Unlock the best of J.P. Morgan for your clients

Model portfolios designed for your clients' financial goals

J.P. Morgan offers a diverse lineup of model portfolios available at a wide range of firms and platforms. Innovative customization and tax-management capabilities are accessible to many advisors through our J.P. Morgan Tax-Smart Platform.

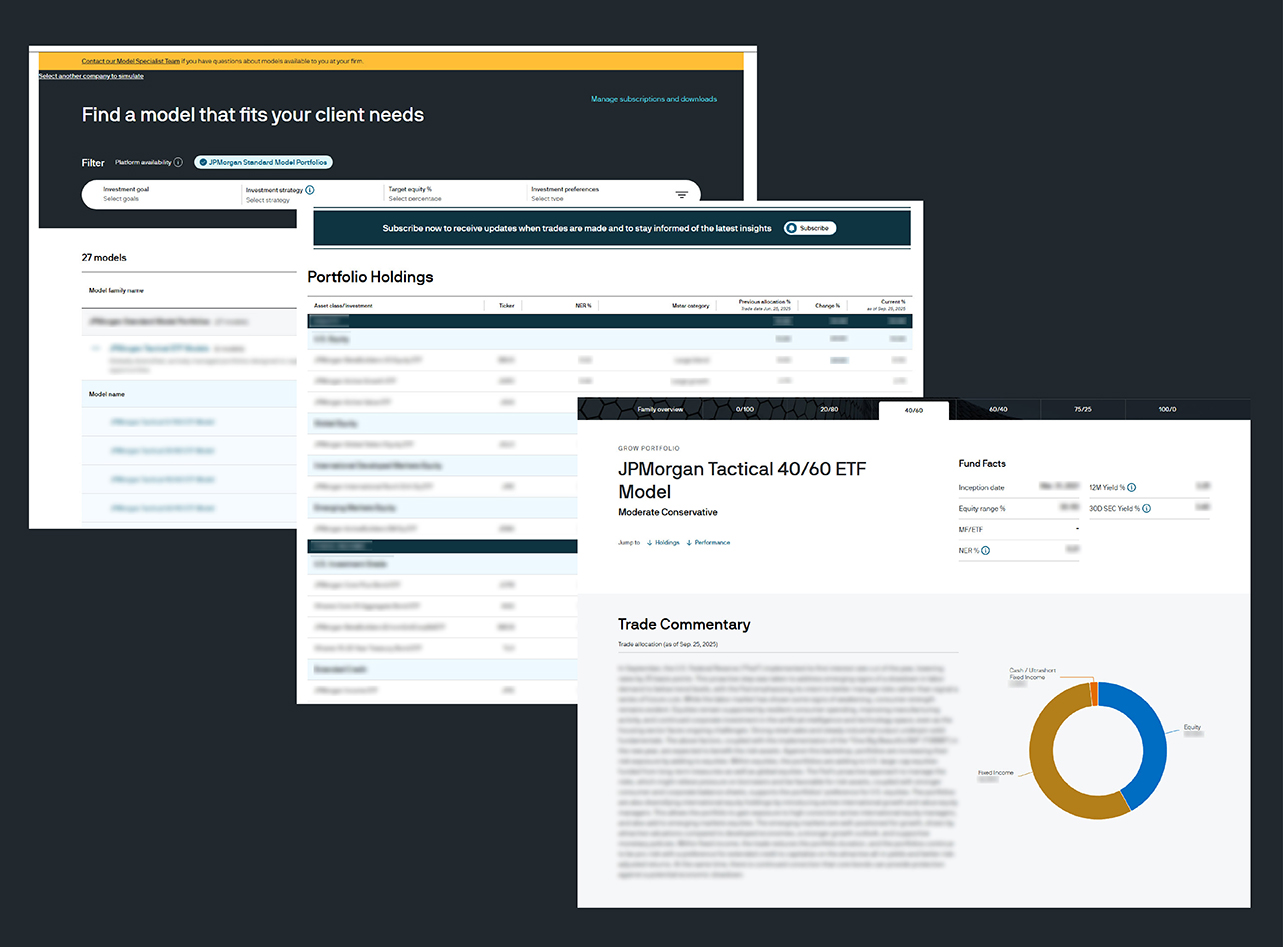

We make it easy to find the right model portfolio and stay informed

- View model portfolios personalized for your firm

- Identify and analyze portfolios aligned with client goals

- Subscribe to real-time trade alerts and commentaries

- Access centralized performance data and fact sheets

Insights & resources

We maintain a constant pulse on the market to minimize risk and respond to opportunity. And we share that with you—including trade alerts for any adjustments we make and why—to give you the market intelligence you need to confidently communicate with your clients.

Models & Markets

Stay up to date with market trends and key themes across our model portfolios, paired with Guide to the Markets slides to help you convey key positioning to clients.

Portfolio Insights

Inform your investment decisions with the latest perspectives and analysis from our Multi-Asset Solutions strategists and investment teams.

Multi-Asset Solutions Insights

Gain insight into the latest market and economic trends and learn about their implications for multi-asset portfolios.

Client-Friendly Materials

Communicate the benefits of model portfolios and your partnership with J.P. Morgan to your clients with our clear, engaging client literature.

Invest with the global leader in multi-asset portfolios

Source: J.P. Morgan Asset Management, as of July 31, 2025.