Brookings Institution, J.P. Morgan Asset Management. Data as of 30.04.2023. Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations. This information is provided for illustrative purposes only to demonstrate macro trends. Forecasts/Estimates may or may not come to pass.

The sustained increase in affluence could create a wide range of growth opportunities in the region, driven by powerful long-term trends such as lifestyle upgrades, demographic changes and financial deepening2.

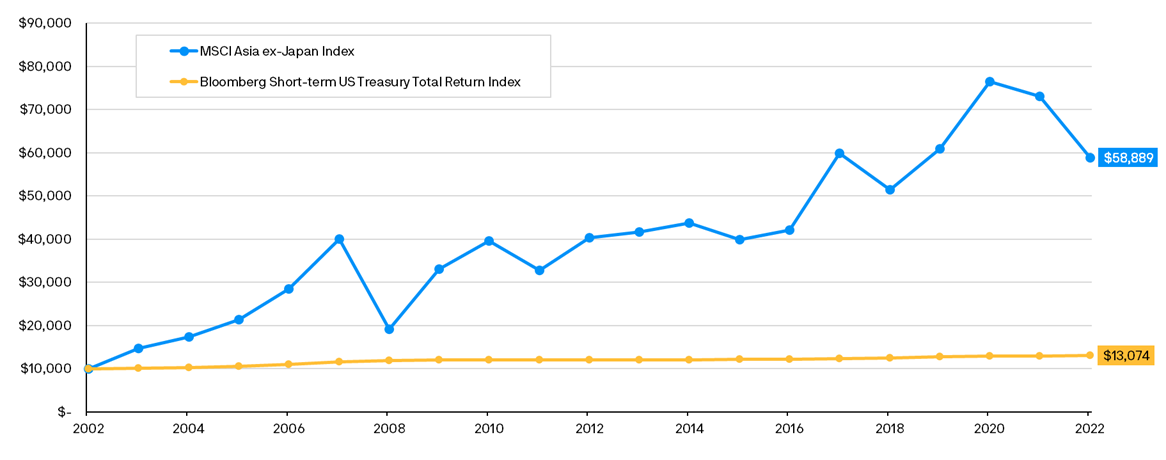

Harnessing Asia’s growth potential requires a long-term perspective as these enduring, multi-year secular themes take time to bear fruit. As illustrated below, investing in Asia ex-Japan equities invariably entails some volatility, but the longer-term outcome could be worthwhile2.

Investing for the long run

As an illustration of long-term investing, the chart below tracks the historical cumulative growth of US$10,000 invested in Asia ex-Japan equities versus short-term US Treasuries over a 20-year time horizon2.

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.05.2023. For illustrative purposes only. Asia ex-Japan equities is based on the MSCI Asia ex-Japan Index. Short-term US Treasuries is based on the Bloomberg Short-term US Treasury Total Return Index. Both indices are in US dollar terms. Results may vary. Past performance is not indicative of current or future results. Provided for information only to illustrate macro trends, not to be construed as offer, research or investment advice. Indices do not include fees or operating expenses and are not available for actual investment. Typically, actual investment also includes fees and charges.

From this perspective, an allocation to Asian equities, in the context of a well-diversified portfolio, can be useful for longer-term goals such as retirement, where investment horizons tend to stretch decades rather than months or years2.

In addition, in instances where Asian assets are underrepresented in a portfolio, we believe Asian equities can present an important source of regional diversification2.

The importance of a bottom-up approach

Nevertheless, investing in Asia should not simply be a passive endeavour for two key reasons:

Asia presents a wide range of markets in different stages of economic and financial development. Varied political systems, policy regimes and business cultures may present unique risks that investors will have to manage and navigate when engaging equity opportunities in this region.

Asian equity markets can exhibit high levels of pricing anomalies. This implies ample scope for skilled active managers to seek underappreciated opportunities that can potentially present attractive returns over time.

These factors underscore the importance of on-the-ground presence3 and rigorous bottom-up stock selection to uncover quality and enduring growth opportunities in this highly dynamic and diverse region.

Position sizing and active allocation will also matter to optimise longer-term outcomes for portfolios as investment prospects can change quickly in these fast-moving markets.

Putting local knowledge to work through Asia-focused growth solutions

J.P. Morgan Asset Management’s suite of Asia-focused equity solutions can help investors dive deeper and uncover attractive bottom-up equity opportunities through a prudent, disciplined and risk-aware approach4.

JPMorgan China A-Share Opportunities Fund*

JPMorgan China Pioneer A-Share Fund*

These funds are high-conviction, bottom-up portfolios of onshore Chinese equities. Capitalising on over half a century of investing experience in China as well as the skills and expertise of one of the largest China investment teams in the world, the Funds seek higher quality companies with attractive growth potential.

JPMorgan Asia Growth Fund*

The Fund leverages the local knowledge of an Asia-based investment team to deliver high-conviction, quality-focused exposure to the long-term, structural trends driving Asia’s dynamic growth.

Click here for the full performance data

*The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met. Investments involve risks. Not all investments, strategies or ideas are suitable for all investors. Investors should make their own evaluation or seek independent advice and review offering documents carefully prior to making any investment.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Source: Estimates for regional contribution are from “The Unprecedented Expansion of the Global Middle Class, An Update”, Brookings Institution, February 2017. Middle class is defined as households with per capita incomes between USD 11 and USD 110 per person per day in 2011 Purchasing Power Parity (PPP) terms. Forecasts/ Estimates may or may not come to pass.

2. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

3. Source: J.P. Morgan Asset Management, as of 30.04.2023. The J.P. Morgan Asset Management Emerging Markets & Asia Pacific (EMAP) investment team has 144 members, split across nine different locations including Taipei, Shanghai, Seoul, Mumbai and Singapore. There can be no assurance that professionals currently employed by J.P. Morgan Asset Management will continue to be employed by J.P. Morgan Asset Management or that past performance or success of such professionals serve as an indicator of the professionals’ future performance or success.

4. Risk management does not imply elimination of risks.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.