Bonds 101: ‘ABS’ and ‘MBS’ as a diversifier in a portfolio

Going beyond the traditional fixed income sectors to tap into the potential of securitisation.

Now that you’ve set some of your investment goals, you may wonder what are the next steps before you embark on your long-term investing journey. Read more

Mapping out the investment options to achieve your goals could be likened to choosing the mode of transport as you travel. You can choose the optimal portfolio mix based on your investment objectives and time horizon, just like you would decide whether to take a bus or a train to reach your destination.

In this article, we share the remaining three frequently asked questions which could help you align an investing plan with your investment objectives and risk appetite. This could help you stay invested based on your needs even as market conditions change1.

1. What are the factors to consider when investing?

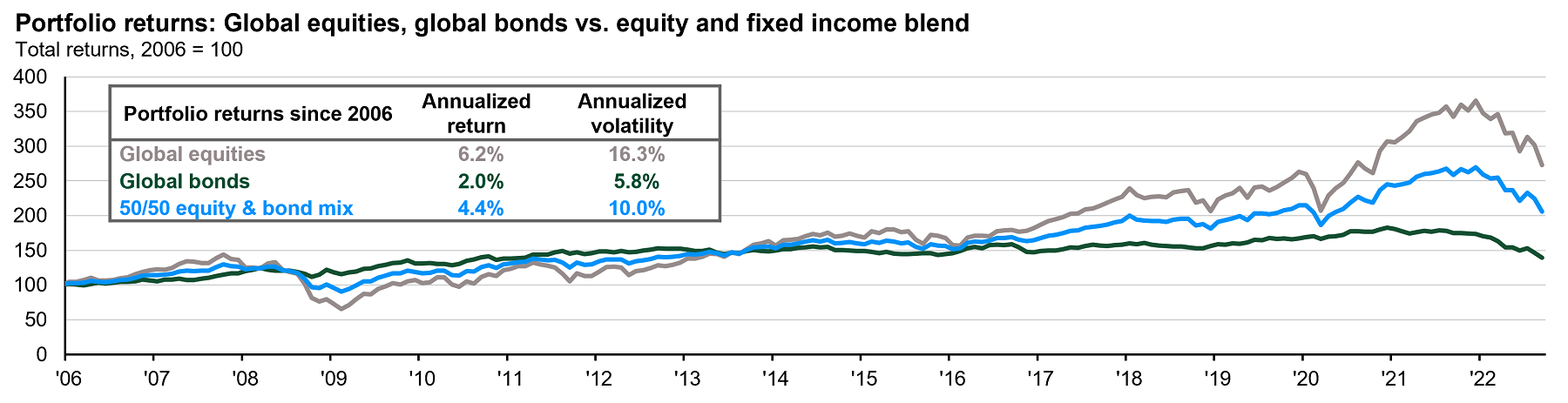

2. Source: Bloomberg Finance L.P., FactSet, MSCI, J.P. Morgan Asset Management. Global equities represented by MSCI AC World Index; global bonds represented by Bloomberg Barclays Aggregate Global Bond Index; 50/50 equity & bond mix represented by a 50% equity (MSCI AC World Index) and 50% bond (Bloomberg Barclays Aggregate Global Bond Index) portfolio. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results. Data reflect most recently available as of 30.06.2021.

2. If I can’t follow the markets closely, what should I do?

3. How can I monitor my investment portfolio flexibly and efficiently?

Conclusion

When you have a busy work schedule, based on your investment objectives and risk appetite, you can consider developing a habit of investing a fixed amount at regular intervals, regardless of the asset’s price. Make the most of an online fund investment platform to help you better manage the impact of market volatility, while generating optimal potential returns to grow your wealth.

This content represents our investment team’s current view and overall strategy provided for information only based on current market conditions not taking into consideration any specific investor’s investment objective and risk appetite. Not to be construed as investment recommendation or advice.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

3. Source:J.P. Morgan DIRECT Investment Platform, as of August 2021.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current or future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.