529 Plan Investment Details

Explore the three different ways to invest in the Advisor-Guided 529 Plan to find the right solution for your college planning needs.

Age-Based Portfolio

This approach simplifies investing to one easy decision. Your assets start in a globally diversified portfolio appropriate for the account beneficiary’s age and then automatically become more conservative as college gets closer. The goal is to maximize return potential in early years and reduce risks when you need to protect capital and generate income for college expenses.

How does it work?

Select this option and let J.P. Morgan handle the rest.

Select your target age to view the related portfolio.

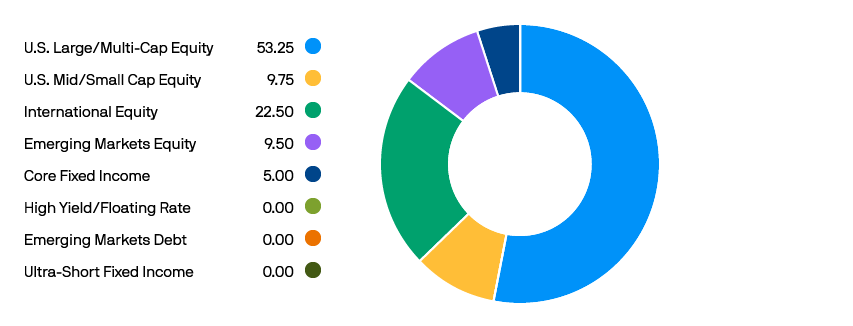

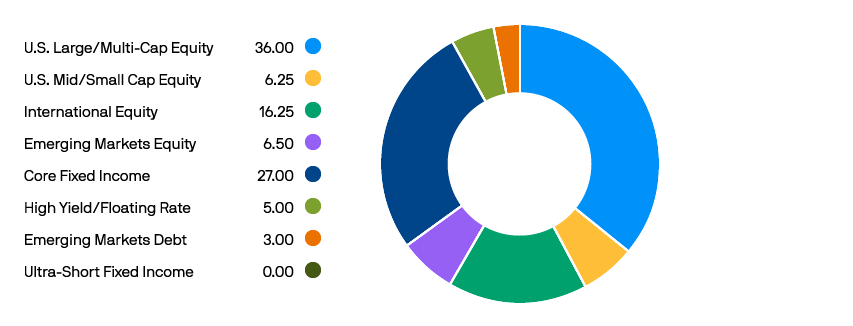

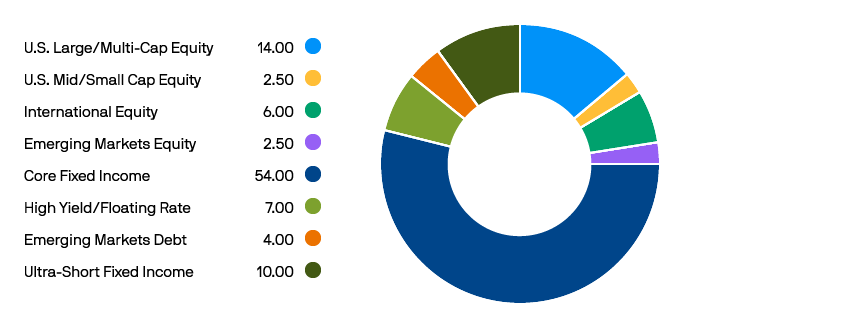

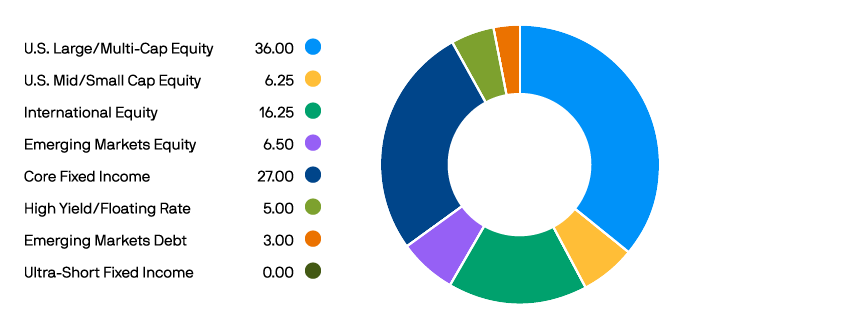

Age 0-5

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

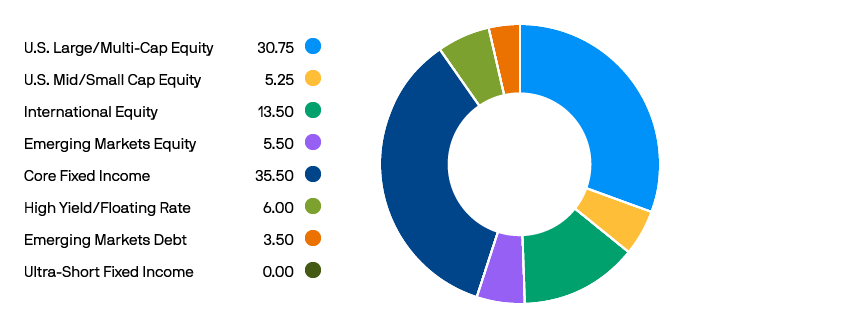

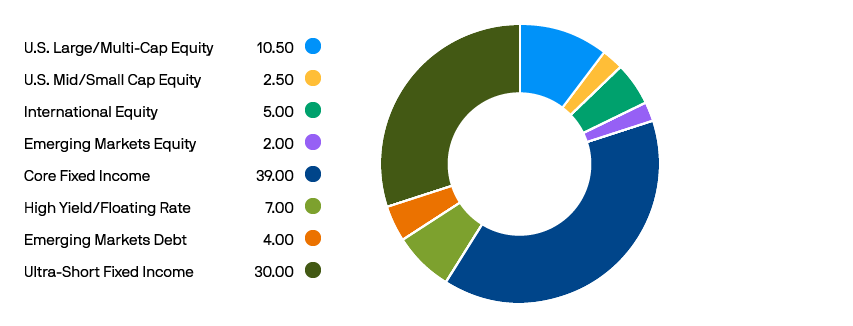

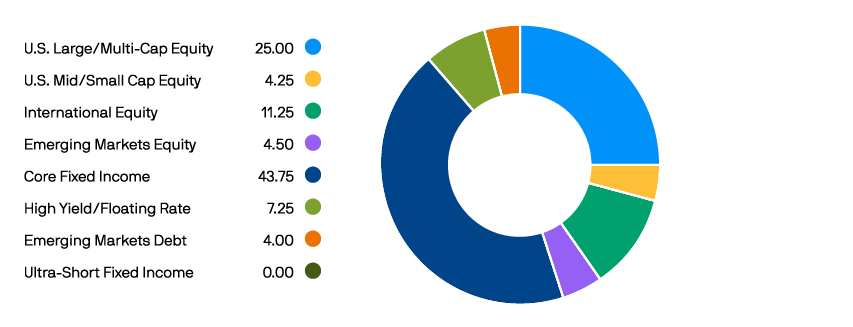

Age 6-8

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

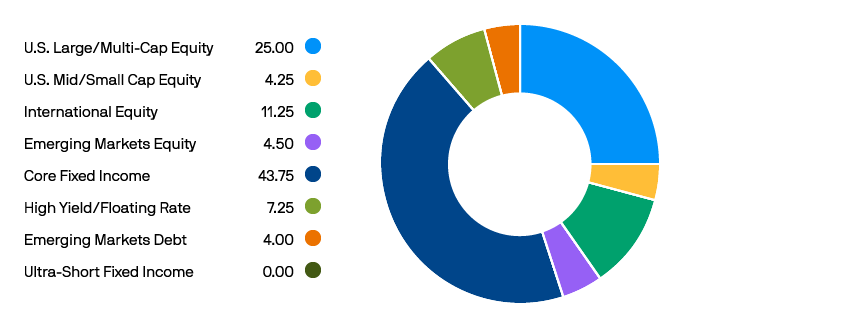

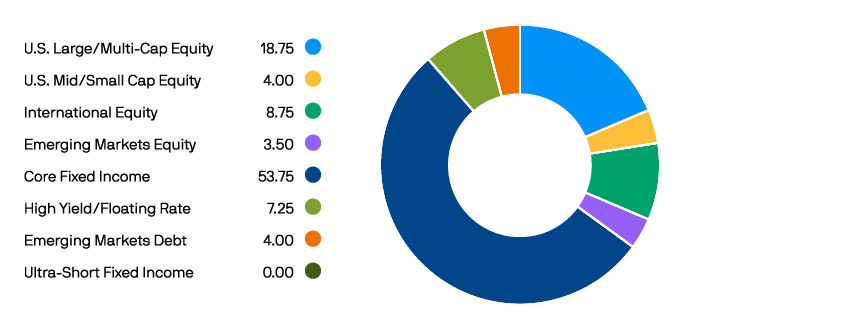

Age 9-10

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

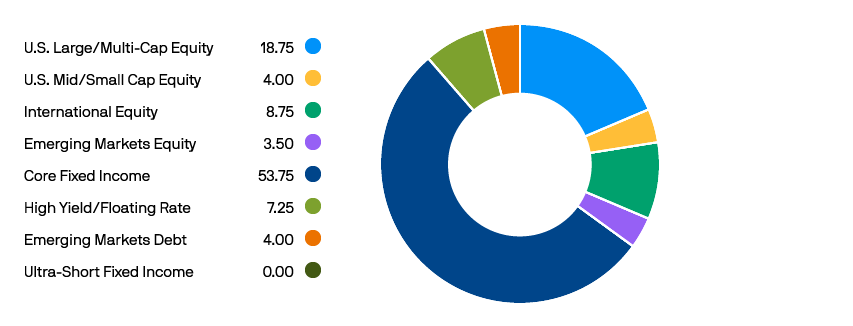

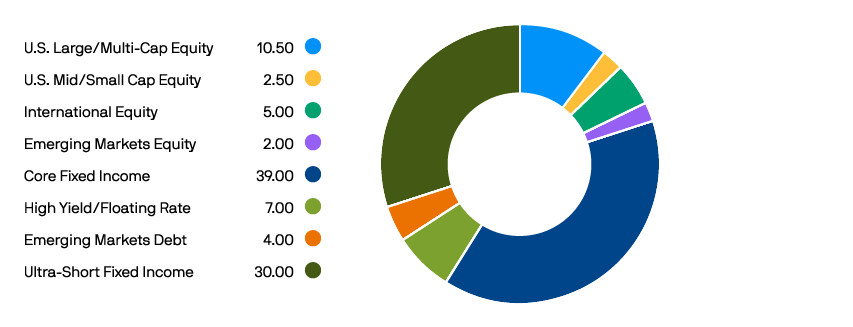

Age 11-12

