Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

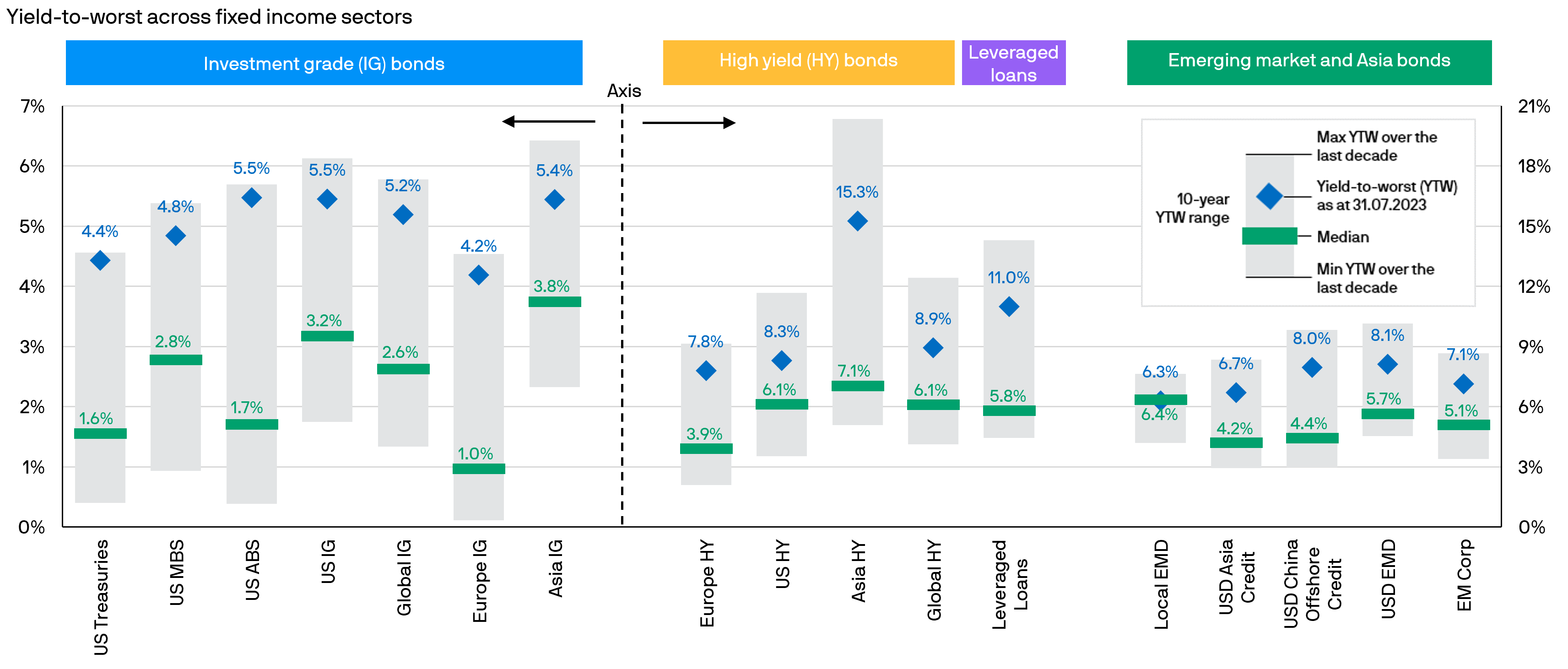

A yield revival in fixed income

Starting yields have increased significantly across different fixed income sectors.

Source: Bloomberg, FactSet, J.P. Morgan Credit Research, J.P. Morgan Asset Management. Data as of 31.07.2023. US Treasuries: Bloomberg US Treasury Index; US MBS: Bloomberg US Mortgage-Backed Securities (MBS) Index; US ABS: Bloomberg Asset-Backed Securities Index; US IG: Bloomberg US Corporate Index; Global IG: Bloomberg Global Aggregate Corporate Index; Europe IG: Bloomberg Euro Aggregate Corporate Bond Index; Asia IG: J.P. Morgan Asian Credit Investment Grade Index; Europe HY: Bloomberg Pan European High Yield (HY) Index; US HY: Bloomberg US Corporate High Yield Bond Index; Asia HY: J.P. Morgan Asian Credit High Yield Index; Global HY: Bloomberg Global High Yield Index; Leveraged Loans: J.P. Morgan Leveraged Loan Index; Local Emerging Market Debt (EMD): J.P. Morgan GBI-EM Global Diversified Index; USD Asia Credit: J.P. Morgan Asia Credit Index (JACI); USD China Offshore Credit: J.P. Morgan Asia Credit China Index; USD EMD: J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified Index; EM Corporates (Corp): J.P. Morgan Corporate Emerging Market Bond Index (CEMBI) Broad Diversified Index. All sectors shown are yield-to-worst. Yield-to-worst is the lowest possible yield that can be received on a bond apart from the company defaulting. Past performance is not indicative of current or future results. Yield is not guaranteed. Positive yield does not imply positive return.

Staying active with fixed income

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Investments in below investment grade or unrated debt securities, may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment.Yield is not guaranteed. Positive yield does not imply positive return.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.