Be tax active with J.P. Morgan

When it comes to taxes, there’s nothing clients want more than to pay less. Partner with us for insights, tools and investment solutions that make it easy to actively build tax benefits into portfolios.

Help your clients keep more of what they earn

Our Tax-Smart Platform offers a range of direct index and actively managed separately managed accounts (SMAs) and model portfolios, so you can deliver tailored, tax-managed solutions to your clients.

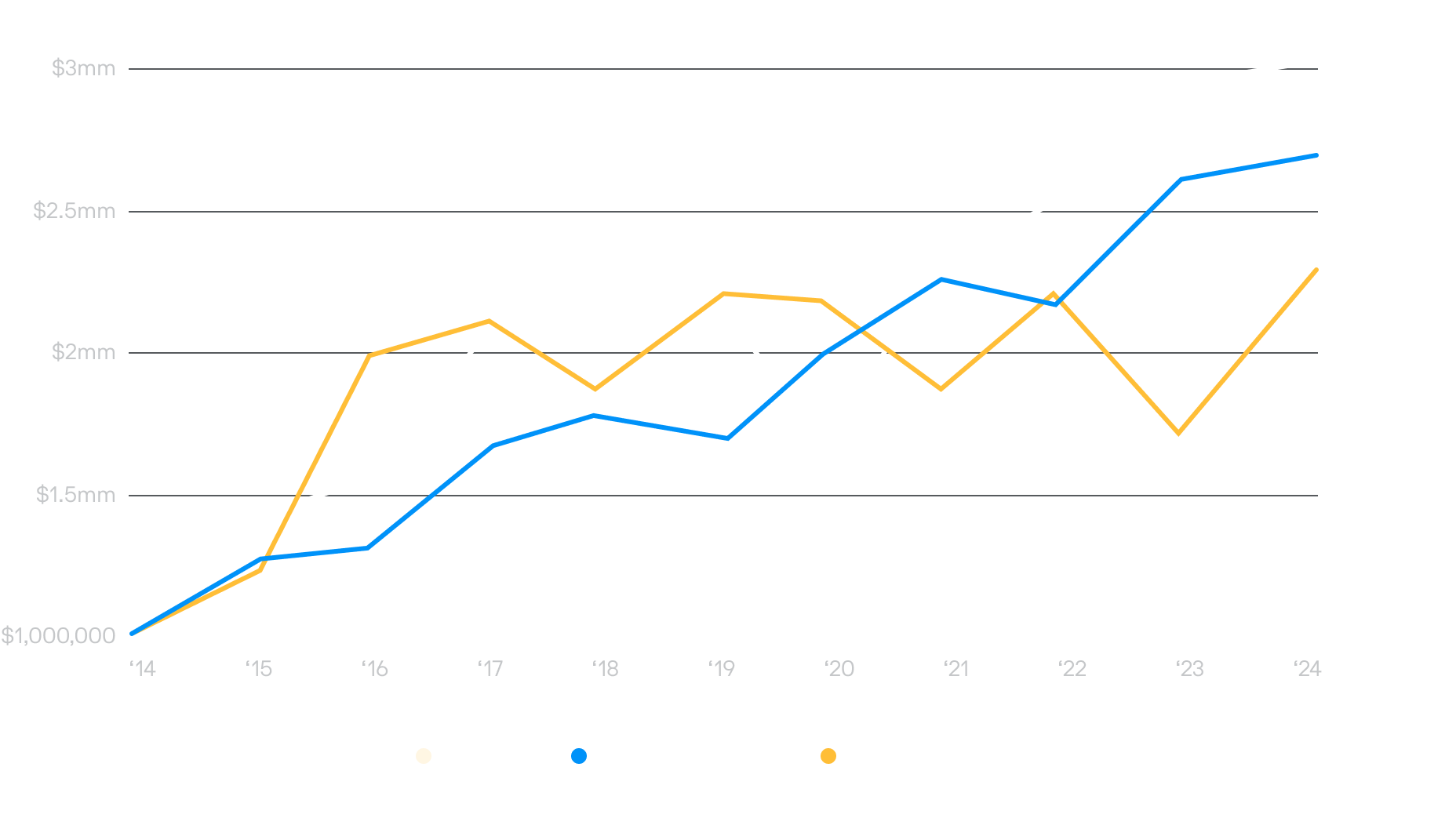

Even small tax bites can have a big impact over time, as shown in this chart.

It’s not surprising that tax management is ranked as the #1 financial need for households with $5 million or more in investable assets.1

10-year growth of $1 million invested in U.S. large cap equities, with and without taxes2

¹Cerulli Associates, The Case for Direct Indexing: Differentiation in a Competitive Marketplace, December 2022.

2J.P. Morgan Asset Management, Factset, as of December 2024; US large cap equities represented by the S&P 500 index. For illustrative purposes only. You cannot invest directly in an index.

Find the right Tax-Smart solutions

Our platform is the only one to offer Tax-Smart direct index and actively managed SMAs as well as a range of model portfolios, giving you more tailored solutions to better serve your clients.

Be tax active with J.P. Morgan

When it comes to taxes, there’s nothing clients want more than to pay less. Partner with us for insights, tools and investment solutions that make it easy to actively build tax benefits into portfolios.