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Age 13

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Age 14

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Age 15-16

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Age 17

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Age 18+

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

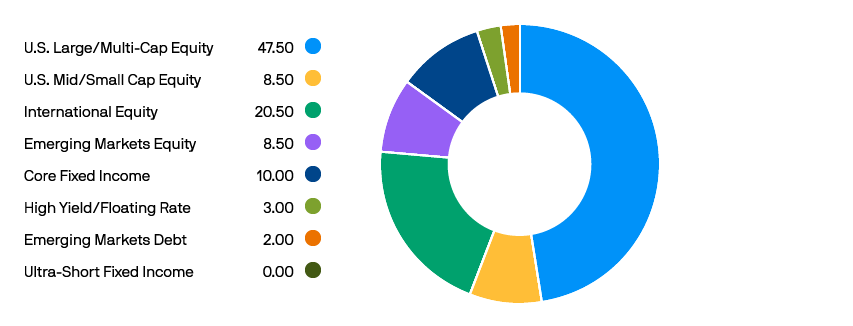

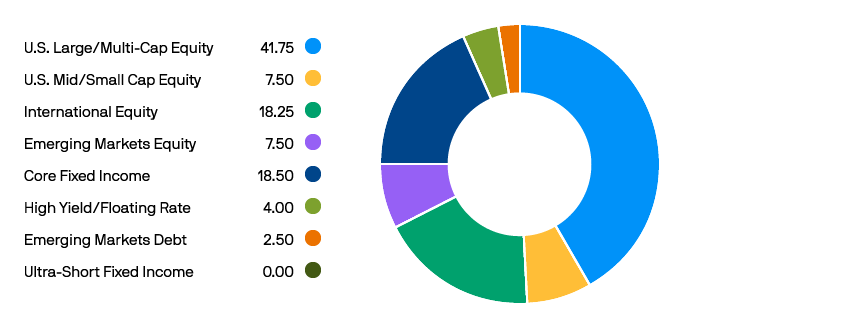

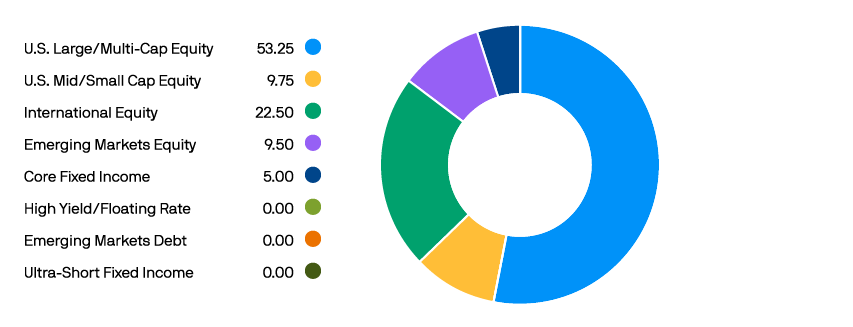

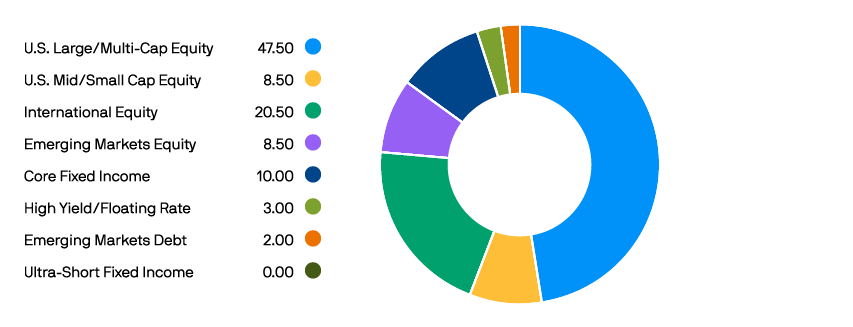

The asset allocation shown in the above chart represents strategic allocations as of August 23, 2019, and may be modified over short to intermediate term.

