J.P. Morgan Asset Management Launches JPMorgan International Dynamic ETF (JIDE) on NYSE Arca

New ETF Delivers Active International Equity Strategy for U.S. Investors

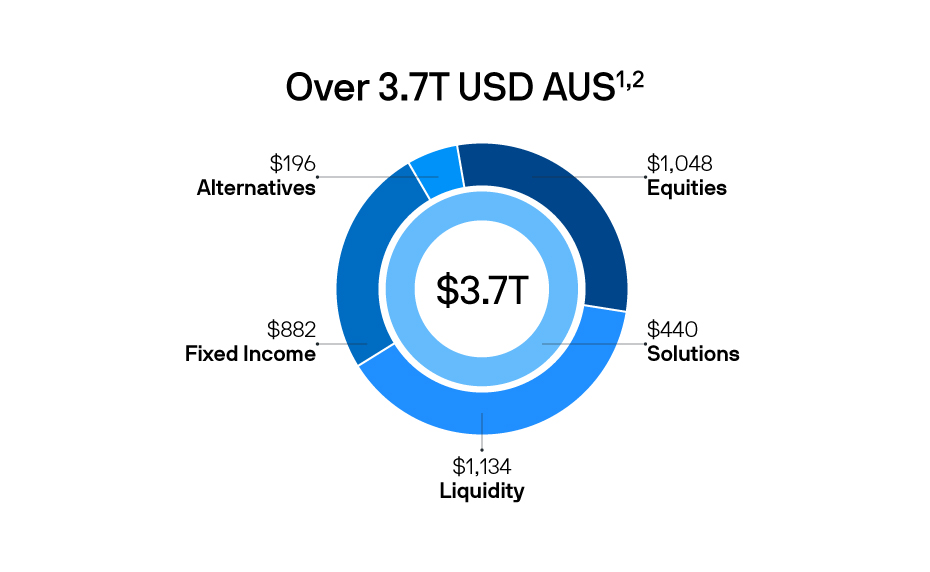

We work together to identify big-picture ideas and develop the deep insights that only our globally connected outlook can deliver. Our clients trust us to manage $3.7 trillion (as of March 31, 2025) in assets to secure what matters most to the individuals, families, companies, and communities they serve.

Our clients face an infinite set of portfolio building challenges. We meet them with a singular focus: to offer investment solutions designed to achieve their long-term goals in the way that’s best for them.

Technology powers every aspect of what we do to help our clients succeed. We continuously advance the state-of-the art to bridge the gap between ideas and reality to build stronger portfolios.

We keep our finger on the pulse of every major market to help you see the present with clarity. We anticipate economic trends, see correlations, and identify risks that others might miss, sharing our perspective continuously through applied intellectual capital.

Our research-led approach is continually evolving to consider everything material to a company’s ability to thrive for the long term – including financially material environmental, social, and governance factors. We believe that when companies and other security issuers manage these factors well, they are more likely to be efficient, less exposed to regulatory and reputational risk, and offer opportunities for our client portfolios. It’s simply how we live up to our long heritage as active managers in sync with the world’s pace of change.

1 In actively managed strategies deemed by J.P. Morgan Asset Management to be ESG integrated under our governance process, we systematically assess financially material ESG factors amongst other factors in our investment decisions with the goals of managing risk and improving long-term returns. ESG integration does not change a strategy’s investment objective, exclude specific types of companies or constrain a strategy’s investable universe.

1 As of March 31, 2025. Due to rounding, data may not always add up to the total assets under service. Includes custom glide path and retail advisory assets; 2 AUS by asset class includes AUS managed behalf of other investment teams;

New ETF Delivers Active International Equity Strategy for U.S. Investors

Experienced retirement research expert to help meet increased demand for actionable retirement insights

Fund marks the firm’s entry into the rapidly evolving money market ETF space

The fund will focus on the small and mid-market, granting investors access to top-tier GPs

Comprehensive study highlights the need for improved plan design and participant support to help with retirement security

The report identifies investment opportunities across global real estate, infrastructure, transportation, timberland, hedge funds, private equity, and private credit

Qualified investors gain access to on-chain assets through Morgan Money®

The fund will focus on the group’s long-standing small- and middle-market buyout strategy

Emerald Ridge, a premier timberland property, spans approximately 28,200 acres (11,400 hectares) across the north coastal and Willamette Valley regions of Oregon

This year marks the flagship report’s 30th anniversary, showcasing J.P. Morgan’s long-standing market expertise and leading research capabilities

Expanded partnership with GeoWealth broadens advisors access to alternative investments

Fund expands the firm’s category-leading Equity Premium Income Suite

Solution offers an innovative lifetime income strategy providing transparency and flexibility to retirement savers.

This strategic transaction was executed as part of a sale-leaseback agreement with a leading North American transportation provider.

Introducing Solo 401(k), an expansion of Everyday 401(k) by JPMorgan

JPMorgan Active High Yield ETF (JPHY) provides access to a leading active high-yield strategy

83% of plan sponsors feel a strong responsibility for employees' financial well-being

The event will bring together innovators, investors and industry leaders to explore the latest advancements and trends shaping the future of healthcare in Saudi Arabia

These transactions reinforce JPMREIT’s commitment to highly functional industrial facilities in dynamic growth markets.

Dr. Dhanak is a seasoned pharmaceutical research and development expert with over 30 years of experience

New role unifies asset manager’s global real estate offering and expands access to firmwide capabilities

Fund joins HELO in the firm’s Hedged Equity suite

Seasoned economic policy expert to meet increased demand for macroeconomic and market-driven policy insights

This addition marks the second offering to be added to the Schwab Alternative Investment OneSource platform, with JPMorgan Real Estate Income Trust (JPMREIT) having been added in 2024.

