Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Investors may be subject to substantial losses or losing the entire investment. The investment decision is yours. You should not invest unless the intermediary who sells you the Fund has advised you that it is suitable for you and has explained how it is consistent with your investment objectives. Please refer to the Offering Document(s) for details.

You must read the following information before proceeding. It provides information on some of the laws and regulations applicable to this website. By accessing this website and any pages thereof, you acknowledge that you have read the following information and accept the terms and conditions set out below and on the relevant pages of this website, and agree to be bound by such terms and conditions. If you do not agree to such terms and conditions below, do not access this website, or any pages thereof.

These Terms of Use are in addition to any other agreements between you and JPMorgan Funds (Asia) Limited (“we” or “us”), including any customer or account agreements, and any other agreements that govern your use of JPMorgan Funds (Asia) Limited's products, services, content, tools, and information available on this website.

Your use of this website is governed by the version of the Terms of Use in effect on the date this website is accessed by you. The information contained in this website is current as at the date of publication but we reserve the right to change the website and the Terms of Use at any time without notice. If you use the website after the amended Terms of Use have been published, you will be deemed to have agreed to the Terms of Use, as amended.

Certain sections or pages on this website may contain separate terms and conditions, which are in addition to these Terms of Use. In the event of a conflict, the additional terms and conditions will govern for those sections or pages.

The information contained herein is issued by JPMorgan Funds (Asia) Limited. JPMorgan Funds (Asia) Limited is regulated by the Hong Kong Securities and Futures Commission ("SFC"), which has authorised the funds mentioned herein (except those specifically referred to as funds which have not been authorised by the SFC). However, the SFC takes no responsibility for the soundness of the authorised unit trusts or mutual funds and does not imply that investment in them is recommended by the SFC.

None of the funds mentioned herein have been approved for sale or purchase by any authority outside Hong Kong Special Administrative Region of the People's Republic of China (“Hong Kong”). This website is not directed to any person in any jurisdiction where (by reason of that person's nationality, residence or otherwise) the publication or availability of this website is prohibited. Persons in respect of whom such prohibitions apply must not access this website. It is the responsibility of any persons who access the information contained herein to observe all applicable laws and regulations of their relevant jurisdiction. By proceeding, you are representing and warranting that the applicable laws and regulations of your jurisdiction allow you to access the information.

The information contained in this website does not constitute a distribution, an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction outside Hong Kong. In particular, the information herein is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America, Canada, Australia, Singapore, Malaysia, Korea and India, to or for the benefit of United States persons (being residents of the United States of America or partnerships or corporations organised under the laws of the United States of America or any state, territory or possession thereof) and persons of any of the aforesaid countries. Further, such information is not directed or targeted at persons in Singapore and may not be acted upon by persons in Singapore.

The information contained in this website does not constitute investment advice. An investment in funds mentioned in this website may not be suitable for all investors and if you are unclear about any of the information on this website, please consult your stock broker, lawyer, accountant, bank manager or other professional adviser.

While certain tools available on the website may provide general investment or financial analyses based upon your personalised input, such results are not to be construed as our providing investment recommendations or advice. Unless otherwise agreed by JPMorgan Funds (Asia) Limited in writing, you alone are solely responsible for your investment decisions based on your investment objectives and personal and financial situation.

JPMorgan Funds (Asia) Limited may grant you access to dealing facilities for use on this website (the “Site”) and other dealing facilities, such as telephone systems, personal data assistance devices and interactive response systems, that may be provided by JPMorgan Funds (Asia) Limited from time to time (the Site and any such other dealing facilities together the “Dealing Facilities” and individually a “Dealing Facility”).

JPMorgan Funds (Asia) Limited may issue you with a client identification number (“CIN”), personal identification number (“PIN”) and/or any other identification (“ID”) from time to time in order for you to access certain parts of this website or to use any other Dealing Facility. You are responsible for safeguarding any such CIN, PIN and/or ID. JPMorgan Funds (Asia) Limited shall be entitled to assume that any person accessing such parts of the website or using any such other Dealing Facility with that CIN, PIN or ID is either yourself or someone authorised to act on behalf of you.

