Bonds 101: ‘ABS’ and ‘MBS’ as a diversifier in a portfolio

Going beyond the traditional fixed income sectors to tap into the potential of securitisation.

Important Information

Below shows the Important Information of JPMorgan Provident Growth Fund, JPMorgan Provident Balanced Fund and JPMorgan Provident Capital Fund. Please press the down arrow button next to the respective fund name to view full details.

JPMorgan Provident Growth Fund

The Fund invests primarily (at least 70%) in a professionally managed portfolio of interests in collective investment schemes (including exchange-traded funds). The underlying assets of the Fund will have a majority investment in global equity markets to seek potential higher returns although the Fund may be weighted towards Hong Kong and Asian markets at the discretion of the Manager, whilst balancing this with a minority exposure to fixed income securities to maintain capital value and income stability

The Fund is therefore exposed to risks related to investment, equity, emerging markets, currency, hedging and derivatives, risks of investing in other collective investment schemes and risks associated with debt securities (including below investment grade/unrated investment, investment grade bond, credit, interest rates, valuation and sovereign debt).

JPMorgan Provident Balanced Fund

The Fund invests primarily (at least 70%) in a professionally managed portfolio of interests in collective investment schemes (including exchange-traded funds). The underlying assets of the Fund will have an exposure in both global equities markets, where the growth opportunities and higher returns are normally available, and bond markets, where capital and income stability are normally found.

The Fund is therefore exposed to risks related to investment, equity, emerging markets, currency, hedging and derivatives risk, risks of investing in other collective investment schemes and risks associated with debt securities (including below investment grade/unrated investment, investment grade bond, credit, interest rates, valuation and sovereign debt).

JPMorgan Provident Capital Fund

The Fund invests primarily (at least 70%) in a professionally managed portfolio of interests in collective investment schemes (including exchange-traded funds). The underlying assets of the Fund will have a majority investment in fixed income securities to ensure that the capital value and income stability of the portfolio is maintained whilst balancing this with a minority exposure to global equities to provide the potential for some capital appreciation for the portfolio

The Fund is therefore exposed to risks related to investment, equity, emerging markets, currency, hedging and derivatives, risks of investing in other collective investment schemes and risks associated with debt securities (including below investment grade/unrated investment, investment grade bond, credit, interest rates, valuation and sovereign debt).

For all the above Funds

Where the income generated by the Fund is insufficient to pay a distribution as the Fund declares, the Manager may in its discretion determine such distributions may be paid from capital. Investors should note that the payment of distributions out of capital represents a return or withdrawal of part of the amount they originally invested or from any capital gains attributable to that original investment. As a result, the capital that the Fund has available for investment in the future and capital growth may be reduced. Any payments of distributions by the Fund may result in an immediate decrease in the net asset value of units. Also, a high distribution yield does not imply a positive or high return on the total investment.

Investors may be subject to substantial losses.

Investors should not solely rely on this document to make any investment decision.

Key takeaways:

Learn about investing with relative ease as you seek a long-term provident strategy based on your appetite for risk and investment objectives.

At J.P. Morgan Asset Management, our Provident Fund Series comprise different combinations of equities and bonds, and at varying risk levels - Growth, Balanced, Capital, presenting choices to help you achieve your different goals at retirement through long-term monthly investing.

#monthly investing #fund #retirement #investing #cash

Some people may want to keep as much cash on hand as possible as they believe there won’t be a steady stream of income for life in retirement. The likely erosion of capital amid market volatility could also cause them to shy away from risk assets. While this may ring true for some people, the return on cash is relatively low and may be insufficient to support a life in retirement if they do not work harder to build their wealth.

