Why sustainability matters

We have noticed the shift. Individuals are increasingly opting for more sustainable choices in their daily lives, and this can range from reusable shopping bags to plant-based meat substitutes1 and even electric vehicles.

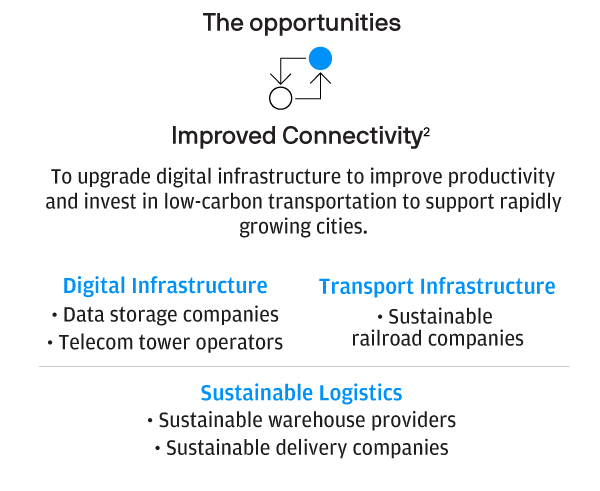

Companies are factoring in sustainability, such as incorporating goals to achieve net-zero carbon emissions and reduce waste. Some governments are also making policy decisions to help transit to a low-carbon economy. From consumers to policymakers, many economic actors are taking sustainability into consideration, and this is creating a wide range of investment opportunities2.

Sustainable growth opportunities

Sustainable investing is a forward-looking approach that seeks to deliver long-term returns in a fast-changing world.

Megatrends like climate change, demographic shifts and urbanisation are driving business changes and sustainable investing opportunities.

Investing to drive climate action

Climate change is one of the largest systemic challenges we face – affecting the way we live, work and interact with our environment. Addressing it will require input and change from governments, companies and individuals around the globe, alongside meaningful investment and widespread innovation.

Investing to build a better life

Investing to help shape a new generation of cities

Sustainability resources

The manager seeks to achieve its stated objectives and there is no guarantee they will be met. This includes illustrations of macro trends which may or may not come to pass.

Provided for information only based on market conditions as of date of publication to illustrate macro trends and investment team’s current view, not to be construed as offer, research or investment advice. Forecasts/ Estimates may or may not come to pass. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Source: J.P. Morgan Asset Management, “Selecting stocks for an environmentally sustainable future”, December 2021.

2. For illustrative purposes only based on current market conditions, subject to change from time to time. This includes illustrations of macro trends which may or may not come to pass. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

3. Source: World Economic Forum, December 2020.

4. Source: BP Energy Outlook Report 2018, December 2018.

5. Source: UNICEF, December 2019.

6. Source: United Nations, June 2019.

7. Source: Habitat, September 2017.

8. Source: Statista, November 2021.

9. Source: J.P. Morgan Asset Management, April 2022.