Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information

JPMorgan Asia Growth Fund

1. The Fund invests at least 70% in equity securities of companies whose predominant business will benefit from, or is related to, the growth in Asian economies. The Fund will have limited RMB denominated underlying investments.

2. The Fund is therefore exposed to risks related to equity, emerging markets, concentration, smaller companies, currency, liquidity, high volatility of the equity market in the Asian region, Chinese variable interest entity, derivatives, class currency and currency hedged classes. For RMB hedged class, risks associated with the RMB currency and currency hedged classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point. The Manager may, under extreme market conditions when there is not sufficient RMB for currency conversion and with the approval of the Trustee, pay redemption monies and/or distributions in USD.

Read More

Key takeaways:

China’s reopening and subsequent recovery could cushion growth in Asia as economic momentum wanes in developed economies.

Asia’s long-term growth story remains intact, supported by a growing middle class, widening access to financial services and accelerating technology adoption. This makes the region a fertile hunting ground for growth opportunities, particularly in the technology, financial services, and healthcare sectors1.

![]()

Global growth powered by Asia

China’s accelerated economic reopening has stoked optimism in markets and for good reason. For one, a rebound of China’s economic activity could provide some relief to an otherwise tepid global growth outlook amid the slowdown across many developed economies1.

This is largely reflected in the upward revisions of the International Monetary Fund’s (IMF) 2023 growth estimates for China and the global economy2. Based on their latest projections, China and India are expected to account for half of global growth in 2023, while the US and Europe combined may only account for just 10%2.

![]()

China’s consumers unleashed

As China’s borders reopen, the free-flowing movement of 15%3 of the world’s population combined with close to three years of pent-up demand and vast accumulated savings4 could be a positive tailwind for economies in Asia with strong trade and tourism links to the world’s second largest economy5.

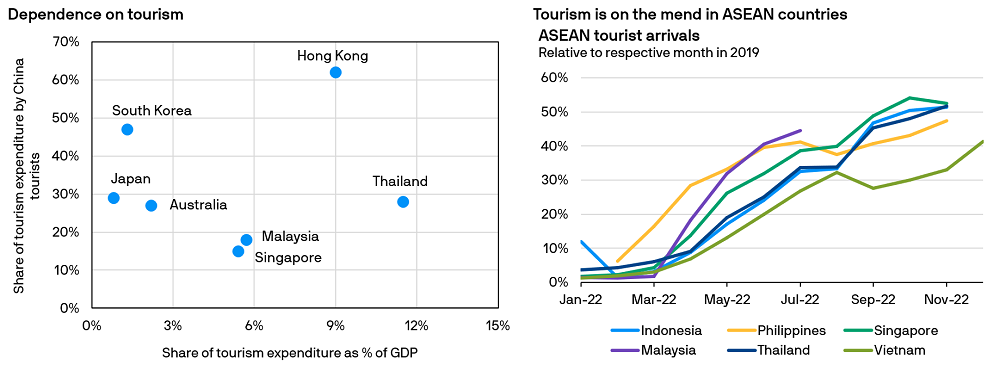

Hong Kong and Thailand are clear beneficiaries as Chinese tourist expenditures account for around 5.6% and 3.2% of their respective pre-pandemic nominal Gross Domestic Product (GDP)5. With tourism on the mend in ASEAN, China’s reopening could provide an added boost, as illustrated below5.

Markets in Asia are expected to be among the biggest beneficiaries of tourist flows from China

Source: (LHS) CEIC, FactSet, Development of Tourism Thailand, General Statistics Office Vietnam, Tourism Malaysia, Korea Tourism Organization, Tourism Research Australia, Hong Kong Tourism Board, Singapore Tourism Board, Japan National Tourist Organization. J.P. Morgan Asset Management. Data as of 06.01.2023. (RHS) CEIC, Development of Tourism Thailand, General Statistics Office Vietnam, Tourism Malaysia. Data reflect most recently available as of 31.12.2022.