Asset Allocation Portfolios

Like the age-based portfolio, these portfolios are broadly diversified across markets and portfolio managers. The difference is that the asset mix in an asset allocation portfolio stays the same unless you and your financial professional decide to switch to a different investment pursuing a different objective.

How does it work?

- Choose your portfolio(s)

- Switch portfolios as your needs change over time

Select your portfolio

JPMorgan 529 Aggressive Portfolio

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

JPMorgan 529 Moderate Growth Portfolio

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

JPMorgan 529 Moderate Portfolio

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

JPMorgan 529 Conservative Growth Portfolio

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

JPMorgan 529 Conservative Portfolio

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

JPMorgan 529 College Portfolio

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

Individual Portfolios

For maximum customization potential, you and your financial professional can choose individual portfolios, each investing in a single underlying asset class. Select one individual portfolio to round out your existing holdings or combine several to create and control an asset mix customized to your specific needs.

How does it work?

- Choose your portfolio(s)

- Decide how much to allocate to each

- Adjust your portfolio mix as appropriate

| ASSET CLASS | INDIVIDUAL PORTFOLIOS |

|---|---|

| U.S. Equity |

|

| Global Equity | |

| International Equity |

|

| Alternative | |

| Fixed Income | |

| Capital Preservation |

Consult your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

*The Portfolio's investment in the JPMorgan U.S. Government Money Market Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the JPMorgan U.S. Government Money Market Fund seeks to preserve the value of your investment at $1.00 per share, it is possible that the Portfolio may lose money by investing in the Fund.

| INVESTMENTS ARE NOT FDIC INSURED, MAY LOSE VALUE AND ARE NOT BANK GUARANTEED. |

Before you invest, consider whether your or the Beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program.

The Comptroller of the State of New York and the New York State Higher Education Services Corporation are the Program Administrators and are responsible for implementing and administering New York’s 529 Advisor-Guided College Savings Program (the “Advisor-Guided Plan”). Ascensus Broker Dealer Services, LLC serves as Program Manager for the Advisor-Guided Plan. Ascensus Broker Dealer Services, LLC and its affiliates have overall responsibility for the day-to-day operations of the Advisor-Guided Plan, including recordkeeping and administrative services. J.P. Morgan Investment Management Inc. serves as the Investment Manager. J.P. Morgan Asset Management is the marketing name for the asset management business of JPMorgan Chase & Co. JPMorgan Distribution Services, Inc. markets and distributes the Advisor-Guided Plan. JPMorgan Distribution Services, Inc. is a member of FINRA.

No guarantee: None of the State of New York, its agencies, the Federal Deposit Insurance Corporation, J.P. Morgan Investment Management Inc., Ascensus Broker Dealer Services, LLC, JPMorgan Distribution Services, Inc., nor any of their applicable affiliates insures accounts or guarantees the principal deposited therein or any investment returns on any account or investment portfolio.

New York’s 529 College Savings Program currently includes two separate 529 plans. The Advisor-Guided Plan is sold exclusively through financial advisory firms who have entered into Advisor-Guided Plan selling agreements with JPMorgan Distribution Services, Inc. You may also participate in the Direct Plan, which is sold directly by the Program and offers lower fees. However, the investment options available under the Advisor-Guided Plan are not available under the Direct Plan. The fees and expenses of the Advisor-Guided Plan include compensation to the financial advisory firm. Be sure to understand the options available before making an investment decision.

For more information about New York’s 529 Advisor-Guided College Savings Program, you may contact your financial professional or obtain an Advisor-Guided Plan Disclosure Booklet and Tuition Savings Agreement at www.ny529advisor.com or by calling 1-800-774-2108. This document includes investment objectives, risks, charges, expenses, and other information. You should read and consider it carefully before investing.

The Program Administrators, the Program Manager and JPMorgan Distribution Services, Inc., and their respective affiliates do not provide legal or tax advice. This information is provided for general educational purposes only. This is not to be considered legal or tax advice. Investors should consult with their legal or tax professionals for personalized assistance, including information regarding any specific state law requirements.

Ugift is a registered service mark of Ascensus Broker Dealer Service, Inc.