You agree to accept responsibility for all activities occurring under your account or password that are due to your conduct, inaction, or negligence. If you disclose your account numbers, CINs, PINs, IDs, and/or passwords to any person(s) or entity, you assume all risks and losses associated with such disclosure. If you permit any other person(s) or entity to use your CINs, PINs, IDs, passwords, or other means to access your accounts, you are responsible for any transactions and activities performed from your accounts and for any use of your personal and account information by such person(s) or entity. If you believe someone may attempt to use or has used your CINs, PINs, IDs, passwords without your permission, or that any other unauthorised use or security breach, loss or theft has occurred, you agree to immediately notify us.

Because all servers have limited capacity and are used by many people, you may not use the website in any manner that would damage or overburden any JPMorgan Funds (Asia) Limited server, or any network connected to any JPMorgan Funds (Asia) Limited server. You may not use the website in any manner that would interfere with any other party's use of the website. You may not use any robot, spider, other automatic device or manual process to monitor or copy our web pages, data or the content contained herein or for any other unauthorized purpose without our prior expressed written permission.

This site is optimised for viewing with Microsoft Internet Explorer (version 6.0 SP1 or above) or Netscape Navigator (version 4.76 or above). Recommended screen resolution is 1024 x 768. Although you may use other means to access the website, be aware that the website may not appear accurately through other access methods, and you use them only at your own risk. You are responsible for setting the cache settings on your browsers to ensure that you are receiving the most recent data.

In relation to accessing any password protected and/or any secure areas including access to any trade documentation relating to any dealing facilities utilised by you ("Trade Documentation"), you acknowledge and accept that (i) you may incur additional charges for utilising such service to access your Trade Documentation, (ii) we may notify you only through electronic means in respect of any of your dealing activities and the availability of your Trade Documentation and you shall be responsible for checking your designated electronic mailbox regularly for any such notice; (iii) you will be responsible for notifying us should you elect to no longer utilise any access to any password protected and/or any secure areas or receive electronic access to your Trade Documentation, and (iv) where your Trade Documentation is no longer available for electronic access, you may incur additional charges if hardcopies of such Trade Documentation is requested.

JPMorgan Funds (Asia) Limited may also through this website collect your personal data or information, including the IP address of your personal computer, the country you are from and certain personal details (such as name, age, gender, profession, etc). We may also use software tools or 'cookies' to gather information about your browsing activities. The information collected may be processed by us, our agents or any other third party which provide services to JPMorgan Funds (Asia) Limited.

Please refer to our Privacy Statement and Cookies Policy for further information on our handling and use of such information.

JPMorgan Funds (Asia) Limited believes that the information contained on the website is accurate as at the date of publication, however no warranty is made as to the accuracy, suitability, usefulness, reliability or completeness of any such information and no liability in respect of any errors or omissions (including any third party liability) is accepted by JPMorgan Funds (Asia) Limited or its affiliates or any director or employee of JPMorgan Funds (Asia) Limited or its affiliates. The use of this website or any other Dealing Facility or any CIN or PIN, and the delivery (“Delivery”) of information or documents by JPMorgan Funds (Asia) Limited or its agents through this website or any other Dealing Facility or via electronic mail or other modes of delivery, is at your own risk. No warranty is given that the content of this website and the Delivery (including any such information) will be error free or that this website or any servers that operate it or the Delivery are free of computer viruses or other harmful components.

Reasonable precautions have been taken to ensure that website content, including account information and pricing data, are complete and accurate. However, due to the nature of information delivery technology and the necessity of using multiple data sources, including third party content, JPMorgan Funds (Asia) Limited is unable to assure the accuracy of the data you access through this website. Website content is presented only as of the date published or indicated and may be superseded by subsequent market events or other reasons. JPMorgan Funds (Asia) Limited has no duty to update this website or any website content. JPMorgan Funds (Asia) Limited shall not be liable to you or any third party for any damages arising from any actions or investment decisions taken by you based on the accuracy (or otherwise) of the data presented through this website. JPMorgan Funds (Asia) Limited or its affiliates and their directors and employees may or may not have a position in or with respect to the securities mentioned herein.

JPMorgan Funds (Asia) Limited does not warrant that the any downloads from this website will meet your needs or expectations, or be uninterrupted, secure or error free or that any files available for downloading through this website are free of computer viruses or other harmful components. You alone are responsible for ensuring adequate protection and backup of data, software, computer and other equipment is made and appropriate safeguard is in place to detect, prevent and eliminate computer viruses and other harmful effects. JPMorgan Funds (Asia) Limited or its affiliates will not be responsible for any costs or expenses which may be incurred if your use of this website or the Delivery or downloads results in any servicing or replacement of property, material, equipment or data.

