Trusted lenders of our clients' capital for over 150 years

Fiduciary excellence is at the core of our practice

Source: J.P. Morgan Chase & Co., J.P. Morgan Asset Management and Morningstar. The manager seeks to achieve the stated objectives. There can be no guarantees those objectives will be met. Past performance is not indicative of comparable future results. See additional disclosures at the end of this deck for more information regarding Morningstar.

1 As of December 31, 2025

2 Percent of AUM outperforming benchmark: 1 YR 80.5%; 5 YR 89%; 10 YR 92%. As of 12/31/25. Source: J.P. Morgan Asset Management. Methodology: Calculated by adding total AUM of all US active fixed income share classes of mutual funds and ETFs beating 10-year primary prospectus benchmark, divided by total AUM of all with a 10-year track record. Gross of fund expenses. Excludes passive funds, 529 funds, and privately placed mutual funds for institutional clients.

Building stronger fixed income portfolios with J.P. Morgan

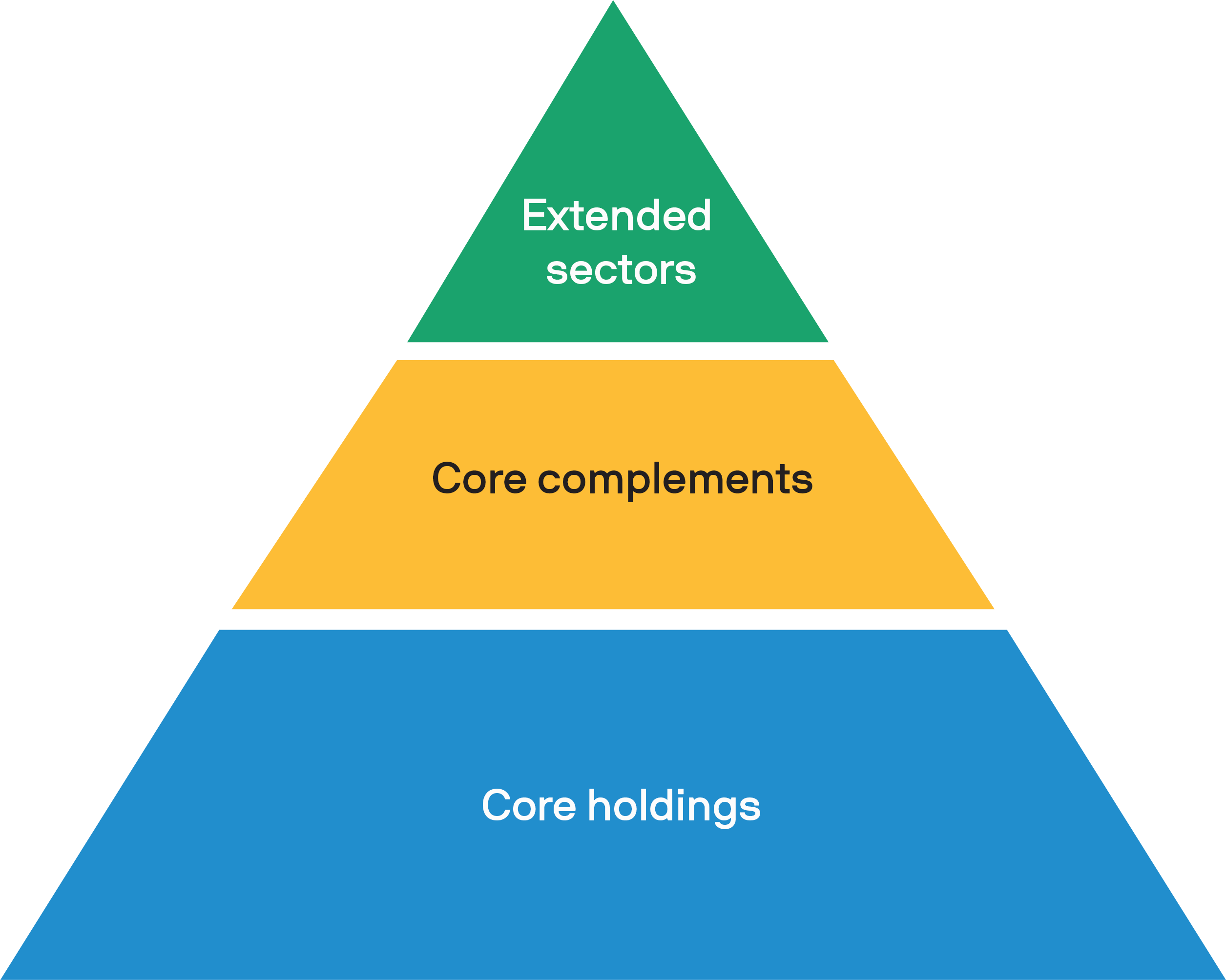

An appropriately diversified fixed income portfolio across core, core complements and extended sectors that seeks to help investors generate income, provide diversification to equities and lower overall portfolio volatility.

Extended sectors

seek to provide higher income and yield

Core complements

seek to reduce correlation to core fixed income

Core holdings

seek lower volatility and diversification to equities

Featured fixed income investments

Explore our range of fixed income investments to build strong portfolios that align with your clients' investment goals.

Explore our fixed income resources

Explore our fixed income ETFs