Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information

JPMorgan Funds – Income Fund

1. The Fund invests primarily in a portfolio of debt securities.

2. The Fund is therefore exposed to risks related to emerging markets, debt securities (including below investment grade/unrated investment, investment grade bond, credit, sovereign, interest rate and valuation risks), concentration, convertibles, currency, liquidity, derivative, hedging and distribution (no assurance on distribution or the frequency of distribution or distribution rate or dividend yield), class currency and currency hedged share classes risks. Pertaining to investments in below investment grade or unrated debt securities, these securities may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment. Investments in asset backed securities and mortgage backed securities may be subject to greater credit, liquidity and interest rate risks compared to other debt securities such as government issued bonds and are often exposed to extension and prepayment risks. These securities may be highly illiquid and prone to substantial price volatility. Investment in RMB hedged share class is subject to risks associated with the RMB currency and currency hedged share classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point.

Read More

About the JPMorgan Funds – Income Fund

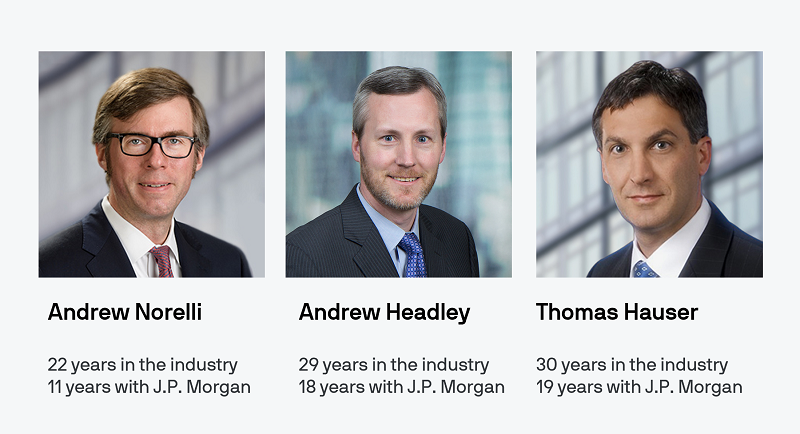

JPMorgan Funds - Income Fund aims to provide income by investing across multiple fixed income sectors and markets. Employing an unconstrained approach, the Fund dynamically shifts among sectors and markets as well as adjusts duration as market conditions evolve. Click here to check the investment team of the Fund1.

This Q&A provides insights on the Fund’s overall investment strategy.

Q1: How does the Fund manage recession risk?

A: Tighter financial conditions can have a real-world impact on economic data. While more economic data have to be observed, US inflation could slow in the coming months – particularly as components such as food and housing costs cool off – and markets could turn their attention to the evolving growth outlook.

Persistently high inflation, rising rates, tighter financial conditions and consumer fatigue are likely to weigh on growth, and thus raising the probability of recession while lowering the likelihood that the Federal Reserve (Fed) would be able to engineer a ‘soft landing’. However, markets have already gone through a dramatic repricing over the past year, and valuations have become relatively attractive.

Against this backdrop, the Fund has focused on upgrading its credit quality, increasing liquidity and allocating towards sectors with strong fundamentals and relatively attractive yield characteristics. Looking into 2023, the Fund will likely continue to adjust its duration2 positioning and to diversify allocations into higher quality securitised3 investments, higher quality high-yield (HY)4 corporates and select emerging market debt.

Q2: How is the Fund upgrading its credit quality?

A: Within the HY corporate sector, the level of distressed debt remains low as many companies have optimised the low-rate environment of the previous years to refinance debt and push out maturities. Fundamentals and valuations within the high yield market continue to look attractive as yields have reset higher and US dollar prices in many cash bonds are trading below par. While holdings in the HY sector are still playing a role in the portfolio, the Fund has actively trimmed the allocation from 29% at the beginning of 2022 to 24% at the end of 20225.

The allocation in investment-grade (IG) credit increased in the portfolio5. The Fund took the advantage of the sell-off in the IG sector earlier and credit-rating upgrades on select securities by rating agencies to help upgrade portfolio quality.

In securitised market, the Fund raised the credit quality by adding position to higher-coupon agency mortgage-backed securities (MBS) in 20225,6.

Q3: The Fund has effectively managed interest rate risk by adjusting duration. Going forward, how would the Fund continue to manage duration risk?

A: Effective duration management contributed to the overall portfolio’s returns in 2022. After being positioned short of US Treasury duration during the lows of August 2020, the Fund has since 2H 2022 moved long of US Treasuries and increased the overall Fund duration as both recession risk and interest rates have increased. The market may be nearing a period of transition where it reverts back to the general, right-way correlation between equity and bond returns.

Looking forward, the Fund’s focus stays on the evolving framework and communication landscape from global central banks, inflation data, the technical make-up of the Fed’s balance sheet as central banks continues its tightening, and cross-asset class correlations for future signals on duration.

In an environment of shifting correlations between risk assets and high-quality duration, it is important to have the flexibility to dynamically adjust duration, sector allocations and overall risk positioning. This flexibility is at the heart of the Fund’s approach to fixed income markets.

Click here to check the latest portfolio composition of the Fund.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yield is not guaranteed. Positive yield does not imply positive return.

1. As of 31.12.2022. Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met. There can be no assurance that professionals currently employed by JPMAM will continue to be employed by JPMAM or that past performance or success of such professionals serve as an indicator of the professionals’ future performance or success.

2. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

3. Securitisation is the process in which certain type of assets, such as mortgages or other types of loans, are pooled so that they can be repackaged into interest-bearing securities. Examples of securitised debt include asset-backed securities and mortgage-backed securities.

4. High-yield credit refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Investments in below investment grade or unrated debt securities, may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment. Yield is not guaranteed. Positive yield does not imply positive return.

5. Source: J.P. Morgan Asset Management. Data as of 31.12.2022. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice.

6. Agency MBS are guaranteed by US government-related bodies, such as Ginnie Mae, Fannie Mae and Freddie Mac, and they are generally AAA-rated.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.