For informational or educational purposes, or as a service and convenience to you, this website may provide referral information, third party content or live links to a regulatory agency, non-profit organisation, or other unaffiliated third party and their websites, including companies that have a relationship with JPMorgan Funds (Asia) Limited.

Our decision to provide referral information to a third party or to pass on an offer made by a third party vendor or to provide a link from our website to a third party website is not an endorsement of the third party, their products or services, or their website accessed through any such links. We are not responsible for the opinions, ideas, products, information, or services offered at such sites. While we would generally only provide such information from, or links to, sources considered reliable, we do not conduct independent investigations and accordingly we make no representations or warranties, express or implied, as to third party products, services, content, tools, information and website, and do not guarantee their accuracy, timeliness, completeness, reliability, suitability or usefulness for any particular purpose as we have no control over the content on such non JPMorgan Funds (Asia) Limited websites. We advise and encourage you to do your own research and make your own assessment.

Although third party content may be displayed, framed-in or provided in a pop-up box on the website, or available through a live link from our website to a third party website, JPMorgan Funds (Asia) Limited does not prepare, edit, guarantee or endorse, approve, recommend or introduce any third party content. By clicking on a link from our website to any third party website, you will leave this website (even if, for your convenience, a second browser window is opened). When viewing third party content through such a link, keep in mind that the third party's website terms and conditions, privacy and security policies, or other legal information may be different from those of JPMorgan Funds (Asia) Limited website. We are not liable for any direct or indirect technical or system issues, consequences, or damages arising from your use of any third party website or information provided by third party. We do not warrant that such site or content is free from any claims of copyright, trademark, or other infringement of the rights of third parties or that such site or content is devoid of viruses or other contamination. Your access, use and reliance upon such content, products or services is at your own risk.

JPMorgan Funds (Asia) Limited or its affiliates, or any of their respective directors, officers, employees or agents shall not liable for any event of Force Majeure, any virus or other harmful component affecting the website or any server that operates it, any interception of data or communications in connection with the public nature of the internet, any problems or technical malfunction of any telephone network or lines, computer online systems, servers or providers, computer equipment, software failure of any email or entry to be received on account of technical problems or traffic congestion on the Internet, telephone lines or at any website, or any combination thereof, including any loss of opportunities or profit arising from any time delay, system disruption or interruption, transmission blackout, delayed transmission or any incorrect data transmission, or any injury or damage to the computer or other electronic devices or property of any person accessing their website or any other person related to or resulting from accessing the websites or downloading any materials from the website of JPMorgan Funds (Asia) Limited or any third party.

JPMorgan Funds (Asia) Limited or its affiliates, or any of their respective directors, officers, employees or agents shall not be liable for any and all losses, injury (including special, indirect and consequential losses), damages, rights, claims and actions of any kind resulting from accessing or downloading any materials from the website of JPMorgan Funds (Asia) Limited or any third party, including without limitation, personal injuries, death and property damage.

EXCEPT AS SPECIFICALLY SET FORTH HEREIN OR WHERE THE LAW REQUIRES A DIFFERENT STANDARD, WE SHALL NOT BE RESPONSIBLE FOR ANY LOSS, DAMAGE OR INJURY OR FOR ANY DIRECT, INDIRECT, SPECIAL, INCIDENTAL, EXEMPLARY, OR CONSEQUENTIAL DAMAGES, INCLUDING LOST PROFITS, ARISING FROM OR RELATED TO THE SYSTEM, EQUIPMENT, BROWSER AND/OR THE INSTALLATION OR MAINTENANCE THEREOF, ACCESS TO OR USE OF THE WEBSITE, FAILURE OF ELECTRONIC OR MECHANICAL EQUIPMENT, THE INTERNET, THE SYSTEM, OR COMMUNICATION LINES, TELEPHONE OR OTHER INTERCONNECT PROBLEMS, BUGS, ERRORS, CONFIGURATION PROBLEMS OR INCOMPATIBILITY OF COMPUTER HARDWARE, SOFTWARE, THE INTERNET, OR THE SYSTEM, FAILURE OR UNAVAILABILITY OF INTERNET ACCESS, PROBLEMS WITH INTERNET SERVICE PROVIDERS, PROBLEMS OR DELAYS WITH INTERMEDIATE COMPUTER OR COMMUNICATIONS NETWORKS OR FACILITIES, PROBLEMS WITH DATA TRANSMISSION FACILITIES OR ANY OTHER PROBLEMS YOU EXPERIENCE DUE TO CAUSES BEYOND OUR CONTROL.

