Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information

1.The Fund invests primarily (at least 70%) in equity securities of companies in the Asia Pacific region (excluding Japan) that the investment manager expects to pay dividends. The Fund will have limited RMB denominated underlying investments.

2. The Fund is therefore exposed to a range of investment related risks which includes risks related to equity, dividend-paying equity (no guarantee that the companies that the Fund invests in and which have historically paid dividends will continue to pay dividends or to pay dividends at the current rates in the future), emerging markets, concentration, smaller companies, currency, liquidity, high volatility of the equity market in the Asian region, Chinese variable interest entity, hedging, derivatives, class currency, and currency hedged classes. For RMB hedged class, risks associated with the RMB currency and currency hedged classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point. The Manager may, under extreme market conditions when there is not sufficient RMB for currency conversion and with the approval of the Trustee, pay redemption monies and/or distributions in USD.

Asia can be a fertile ground of dividend-paying stock

We believe Asia is more than a growth story. It is also home to a wide range of dividend-paying companies.

Number of companies yielding more than 4% by region

Constituents of MSCI AC World Index

JPMorgan Asia Equity Dividend Fund combines income & growth equity plays

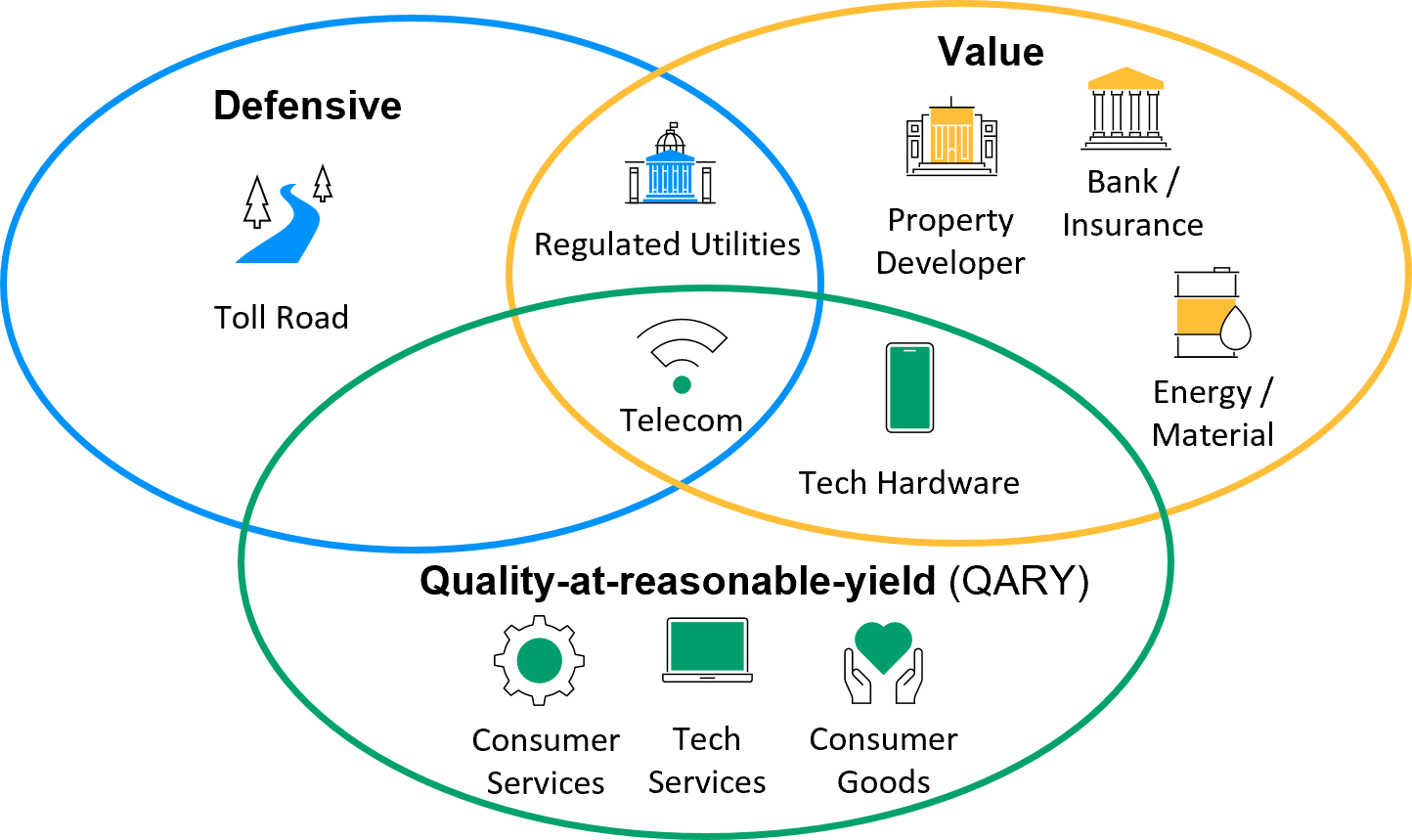

Harnessing attractive dividend opportunities in APAC via a flexible mix of stocks: value, defensives & quality-at-reasonable-yield (QARY).

3 key segments with quality dividend stocks

Source: J.P. Morgan Asset Management. Data as of end-September 2023. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Diversification does not guarantee investment return and does not eliminate the risk of loss.

Sectors that provides diversified sources of return

Financials: a number of Asian financials are well capitalised and we believe systemic risk in this space is relatively low. Improving fundamentals, structural growth and underlying value in the sector provide diversified sources of return.

Insurance: insurance penetration particularly in China remains below the developed markets’ average.

Quality businesses with cost control and pricing power

Semiconductors: digitalisation and the deployment of 5G are driving robust chip demand across smartphone, high-performance computing and the Internet of Things.

Consumption: quality consumer businesses in China with strong branding and pricing power can benefit from China’s recovery.

Opportunities emerging from macro adjustments

Telecommunications: consolidation is a key theme as companies are pursuing scale to share the cost of rolling out 5G, creating leaders with the advantage of scale.

Utilities: with the expectation of recovering demand, a number of select names benefit from automation, electrification and renewable proliferation.

Source: J.P. Morgan Asset Management. Data as of end-September 2023. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Diversification does not guarantee investment return and does not eliminate the risk of loss.

The opinions and views expressed here are those held by the author as at the date of this document, which are subject to change and are not to be taken as or construed as investment advice. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstances and market conditions.

Unless stated otherwise, all information is sourced from J.P. Morgan Asset Management, as of end-September 2023. The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein.

Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document(s) for details, including the risk factors. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.