Searching the globe for equity opportunities

While the US market remains an important source of alpha opportunities, there is an increasing appreciation among investors for the need to diversify return streams.

Important Information

JPMorgan Sustainable Infrastructure Fund

1. The Fund invests primarily (at least 70%) in equity securities globally (including listed real estate investment trusts (“REITS”)) that are well positioned to promote the development of the infrastructure required to facilitate a sustainable and inclusive economy, whilst not significantly harming any environmental or social objectives and following good governance practices.

2. The Fund is therefore exposed to risks related to investment, equity, REITs, sustainable investing, infrastructure companies, its investment strategy (associated with concentration in a single theme and/or sub-theme; sub-themes and changing market trends; the use of big data research and artificial intelligence technique), concentration, emerging markets, small companies, currency, derivatives and class currency.

Read More

Key takeaways:

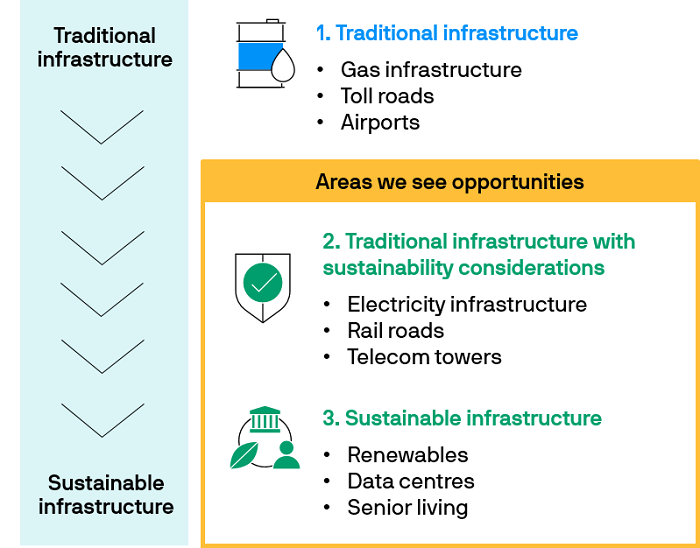

We share a perspective on sustainable and traditional infrastructure, and the opportunity set1 in the drive for sustainability.

Infrastructure in the traditional sense

Electricity networks, railroads and telecom towers would generally come to mind when investors think of infrastructure. Infrastructure can be defined as the set of fundamental facilities and essential assets that support the day-to-day functions of households, firms and society at large.

It is becoming increasingly challenging to employ a business-as-usual approach to investing in infrastructure, where some projects could lead to ecological concerns and increased carbon-dioxide emissions. This, coupled with changes in demographics and rapid urbanisation, are creating unique challenges.

In this regard, we see opportunities in infrastructure companies that align with sustainable investing goals and trends, such as environmental resiliency, social infrastructure and improved connectivity.

How we align infrastructure with sustainability2

Provided for information only based on market conditions as of date of publication to illustrate macro trends and investment team’s current view, not to be construed as offer, research or investment advice.

As the world transitions to a low-carbon economy, traditional infrastructure business models such as gas infrastructure are relatively less attractive from a risk/reward perspective.

Instead, we believe there are unique opportunities in infrastructure companies that are striving to help build a more sustainable and inclusive economy. Such companies are better positioned as they provide solutions that help address megatrend challenges. For example, electrification is at the core of decarbonisation, and this has spurred the development of related assets such as electricity networks.

Additionally, we seek to capture growth opportunities in innovative infrastructure areas that leverage new technologies to buid a more sustainable future. For example, electric vehicle charging stations and battery storage are part of the infrastructure framework that helps drive electrification.

![]()

Environmental Resilience

Changes in climate patterns are driving greater awareness to make our planet more liveable, presenting opportunities in infrastructure companies engaging in renewable energy, electricification and cleaner water.

Electricity infrastructure

Electricity networks

Water infrastructure

Water network companies

Water treatment companies

Renewables infrastructure

Wind, solar and hydropower developers

![]()

Social Advancement

Demographic shifts have driven demand in some social infrastructure, presenting opportunities in medical infrastructure, as well as social housing and education infrastructure.

Medical infrastructure

Healthcare facilities

Senior living providers

Social housing & education infrastructure

Affordable housing companies

Student accommodation providers

![]()

Improved Connectivity

Additionally, the growth of megacities will require an uplift in technology to help improve connectivity, drive envinronmentally friendlier forms of transportation and improve logistics in the urban environment.

Digital infrastructure

Data storage companies

Telecom tower operations

Transport infrastructure

Sustainable railroad companies

Sustainable logistics

Sustainable warehouse providers

Sustainable delivery companies

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice.

Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Investments involve risks. This includes illustrations of macro trends which may or may not come to pass. Investors should seek professional advice before investing. Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

2. Source: “Worried about inflation? A new breed of real assets may be right for you.”, J.P. Morgan Private Bank, 28.05.2022.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.