Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

You have set your investment goals – 5 FAQs on long-term investing: starting out and you are taking cues from elite athlete training when investing for the long term; we believe you are almost halfway on your journey towards long-term investing1.

Adopting a long-term investing strategy could be likened to traveling on a long-distance journey. Having a mix of transportation modes, including flight, train and road could be an optimal way to reach your destination. Similarly, a well-diversified portfolio can help you manage risk as you seek consistent return opportunities.

1. The roles of different asset classes in a portfolio

Instead of directly investing in a particular stock or bond, investors could consider accessing a diversified range of investment opportunities across asset classes, markets, regions and sectors to help navigate different market conditions.

Asset classes in a portfolio1

| Equities | Fixed income | Multi-asset |

|

|

|

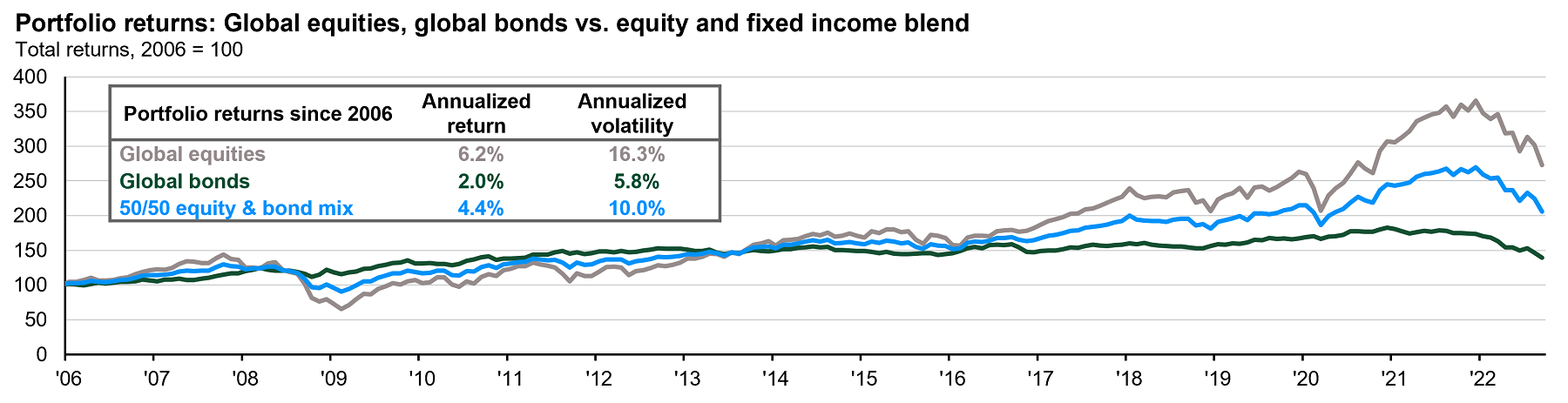

As illustrated in the chart2, over the past 16 years, a well-diversified portfolio of stocks and bonds returned an average of 4.4% per year with lower annualised volatility than a pure equity portfolio. Read more: 5 FAQs on long-term investing: staying invested

2. Source: Bloomberg Finance L.P., FactSet, MSCI, J.P. Morgan Asset Management. Global equities represented by MSCI AC World Index; global bonds represented by Bloomberg Barclays Aggregate Global Bond Index; 50/50 equity & bond mix represented by a 50% equity (MSCI AC World Index) and 50% bond (Bloomberg Barclays Aggregate Global Bond Index) portfolio. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results. Data reflect most recently available as of 30.09.2022.

Based on your investment objectives and risk appetite, how can you start diversifying your investment portfolio?

2. Investing flexibly through a monthly fund investing platform

Generally, different fund choices are available on a monthly fund investing platform such as J.P. Morgan DIRECT Investment Platform3. Our monthly fund investment plan requires a minimum subscription of HK$1,000 per month and investors will be also able to enjoy the online trading services and keep track of their investments.

J.P. MORGAN MONTHLY FUND INVESTMENT

Minimum monthly investment is as low as HK$1,000 – making it easy for you to start a habit of investing!

We offer a wide range of fund choices. All investors, no matter aggressive or conservative, we have solutions for you.

With our professional expertise, investing is made easy even for first-time investors.

Pick any day and amount of your choice for your monthly investment. Enjoy total flexibility as instructions can be changed anytime!

Investors normally strive to achieve their long-term financial goals based on their investment objectives and risk appetite. In addition to investing across asset classes which have low correlations, having a mix of currencies and locations can also help manage concentration risk. Even within the same asset class, there are generally opportunities to diversify beyond the traditional into the extended sectors.

On J.P. Morgan DIRECT Investment Platform, the Portfolio Risk Rating is shown in the 'My Portfolio'3. The rating, from lowest risk level to highest risk level, includes conservative, stable, balanced, growth and aggressive.

Similarly, each fund also has its own risk-rating range from 1 (being the lowest) to 5 (being the highest) which will contribute to your portfolio risk rating. You can regularly review your portfolio risk and rebalance the portfolio as needed.

Conclusion

In a long-term investment journey, investors can consider monthly fund investing on the J.P. Morgan DIRECT Investment Platform3 to tap into a broad range of funds at relatively lower costs, depending on their investment objectives and risk appetite.

This content represents our investment team’s current view and overall strategy provided for information only based on current market conditions not taking into consideration any specific investor’s investment objective and risk appetite. Not to be construed as investment recommendation or advice.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

3. Source: J.P. Morgan DIRECT Investment Platform, as of October 2021.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current or future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.