Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Dec 2021 (3-minute read)

Key takeaways:

How smart can a pen be2 ?

Pens are no longer used only for writing in the healthcare sector. And some pens have become smarter.

Innovative medical devices such as a smart, reusable insulin pen2 is improving the quality of life for patients with diabetes. It’s a pen that offers quick and relatively painless injections, can calculate and track doses as well as provide reminders, alerts and reports. When connected to a smartphone app, the pen could also help diabetics better monitor their blood sugar levels, diet and exercise. The data on the pen could also help doctors and patients make optimial treatment decisions.

Additionally, some healthcare companies are using data science and artificial intelligence for new medicines and timely diagnosis. Such breakthrough in treatments and innovative technologies are presenting long-term growth opportunities in the healthcare sector.

Investing in healthcare - same, same but different1

What to keep in mind

A digital transformation of healthcare is taking place across all members of the Organization for Economic Co-operation and Development (OECD) grouping, accelerated by the public health crisis and driven up by digitisation of IT infrastructure as well as growing demand from patients3. Additionally, a rapid rise in demand among emerging markets could help accelerate the sector’s long-term growth.

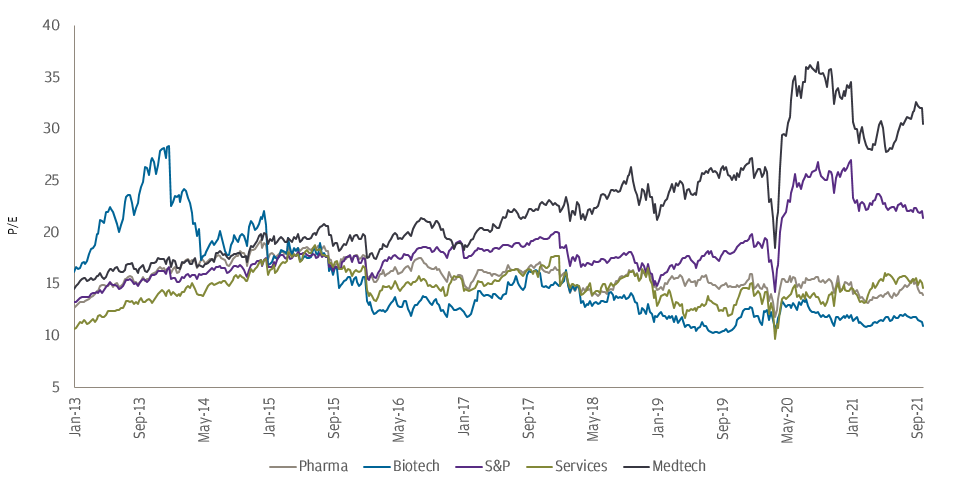

Forward P/E of US healthcare sectors and the S&P 5004

Governments and companies have accelerated investments in healthcare, including sub-sectors such as innovative medical technologies, biotechnology, pharmaceuticals and new medical devices and services. As illustrated in the chart4, these various healthcare sub-sectors, where valuation remains relatively attractive, are presenting long-term growth opportunities.

Conclusion

The global public health crisis has brought healthcare to the forefront, presenting long-term growth opportunities in sub-sectors such as innovative medical technologies, biotechnology, pharmaceuticals as well as new medical devices and services. Additionally, the growing middle class in emerging markets and an ageing population could help accelerate demand and the sector’s long-term growth.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

2. Source: “What is a smart insulin pen?”, American Diabetes Association. As of November 2021.

3. Source: “Health at a Glance 2021: OECD Indicators”, Organisation for Economic Co-operation and Development, 09.11.2021

4. Source: J.P. Morgan Asset Management’s chart based on data from Bloomberg between 04.01.2013 and 30.09.2021. Forward price-to-earnings (P/E) is next 12 months. Forecasts and estimates are indicative of macro trends, may or may not come to pass.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.

Eyes on the future with an innovative asset allocation strategy

Capturing dividend opportunities across Asia

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

A pulse check on our Asian bond portfolio

After a difficult year for bonds, we explain why fixed income could once again prove to be a useful diversifier for portfolios.

As the Fed’s rate hike cycle concludes, bonds can present an important source of income and diversification for portfolios.

We share our views on Asian bonds and how we position in 2H 2023.

We explain why investors should pay greater attention to quality bonds.

We share insights on the Japanese equity strategy while riding on cyclical and structural tailwinds.

ASEAN, China and the broader Asia ex-Japan region present ample opportunities for long-term growth.

Here is a chart indicating IG bond opportunities as US Treasury yields stay elevated.

A quick look at how the Fund is positioned as recession risks loom and financial conditions tighten.

A quick take on our strategy in investing Asian income assets amid global economic slowdown and China’s reopening.

We highlight the impact of China’s reopening on Asia equities and the key secular trends driving long-term growth in the region.

Flexibility is at the heart of our approach to fixed income markets.

Income investing can help tap investment opportunities while managing volatility through cash flows from a diversified portfolio of income generating assets.

We share the key themes driving equities as China reopens.

We share the key themes that are driving equity investment opportunities in ASEAN.

Rising government bond yields have presented more room to manage the impact of rate hikes. How big is this leeway?

We share our views on the fixed income opportunities in the current tough times.

Income investing remains relevant in the current market environment, as volatility is poised to remain elevated.

We believe that quality and yield opportunities can still be found in bonds.

We share a 2H 2022 market outlook on the key themes in China equity investing.

How technology is advancing the process of diagnosis – listening, observing, enquiring and examining – while presenting market opportunities.

Learn about how sustainable infrastructure helps drive the development of metaverse and electric vehicles.

We share a perspective on sustainable and traditional infrastructure.

Digital education helps enhance the learning experience, driving new growth opportunities.

We share our perspectives on positioning for income as rates rise.

Going beyond the traditional fixed income sectors to tap into the potential of securitisation.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

The securitisation market has regained much ground in the past decade.

Diversification sounds easy, but how to do it effectively?

Feel free to call our InvestorLine or email us if you would like further information about our Funds or J.P. Morgan DIRECT Investment Platform services: