Generate a 401(k) proposal to

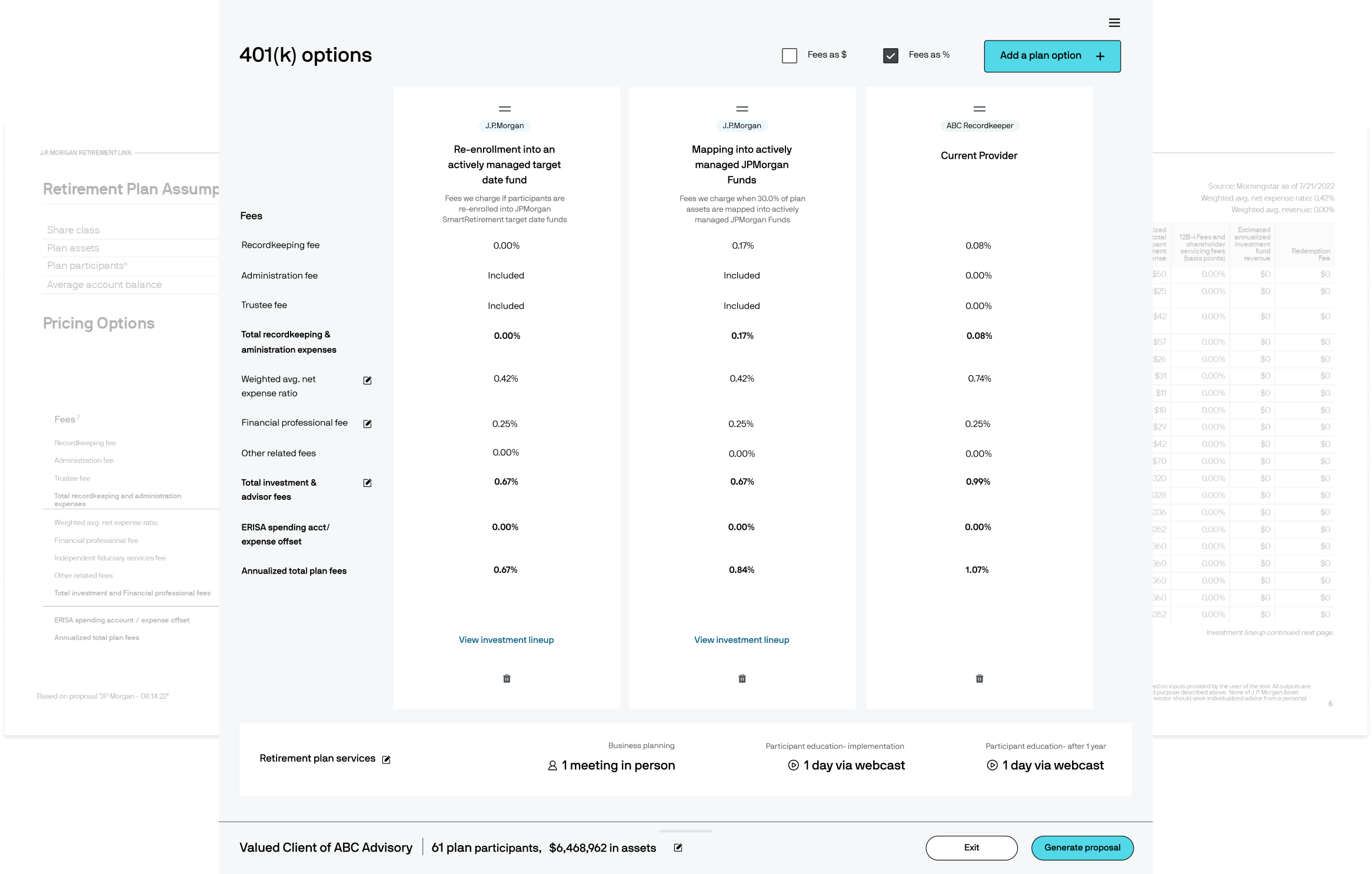

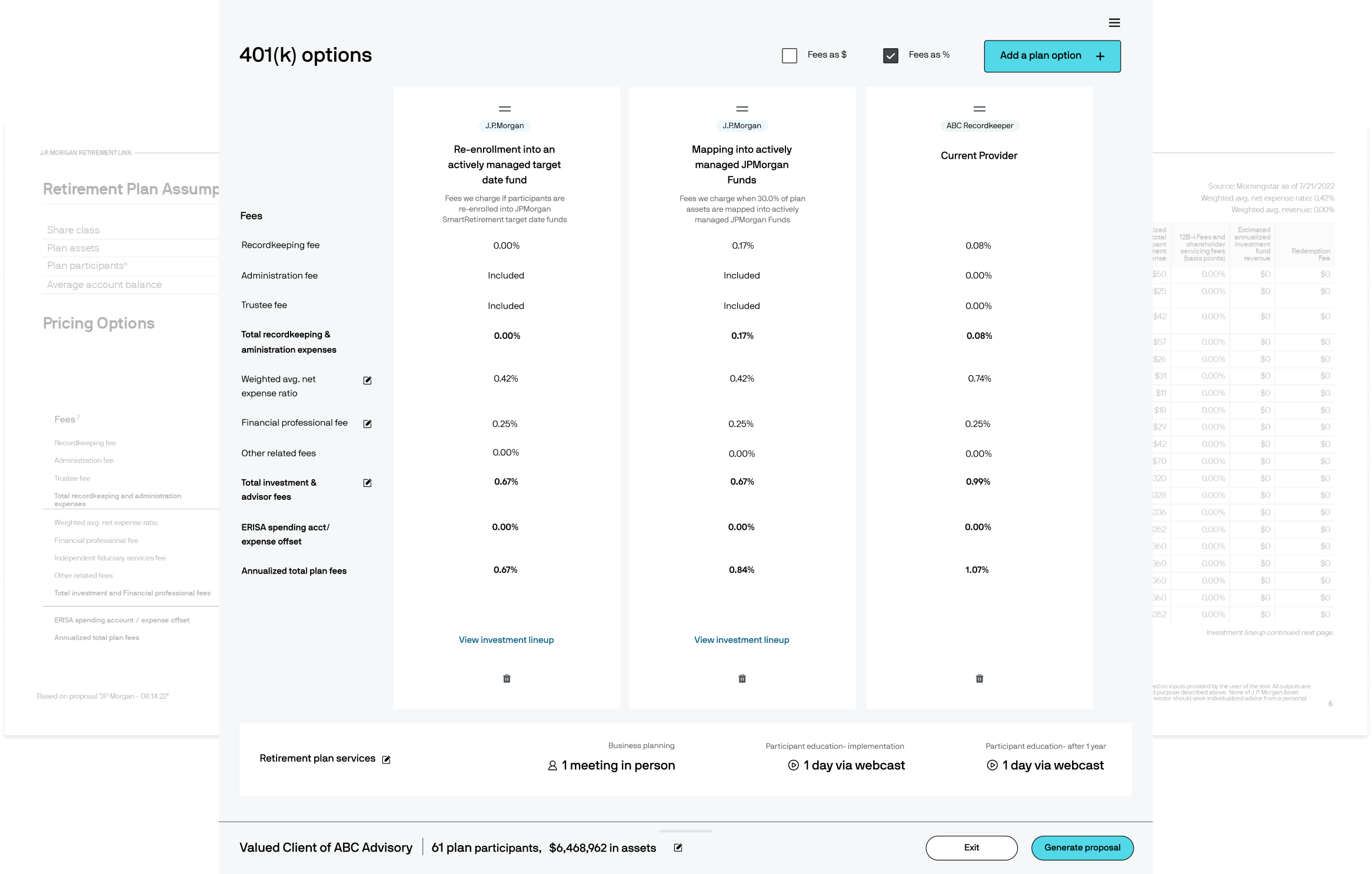

compare plan fees and reduce costs

Discover how affordable 401(k) plans can be for your clients

More retirement plan tools and resources

Compare up to six 401(k) plan options

Benchmark your clients' 401(k) plans against top industry providers

Get affordable 401(k) start-up plan pricing

Generate a 401(k) proposal to

compare plan fees and reduce costs

Discover how affordable 401(k) plans can be for your clients

More retirement plan tools and resources