Facing a shortfall at retirement when investment returns are too low

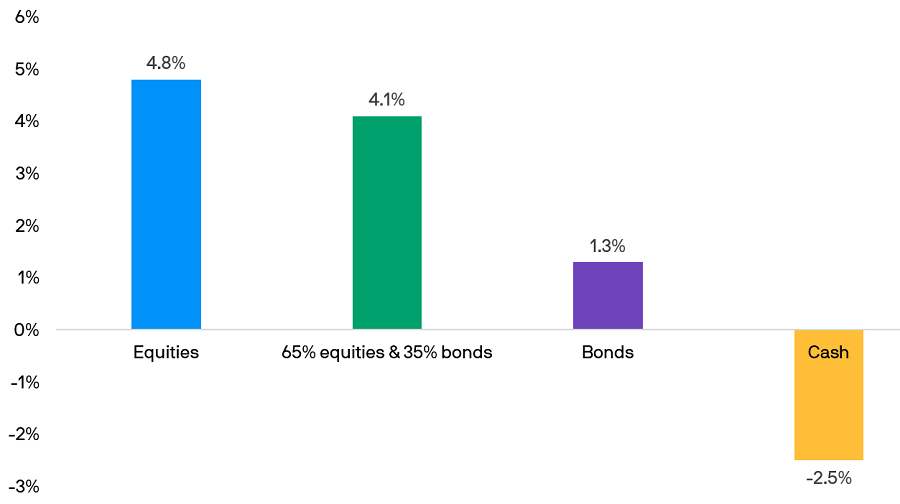

For low-risk investments, what comes to mind are generally bonds or cash which could generate a relatively low rate of return. Based on historic data, the average annual total return of bonds between 2007 and 2021 was 1.3%, after taking into account the average inflation rate of 2.8% over the same period. The average annual total return on cash was even lower, at -2.5% as inflation stayed elevated. But with an investment mix of equities and bonds, the average annual total return could rise to 4.1%, as illustrated below.

The real total return of various assets between 2007 and 2021

(average annual return after discounting inflation)

Data represented as real total rate of return of indices. Returns shown as of 02.01.2007 to 31.12.2021. Source: FactSet, MSCI, J.P. Morgan Asset Management. Equities represent 1/3 MSCI Zhong Hua Index and 2/3 MSCI AC World Index, bonds represent the Bloomberg US Aggregate Total Return Index, 65% equities and 35% bonds portfolio consists of the indices of the aforementioned sub-allocations for equities and bonds, cash represents the Hong Kong bank deposit rate and inflation represents the Hong Kong Total Consumer Price Index. Currency is in Hong Kong dollars. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results.

Being risk-averse could be the biggest risk when planning your retirement

While having a large cash-holding could provide for a relatively carefree life as you retire, this approach is relatively passive with low real return. It may not help you combat inflation over 20 or 30 years of retirement. You may also psychologically feel that you would have less money as you age, or perhaps just having only enough to meet the basic expenses. You may also have to strive harder to stay healthy to avoid possible large healthcare or other big-ticket expenses. This isn’t exactly a life in retirement that you can sleep well at night.

More importantly, you may wish to maintain a quality lifestyle in retirement as before, being able to travel for leisure or even to live your second life in a more comfortable home environment. As such, returns that are merely higher than inflation is unlikely to suffice. A well-mapped investment plan is needed to accumulate your wealth.

One of the biggest risks to your retirement plan is risk aversion. Depending on your investment objectives and risk appetite, you can consider a well-diversified investment portfolio with multiple assets to help manage risk while seeking potential return opportunities over the long term, alongside the habit of regular investing, to fund a relatively comfortable life in retirement.

Harnessing risk to help you make investment choices with relative ease

Investments involve risks – the key is knowing how much risk you can undertake as you invest to fund a comfortable retirement. Generally, this depends on various factors including age, appetite for market volatility and retirement goals. The closer one gets to retirement, the more vigilant one becomes towards the different levels of risk. For those who have higher risk tolerance and more time in the market, they enjoy more flexibility to consider the different levels of risk that they can take on.

You may invest with relative ease as you seek an optimal long-term provident strategy based on your appetite for risk and investment objectives.

The J.P. Morgan Provident Fund Series comprise different combinations of equities and bonds, and at varying risk levels - Growth, Balanced, Capital, presenting choices to help you achieve your different goals at retirement through long-term monthly investing.

It is worthwhile to pay closer attention to fee charges because small sums can add up to a significant amount over the long term. The savings from annual discounts in fees can have a snowball effect and generate potential returns. The annual management fee of the new J.P. Morgan Provident Fund Series – Distribution Unit – R is relatively low#, presenting an available choice for monthly retirement investment. Additionally, the Distribution Unit – R aims to pay dividend every month*, presenting an available choice to those who expect to receive income on a regular basis to help manage their daily expenses. *Aim at monthly distribution. Dividend rate is not guaranteed. Distributions may be paid from capital Refer to important information 3.

# The lower management fee refers to the management fee of the JPMorgan Provident Fund Series – Distribution Unit – R: JPMorgan Provident Growth Fund (1%), JPMorgan Provident Balanced Fund (1%), JPMorgan Provident Capital Fund (0.8%), compared to the management fee of JPMorgan Provident Fund Series – Distribution Unit: JPMorgan Provident Growth Fund (1.25%), JPMorgan Provident Balanced Fund (1.25%), JPMorgan Provident Capital Fund (1.25%). Please note that investing in the JPMorgan Provident Fund Series – Distribution Unit – R involves ongoing charges. Total ongoing charges including management fees and other expenses are: JPMorgan Provident Growth Fund (1.27%), JPMorgan Provident Balanced Fund (1.28%), JPMorgan Provident Capital Fund (1.27%). The ongoing charges figure is estimated because the class is newly set up and recently launched. The figure is based on the estimated costs and expenses of the class over 12 months, as of 30 June 2021. The actual figure may be different from the estimated figure and may vary from year to year. For details, please refer to the respective product key facts statements of the funds.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.