Better meetings

Create and present custom versions of our Guide to the Markets and Guide to Retirement . Annotate slides to add your personal touches. And deliver a truly unique client experience that informs conversations and inspires confidence.

Better meetings

Create and present custom versions of our Guide to the Markets and Guide to Retirement . Annotate slides to add your personal touches. And deliver a truly unique client experience that informs conversations and inspires confidence.

Greater access

Do more with the Apple devices you use most. Access our latest insights and leading experts 24/7 to stay ahead of fast-moving markets when not behind your desk.

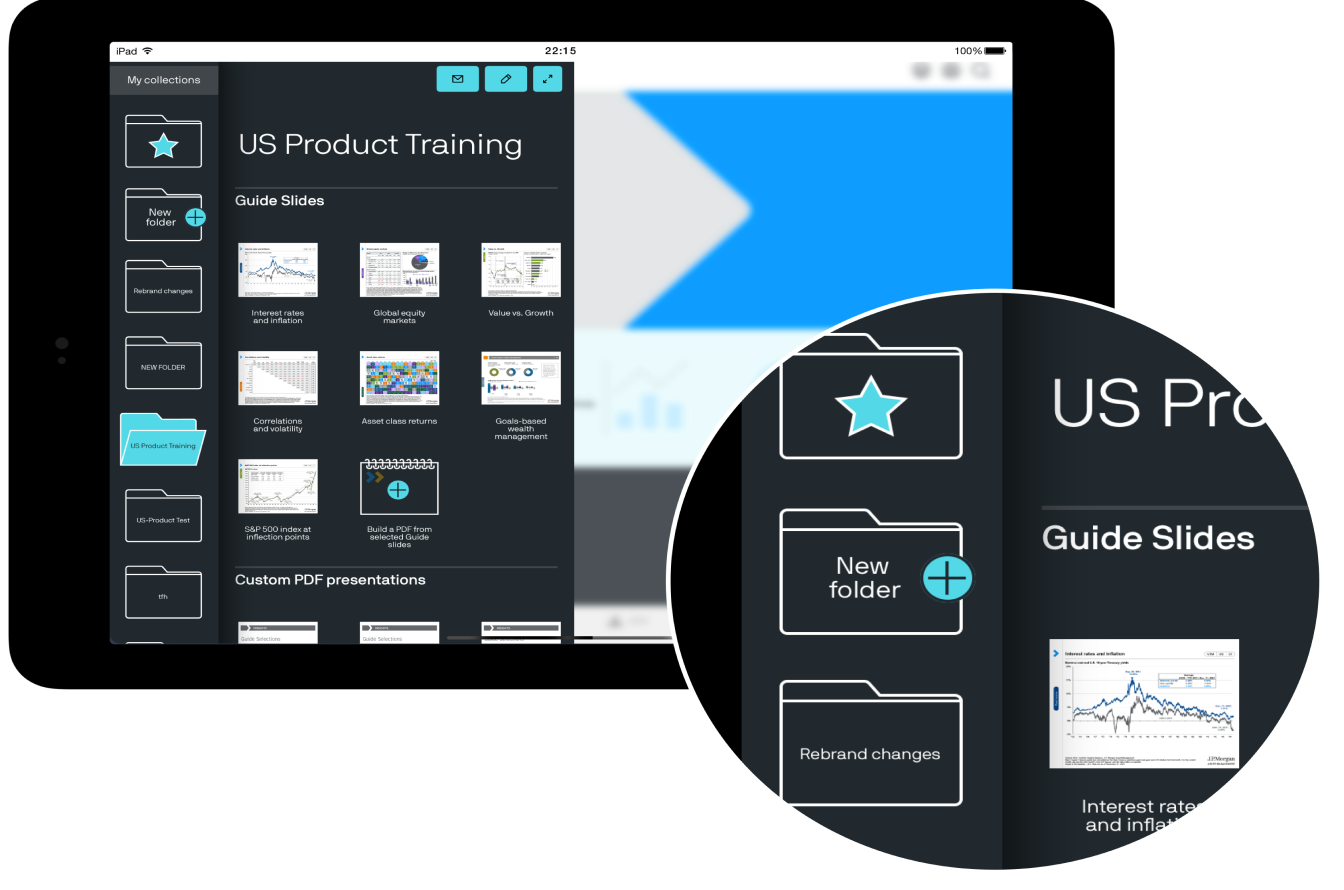

Simpler life

Save items one time, with one touch, and automatically get updated versions. Create custom folders to easily organize and quickly retrieve your favorites. Access those same folders on both our App and website to work seamlessly across devices.

Frequently Asked Questions

Insights App allows you to create custom versions of our industry-leading Guide to the Markets and Guide to Retirement. You’ll find audio commentary and talking points for each Guide slide along with videos, podcasts, market bulletins, commentary and portfolio analytics – all of which you can save, organize and share.

If you have any questions about access, please contact your J.P. Morgan representative or email the App Support Team.

Yes, the App is available for free on the Apple App Store for your iPhone® and iPad®. Please refer to the App Store for the latest compatibility information.

Yes, the App can be used in your discussions with end-clients, subject to their consent. However, the App and its content are designed for advisors, not end-clients.

Yes, the App will work anywhere, provided your device is connected to the Internet.

Yes, the App is publicly available to download on the Apple App Store, but you must log in to access certain content and features.

Registration is not required to use the App, but certain content and features — such as sharing, saving favorites and creating custom PDFs — are only available after logging in.

Registration is available to the general public, but materials in the App are primarily for intermediaries, financial advisors, advisory firms, institutional clients and institutional consultants. If you are not able to register, please contact your J.P. Morgan representative or email the App Support Team to request access. Investors accessing the App are advised to consult their own independent financial advisors and consider any legal and financial advice before making investment decisions.

Yes. When offline, you can access all the same content and personal folders available to you while online.

You remain logged in even after exiting the App. To log out, tap the “Settings” tab on the bottom of the screen, then tap the “Log Out” button.

The Insights App does not store any personal information.

From the welcome screen, tap the “Log In” button. At the bottom of this new screen, tap “Forgot your username or password?” Enter your username or email address on record, and we will send a new username or password to the email address on record. If you prefer, you can contact your J.P. Morgan representative or email the App Support Team.

Hard close the App from the system tray. If that doesn’t work, restart your device. After it restarts, tap the Insights App icon to resume. If the problem persists, please delete the App and reinstall.

Please contact your J.P. Morgan representative with feedback or suggestions.

Please contact your J.P. Morgan representative or email the App Support Team, and we’ll direct your queries.

On the Bench slides are updated quarterly, approximately 2-3 weeks after Guide to the Markets is released.

No, items saved in “My Favorites” and personal folders are refreshed whenever newer versions become available. However, items in customized PDF presentations are not refreshed.

Yes, all content in the App also appears on the Market Insights website.

Apple, the Apple logo, iPad and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.