Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

In the first of a two-part series, our investment team shares their 2H 2022 outlook on China equities and the three long-term structural themes.

Key takeaways:

We believe further monetary and fiscal stimulus, and some easing in the regulatory environment are expected to support China’s economy and could help to manage the risk1 of slowing growth.

Active management remains crucial, and we believe that key potential secular growth opportunities continue to resonate well among investors looking to take advantage of undemanding valuations within China’s technology, consumer and renewables industries1.

Policymakers can take various actions to help meet their growth target

There are reasons to be cautiously optimistic on China’s economic and market outlook in 2H 2022. The outbreak of the Omicron variant hit the economy hard in 2Q 2022, especially in consumption and the job market. This is prompting the government to step up fiscal support to revive economic growth.

Source: J.P. Morgan Asset Management. For illustration purposes only. As of 30.06.2022.

Central bank policy is likely to be more supportive of growth, in contrast with other major central banks’ tightening bias. For this recovery to be sustainable, consumer and business confidence need to stay buoyant.

China’s economic rebound and additional stimulus could support earnings recovery. Its regulatory environment shifting from ‘framework setting’ to ‘enforcement’ could also help reduce uncertainty. These could facilitate a valuation re-rating in both onshore and offshore China equities.

Three long-term structural themes1

We believe the key secular growth opportunities remain unchanged in China’s technology, consumption and carbon neutrality sectors.

1. Technology

Going beyond smart phones and e-commerce

Technology has gone beyond smart phones and e-commerce in China. Artificial intelligence and cloud computing are becoming a part of everyday life. Against the backdrop of geopolitical uncertainty and the outbreak of the Omicron variant, China’s technology industry is embracing an inward economic pivot and is looking to make breakthroughs in core technologies to reduce its reliance on imported software and hardware.

Source: “China’s Share of Global Chip Sales Now Surpasses Taiwan’s, Closing in on Europe’s and Japan’s”, Semiconductor Industry Association, 10.01.2022. Forecasts and estimates are indicative of macro trends, may or may not come to pass.

Semiconductor and other hardware industries

Within China’s semiconductor industry, some companies are currently producing semiconductors at lower costs, and looking to provide better customer service.

Software and industrial automation

Software companies are also riding on the digitalisation trend and the government’s support for the creation of domestic champions. Industrial automation is another area of structural growth as companies in China are increasingly looking into labour supply and cost because of a ‘greying’ workforce and rising wages.

2. Carbon neutrality

Energy transition and carbon neutrality

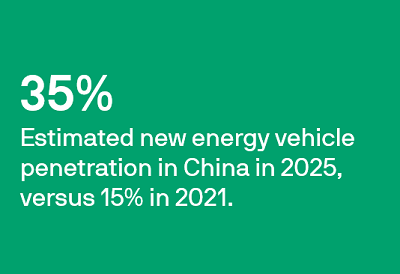

Energy transition and carbon-neutrality are likely to remain one of the core investment themes. We expect rising new energy vehicle penetration, stricter emission standards and controls, and faster adoption of renewable energy to continue, and this could support revenue and earnings growth of related segments.

Source: China Association of Automobile Manufacturers, data as of February 2022. Forecasts and estimates are indicative of macro trends, may or may not come to pass.

Additionally, the electric vehicle supply chain and renewables such as solar power supply chains, installation, and storage could present opportunities too.

3. Consumption

The expanding middle class

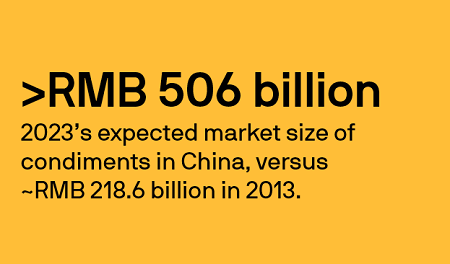

We continue to see brands benefiting from the longer term ‘premiumisation’ trend as the growing middle class demands better and healthier products. In some areas, industry consolidation opportunities can help compound growth.

Source: China Condiment Industrial Association, Euromonitor, as of January 2022. Forecasts and estimates are indicative of macro trends, may or may not come to pass.

Healthcare spending will also likely continue to increase, and we see opportunities in areas such as medical equipment and contract research organisations (CROs) and contract manufacturing organisations (CMOs).

Conclusion

Overall, we are of the view that China’s policy seems to be shifting from de-risk to pro-growth. We are taking a longer term view, despite short term volatility, and are considering to selectively build positions from here.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research or investment recommendation or advice.

Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.