Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Key takeaways:

Income investing presents a middle ground of opportunities that can help investors capture broader market upside while providing buffer through cash flows from income generating assets to help ride through volatile times.

Bonds have become more attractive given the meaningful pick up in yields while income generated from dividend equities, real estate investment trusts (REITs) and covered calls can help diversify income sources.

The sweet spot between caution and optimism

Investment markets are off to a good start. China’s reopening, moderating US inflation and firming expectations of smaller interest rate hikes by the Federal Reserve have seemingly prompted a turn in market sentiment.

Among investors, some may be considering the prospect of dialling up risk in portfolios to make the most of the recovering market sentiment. Yet there are risks ahead. Aggressive monetary policy tightening has increased the risks of a downturn in the US, while China may be facing some challenges in the transition towards living with COVID-19. Elevated economic uncertainty may keep markets volatile for some time.

Against these considerations, investors could be searching for ways to harness opportunities in a recovering market without piling on the risks. Income investing can be one option. It presents a middle ground of opportunities that can help investors capture broader market upside while providing buffer through cash flows from income generating assets such as bonds and dividend-paying stocks to help ride through volatile times.

Dividend-paying stocks: more than just a source of income

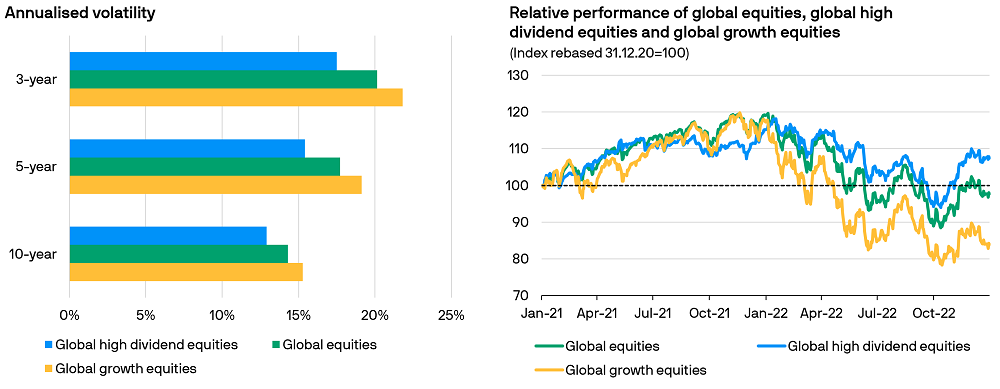

Dividend-paying stocks have historically exhibited lower volatility versus the broader index and growth stocks. As illustrated below, the annualised volatility of the MSCI ACWI High Dividend Yield Index has consistently stayed lower than the MSCI ACWI Growth Index across different time periods.

This low volatility characteristic, coupled with meaningfully higher dividend yields relative to its growth peers, have contributed to the outperformance of dividend paying equities over the last two years. Given the uncertain economic backdrop, dividend paying equities could still play an important role for portfolios.

High dividend stocks tend to exhibit lower volatility relative to its growth peer. It has also outperformed the broader index over the last two years.

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.12.2022. Global equities represented by MSCI All Country World Index (MSCI ACWI). Global high dividend equities represented by MSCI ACWI High Dividend Yield Index. Global growth equities represented by MSCI ACWI Growth Index. Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not indicative of current or future results.Yield is not guaranteed. Positive yield does not imply positive return.

Fixed income is fashionable again

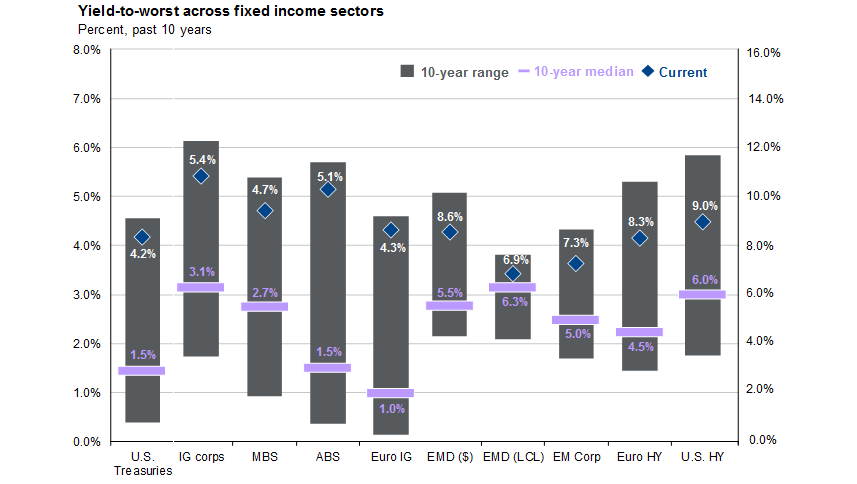

Bonds are generally the foundation of any income portfolio. After a year of significant repricing in bond markets, as illustrated below, yields across various fixed income sectors have risen to decade highs due to monetary policy tightening by major central banks. This illustrates the role of fixed income in portfolios as higher yields may bring in opportunities for higher investment income and may potentially serve as a hedge to help manage recession risks.

IG = investment grade. HY = High yield. EMD (LCL) = Emerging market (Local currencies). Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.12.2022. Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment.Past performance is not indicative of current or future results.Yield is not guaranteed. Positive yield does not imply positive return.

Stay diversified, stay flexible, stay active

Amid a fluid market environment, it is important to engage risk mindfully and prudently. Income investing can help tap investment opportunities while managing volatility via potentially steady cash flows from a diversified portfolio of income generating assets. It presents a more durable, long-term approach to revisiting market opportunities as silver linings emerge after a difficult 2022.

The flexibility to capture opportunities within and across asset classes, sectors and geographies as well as dynamically adjust portfolio allocation is essential to navigate the cross currents in an uncertain market environment. Active duration management in response to a changing interest rate environment is also critical to steer fixed income portfolios during a period of high inflation and slowing growth.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research or investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.