Timberland management strategy exceeds fundraising target and reaches $2.3 billion with additional strategy commitments

The Guide provides saving and investing insights to help advisors and their clients plan for education

These strategic acquisitions underscore JPMREIT's commitment to high-quality, attainable housing assets.

13th edition of Guide explores key themes that will impact retirement planning this year, including Social Security and guaranteed income

Laseter Development Group will focus on delivering housing in rapidly growing Sunbelt market

Fund Aims to Deliver Attractive Income and Capital Growth

Research explores private equity, private credit, real estate, infrastructure and transport, hedge funds, and secondaries

Experienced alternatives expert to meet increased demand for alternatives thought leadership

Assets to be managed for both carbon capture and timber products

This investment allows JPMREIT to access infill logistics facilities in one of the fastest-growing metro areas in the U.S.

The long-term growth outlook has risen, driven by robust capital investment, advances in artificial intelligence (AI) and automation, and fiscal activism.

Collaboration with GLMX to offer clients a broader range of money market instruments

New integration to streamline liquidity management workflows for customers

This represents JPMREIT’s second real estate debt investment.

Spence to continue global momentum for active ETF business

J.P. Morgan Asset Management announced the launch of the JPMorgan Fundamental Data Science (FDS) Suite on the Nasdaq Stock Exchange.

Myerberg Brings Expertise from Morgan Stanley to Accelerate J.P. Morgan's Real Estate Growth

Nearly 80% of Plan Participants Worry About Securing Lifetime Retirement Income

Mr. Siletto joins from Vivo Capital as Co-Managing Partner

The fund closed above its $500 million target

Mr. Hussain joins the firm from BlackRock, where he was Head of Americas Fundamental Fixed Income Product Strategy

Rayees Rahman of Harmonic Discovery named winner of the inaugural J.P. Morgan Asset Management: Life Sciences Innovation Summit

This acquisition is part of a strategic joint venture to pursue retail opportunities with Acadia Realty Trust (NYSE:AKR), an equity real estate investment trust.

Will lead new ETF Insights program

His 30 years of industry experience includes drug development, deal making, venture investing, commercialization, and leadership experience on a global scale.

JPMorgan Active Bond ETF (JBND) is expected to begin trading in February

Application Period Opens November 16, 2023

The 28th edition of the LTCMAs

’40 Act private equity fund provides access to qualified individual and institutional investors

Industry-first partnership will provide custom, tax-smart management at scale for Raymond James Advisors and their clients.

Focused on adding value for investors, JBND employs a bottom-up, value-oriented approach that emphasized security selection.

Funds seek to deliver JPM active management expertise and risk controls through ETF structure

Funds seek to deliver JPM active management expertise and risk controls through the ETF structure

90% of plan sponsors believe it is important to offer investments that help participants generate income in retirement.

Funds are expected to liquidate in Fall 2023

Assets to be managed for both carbon capture and timber products to meet growing wood demand

Digital platform leverages 55ip's ActiveTax® technology to allow advisors to create customized, tax-efficient portfolios; Custom Invest - U.S. Large Cap Equity is the first strategy on platform, benchmarked to S&P 500

Industry Veteran Brings Extensive Private and Public Experience to Firm's Efforts

10th edition of Guide examines impacts of longevity, spending behaviors and inflation on retirement

Industry-first research draws upon real-world data to explore Defined Contribution plan participants' holistic lifecycle from saving to spending

Inaugural publication, Getting Real About Rates, considers strategies for investors to overcome negative real bond yields

The active equity ETF will employ the expertise of J.P. Morgan's Global Equities platform, creating a unique portfolio that offers differentiated alpha potential in the value space.

The smartphone and tablet-enabled platform offers clients a new way to access interactive analysis on major economic themes impacting markets and investors Image embedded in Press Release also attached. Placement is just above the "About J.P. Morgan Asset Management's Market Insights" section - can be seen in the doc attached as well.

Sikora joins Growth Equity Partners to help lead the platform's investing efforts on the West Coast

Combining Mutual Fund and ETF Boards also proposed; moves would expand firm's fast-growing active ETF complex to 17 active strategies

New team to leverage deep sourcing and investment capabilities in direct lending, as part of J.P. Morgan Private Capital

Findings from Sixth Research Study Shows That Many DC Plan Participants Appear Unsure About Retirement Planning

Funds expand JPM's newly launched ActiveBuilders ETF suite, seeking to deliver JPM core active management expertise and risk controls through low-cost ETF technology

Provides direct access to Forestry sector and alignment with UN Sustainable Development Goals and Principles of Responsible Investing J.P. Morgan Asset Management Acquires Campbell Global, a Leading Player in Forest Management and Timberland Investing

The Board of Trustees of the J.P. Morgan Exchange-Traded Fund Trust has approved a reverse split of the shares of six ETFs.

Guide Analyzes Key Issues Impacting Retirement Planning in 2021

Employing the scale and expertise of J.P. Morgan's Global Equities platform, both funds seek broad S&P 500 equity exposure while hedging overall market risk relative to traditional long-only equity strategies.

Report Highlights Opportunities Across Hedge Funds, Private Equity, Private Credit, Real Estate, Infrastructure, other Real Assets and Liquid Alternatives

A history of innovation that continues today

Financial Professionals can call our Advisor Service Center to speak to a J.P. Morgan representative

Direct Shareholders and all other inquiries should call Shareholder Services to speak to a representative