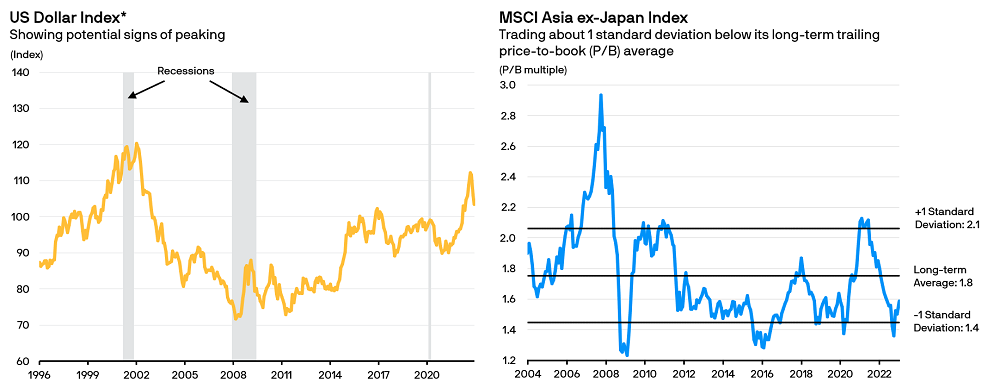

China’s domestic consumption-led economic recovery and the potential positive spillovers from its reopening may augur well for Asian risk assets1. Undemanding equity valuations, potentially peaking US Dollar strength and a seemingly less hawkish Federal Reserve in the face of weakening inflationary pressures could create a more conducive environment for Asian equities1. Nevertheless, diversification and active management will be essential to navigate a fluid macro environment.

Potentially peaking US dollar strength and undemanding equity market valuations may augur well for Asia equities

Source: (LHS) FactSet, OECD, Tullett Prebon, WM/Reuters, J.P. Morgan Asset Management. *The US dollar index shown here is a nominal trade-weighted index of major trading partners’ currencies. Major currencies are the British pound, Canadian dollar, euro, Japanese yen, Swedish kroner and Swiss franc. Data as of 31.12.2022. (RHS) MSCI, J.P. Morgan Asset Management. Data as of 31.01.2023. Indices do not include fees or operating expenses and are not available for actual investment. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met. Forecasts are not a reliable indicator of future performance. Past performance is not a reliable indicator of current and future results.

![]()

A region pregnant with growth potential

China’s decisive shift towards living with COVID-19 could book-end the era of disruptive pandemic restrictions. Importantly, this could trigger a shift in investor focus from COVID-related uncertainties that tend to plague this side of the world to longer-term secular themes powering growth in the Asia region.

Lifestyle upgrades due to a rising middle class, demographic changes, accelerating adoption of digital services and consumer technology and increasing demand for more sophisticated financial products and services are among powerful long-term trends that could play a significant role in shaping opportunities in Asia’s equity markets.

Looking for quality and growth in the Asia region1

Source: J.P. Morgan Asset Management. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. Provided to illustrate broad market trends, not to be construed as research or investment advice.

Lifestyle upgrades

Demographic changes

Financial deepening

Putting local knowledge to work

Asia is certainly bigger than the sum of its parts. The region is home to many different economies in varying levels of development, with their own unique histories, cultures, markets and idiosyncracies. Stock selection will require a more nuanced understanding of the business fundamentals and domestic environment that define these various markets. For a region as diverse as Asia, local knowledge and active management matter.

To that end, the JP Morgan Funds – Asia Growth Fund leverages the local knowledge of an Asia-based investment team tapping into high-conviction, quality-focused exposure that are tied to the region’s dynamic growth1.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

2. Source: “Global Economy to Slow Further Amid Signs of Resilience and China Re-opening,” International Monetary Fund (IMF), 30.01.2023.

3. Source: “A guide to China”, J.P. Morgan Asset Management, February 2022.

4. Source: "2023: The rainbow after the storm", J.P. Morgan Asset Management, December 2022.

5. Source: “The spillover effects of China’s reopening”, J.P. Morgan Asset Management, 10.01.2023.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.