Portfolio Pulse: JPMorgan Asia Equity Dividend

Capturing dividend opportunities across Asia

Important Information

1. The Fund invests primarily (i.e. at least 70% of its total net asset value) in debt and equity securities (directly or indirectly through collective investment schemes with investment objective and strategy similar to that of the Fund) whose issuers are well positioned to promote or contribute to, the world’s transition towards a sustainable future. The Fund will have limited Renminbi (RMB) denominated underlying investments.

2. The Fund is therefore exposed to a range of investment related risks which includes risks associated with sustainable investing, the Fund’s investment strategy (including risks associated with future transition concept, its sub-themes and changing market trends, risks associated with concentration in a single theme and/or sub-theme and risks associated with the use of big data and artificial intelligence technique), dynamic asset allocation strategy, debt securities (including downgrading risk, below investment grade/ unrated investment risk, credit risk, interest rate risk, valuation risk, volatility and liquidity risk), equity, emerging markets, investing in other collective investment schemes, concentration, currency, derivatives, liquidity, hedging, class currency and currency hedged classes. Pertaining to investments in below investment grade or unrated debt securities, these securities may be subject to higher liquidity risks and credit risks compared with investment grade bonds, with an increased risk of loss of investment.

About the JPMorgan Future Transition Multi-Asset Fund

A targeted and yet diversified portfolio to gain exposure to future transition trends by using proprietary technology that combines big data research and artificial intelligence.

Asset Allocation

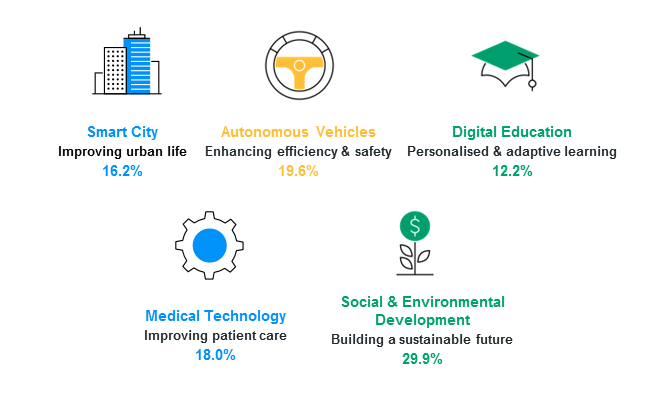

5 themes to shape our future

*ESG = Environment, Social and Governance. SFC authorization is not a recommendation or endorsement of a fund nor does it guarantee the commercial merits or ESG attributes of a fund or its performance. It does not mean the fund is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors.

Data as of end-September 2023. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Diversification does not guarantee investment returns and does not eliminate the risk of loss. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Dynamic allocation to capture growth potential while managing risks

A globally diversified portfolio+

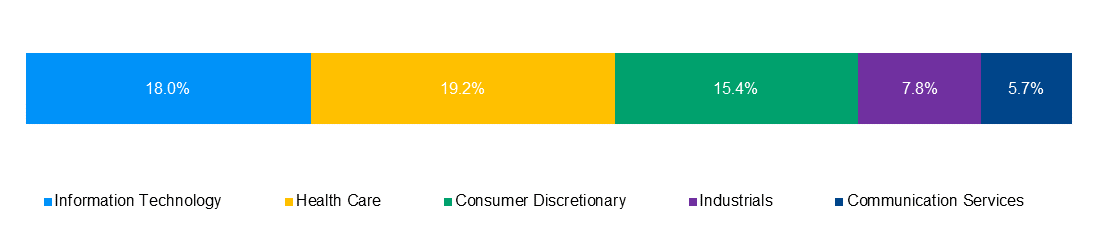

Sector exposure of equity sleeve+

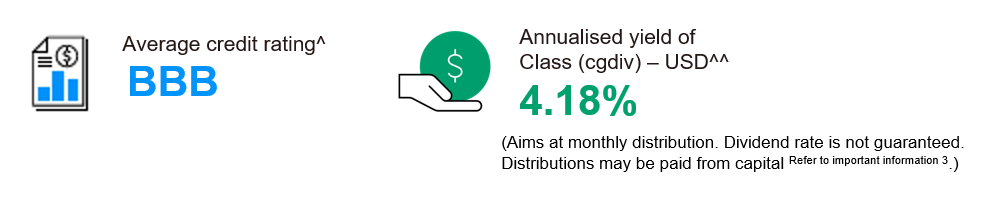

Other key characteristics+

+Source: J.P. Morgan Asset Management. Data as of end-September 2023. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice.

^Source: J.P. Morgan Asset Management, S&P, Moody’s, Fitch, DBRS, Kroll, Morningstar, as of end-September 2023. The credit rating is based on the highest of different rating agencies. Average rating is the weighted average of the credit ratings of bond holdings (including non-rated bonds) and net liquidity.

^^ Ex-dividend: 28.09.2023. Annualised yield = [(1+distribution per unit/ex-dividend NAV)^distribution frequency]-1. The annualised dividend yield is calculated based on the monthly dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Yield is not guaranteed. Positive distribution yield does not imply positive return.

Diversification does not guarantee investment return and does not eliminate the risk of loss.The opinions and views expressed here are those held by the author as at the date of this document, which are subject to change and are not to be taken as or construed as investment advice. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstances and market conditions.

Unless stated otherwise, all information is sourced from J.P. Morgan Asset Management, as of end-September 2023. The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein.

Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document(s) for details, including the risk factors. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.