Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information JPMorgan Funds – Asia Pacific Income Fund |

About the JPMorgan Funds – Asia Pacific Income Fund

JPMorgan Funds – Asia Pacific Income Fund aims to provide income and long-term capital growth by investing primarily in income-generating securities across Asia-Pacific markets (excluding Japan). The Fund dynamically allocates its assets to equities and fixed income in Asia Pacific, combined with flexible currency hedging. Click here to learn more1,2.

A banking crisis in the US and Europe, recent central bank actions, a weakening US dollar and Asia’s reopening have prompted some investors, depending on their investment objectives and risk appetite, to reassess emerging markets and Asian assets.

This Q&A provides insights on the Fund’s overall investment strategy.

Q1: How would the recent market turmoil impact global growth and what are the risks & benefits to Asia?

Major central banks in developed markets have remained focused on inflation. As such, financial conditions have tightened meaningfully, likely contributing to a further slowdown in global economic growth.

But compared to the US and other developed markets, many emerging Asian economies, including China, are currently running at a different cycle. Projected GDP growth in Asia is still higher. Inflation in Asia is also more tepid. Asian central banks have started the year with high policy rates, and are likely to leave more room for rate cuts in 2023. This presents an opportunity set for some investors to diversify across different geographical locations.

Still, a wide range of outcomes should be expected for Asian economies due to the dispersion in commodity dependency and correlation to global growth. While the export outlook is likely to be challenging for major Asian commodity and electronics exporters in the coming months, a rebound in domestic growth momentum in China is expected to have wider benefits for Asia overall.

Q2: How is the Fund tapping into the opportunities from China’s reopening?

The balance of data that we are tracking has suggested China’s recovery story remains intact – domestic travel has accelerated, and box-office sales and hotel bookings have risen above pre-pandemic levels3. With the government’s moderate growth target, the policy environment could remain supportive.

China’s reopening will likely bring a host of opportunities for income-generating assets in Asia. Banks and some quality stocks with reasonable yields are poised to ride on the upside in the early stages of recovery. The Fund has been adding a number of Chinese consumer discretionary and some Asian banks since 2022 4Q and some technology companies since early 20234.

Q3: How is the Fund’s approach and allocation tapping into Asian income opportunities while managing market volatility?

The Fund has been taking a low-volatility approach to optimise income in Asia Pacific. A low-beta, value and quality equity portfolio combined with fixed income seeks an optimal balance between yield and capital appreciation opportunities, while also seeking to manage market volatility.

While the past year has been challenging, the Fund kept its annualised volatility at a level lower than its benchmark partly due to the slightly underweight position in equities4. Within equities, the Fund has kept defensives and selective financials as a hedge against volatility. The Fund has rotated within financials by adding companies with defensive cash flows, and then optimising from those with relatively high valuation. In fixed income, the focus has been on issuers with higher credit ratings, while actively rotating to new issuances after the pick-up in spreads. Click here to check the latest portfolio composition of the Fund.

The Fund continues to adhere to its ways of assessing valuation and earnings momentum to actively allocate assets between equity and fixed income as markets evolve.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yield is not guaranteed. Positive yield does not imply positive return.

1. As of 28.02.2023. Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met. Actual account allocations and characteristics may differ.

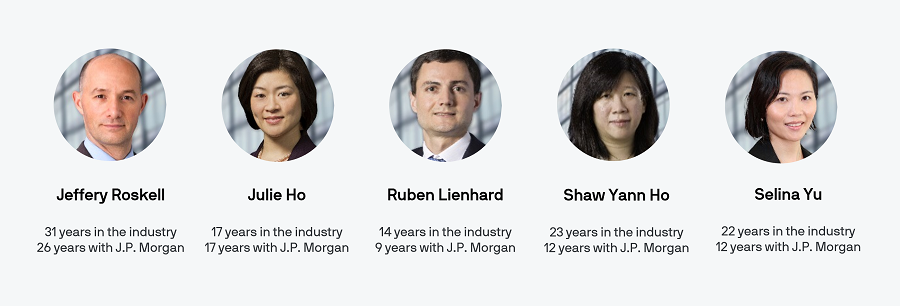

2. There can be no assurance that professionals currently employed by JPMAM will continue to be employed by JPMAM or that past performance or success of such professionals serve as an indicator of the professionals’ future performance or success.

3. Source: J.P. Morgan Asset Management. Data as of 28.02.2023.

4. Source: J.P. Morgan Asset Management. Data as of 28.02.2023. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.