Refocusing on the long run

Investing principles

Samantha Azzarello

Times of stress often lead investors to focus too intently on the short run. Consequently, we believe it is particularly important at the end of the most-stressful year to revisit investing principles that hold across market environments.

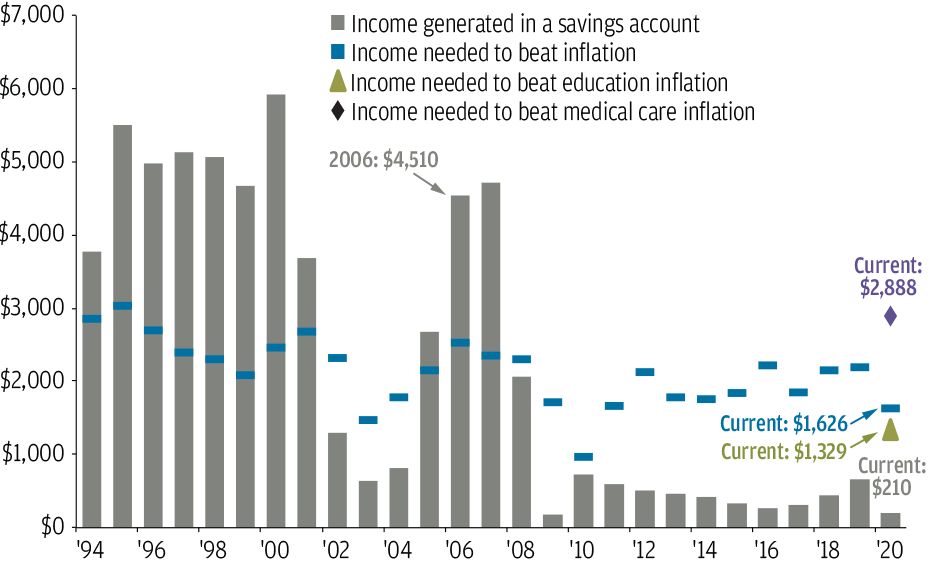

Getting invested is still key. While cash returns are extremely low, an extraordinarily high quantity of cash — almost $13 trillion — sits on the sidelines. While significant cash holdings often feel comfortable to investors since they are not subject to losses in nominal value, we know that inflation erodes purchasing power of cash holdings every year (Exhibit 1). More importantly, sizable cash allocations, by definition, reduce the potential for growth from the historically superior returns from long-term assets.

Exhibit 1: Returns on cash are low and are expected to stay that way

INCOME EARNED ON $100,000 IN A SAVINGS ACCOUNT*

Source: Bankrate.com, BLS, FactSet, Federal Reserve System, J.P. Morgan Asset Management, *Savings account is based on the national average annual percentage rate (APR) on money-market accounts from Bankrate.com from 2010 onward. Prior to 2010, money market yield is based on taxable money market funds return data from the Federal Reserve. Annual income is for illustrative purposes and is calculated based on the average money market yield during each year and $100,000 invested. Current inflation is based on September 2020 Core CPI, education inflation and medical care inflation. Current savings account is based on the October 2020 national average annual percentage rate (APR) on money-market accounts. Past performance is not indicative of comparable future results. Guide to the Markets – U.S. Data are as of November 30, 2020.

Staying diversified is a second principle that applies with even greater relevance in 2021. With the post-COVID-19 world yet to emerge, a well-balanced, diversified approach to investing is warranted and, over time, has shown to be a winning strategy for long-run investors.

With that in mind, we note what can be added to an investor’s choice set to build stronger portfolios through valuation opportunities, alpha generation and differing income streams.

To start, high quality fixed income will still act as a ballast in portfolios, even with low rates. Next, a healthy allocation to equities is as relevant as ever, though a focus on valuations is necessary. While U.S. equities are home base for many investors, looking to cheaper parts of the market such as value and cyclical sectors makes sense as the economy continues to recover. The valuation opportunities abroad are also compelling. International equities are cheaper and have potential for higher returns than their U.S. counterparts. Some of the most exciting growth and alpha-generating opportunities will come from emerging markets. In particular, Asia and other selective EM countries may have the ability to generate substantial alpha through strong active management. Lastly, income will continue to be top of mind as rates stay low. For many investors, the pivot to alternatives will provide new sources of income and added diversification benefits.

Lastly, a trend we expect to continue is the adoption of sustainable investing methods. This has become a truly multifaceted space allowing investors to contribute to goals beyond just maximizing returns and controlling risk. In addition, a commitment to sustainable investing methods can allow investors to get ahead of trends in both innovation and regulation, which will be important in determining winners and losers in the decade ahead.

Despite generally positive market returns, few will lament the end of the pandemic year of 2020. 2021 should be the year of the vaccines and, as such, will give all of us a new start on a hopefully long economic expansion. However, for investors, generating strong returns in the decade ahead will require a renewed commitment to basic investment principles, particularly given an altered economic landscape, elevated valuations and the policy changes that have emanated from the year of the pandemic.