Units or shares in funds mentioned on this website may only be bought and sold on the terms set out in the relevant explanatory memorandum or Hong Kong offering document, as applicable. Investments in emerging markets and smaller companies may involve a higher degree of risk and are usually more sensitive to price movements. Past performance is not a guide to future returns and investors should be aware that the value of units or shares and the income from them may fall as well as rise and they may not get back the full amount invested. Exchange rates may also cause the value of the underlying overseas investments to go up or down. Prospective investors should consult their own professional advisers on the legal and tax implications of making an investment in, holding or disposing of any securities mentioned herein and the receipt of distributions with respect to such a fund.

All copyright, trademark, logo, patent, intellectual and other property rights in the information contained herein is owned by JPMorgan Funds (Asia) Limited or its affiliates. No rights of any kind are licensed or assigned or shall otherwise pass to persons accessing such information. Under no circumstances should information contained herein or any part of it be copied, reproduced or redistributed without JPMorgan Funds (Asia) Limited's express written consent.

You acknowledge that content on the Site or otherwise available from JPMorgan Funds (Asia) Limited through any other Dealing Facility (“Content”) is subject to copyright and possibly other intellectual property rights (“IPRs”). Unless expressly permitted by law, the applicant shall not, and shall not permit any other person to, sell, modify, copy, reproduce, distribute, display or publish any Content which the applicant does not own or hold under licence or otherwise infringe the IPRs of any person in using the Site or any other Dealing Facility or any Content.

The website or any other Dealing Facility may contain Content posted, emailed or otherwise submitted by you and/or, in the case of the website, by other users of the website (“User Content”). JPMorgan Funds (Asia) Limited has the right to access and examine any User Content and may in its absolute discretion move, remove or disable access to User Content or cause the same to be done. You grant JPMorgan Funds (Asia) Limited a perpetual, irrevocable, royalty free licence to use, reproduce, modify, adapt, publish, translate, incorporate in other works, distribute and display any information posted, emailed or otherwise submitted by you, in whole or in part.

You are responsible for obtaining, installing, maintaining and operating all software, hardware or other equipment (collectively, "System") necessary for you to access and use this website including specifically any password protected and/or secure areas. This responsibility includes, without limitation, your utilising up to date web-browsers and the best commercially available encryption, antivirus, anti-spyware, and internet security software. You are additionally responsible for obtaining Internet services via the Internet service provider of your choice, for any and all fees imposed by such Internet service provider and any associated communications service provider charges. You acknowledge that there are certain security, corruption, transmission error, and access availability risks associated with using open networks such as the Internet and electronic communication, you hereby expressly assume such risks, including, but not limited to those we may disclose in our materials. You acknowledge that you are responsible for the data security of the Systems used to access this website, and for the transmission and receipt of information using such Systems. You acknowledge that you have requested access to the website for your convenience, have made your own independent assessment of the adequacy of the Internet and Systems and that you are satisfied with that assessment. JPMorgan Funds (Asia) Limited is not responsible for any errors or problems that arise from the malfunction or failure of the Internet or your Systems nor are we responsible for notifying you of any upgrades, fixes, or enhancements to, or for providing technical or other support for your Systems. Although we may provide a link to a third party site where you may download software, we make no endorsement of any specific software, hardware or Internet Service Provider and your use of any such software, hardware or service may also be subject to the license or other agreements of that provider, in addition to these Terms of Use.

As a condition of your use of this website, you agree to make JPMorgan Funds (Asia) Limited and its third party providers whole for any and all claims, losses, liabilities and expenses (including but not limited to attorney's fees) arising from any use of this website or your violation of these Terms of Use.

These Terms of Use shall be governed in all respects by the laws of Hong Kong.

You shall comply with all laws, rules and regulations by any governmental authority or agency which govern or apply to the operation and use of this website. These Terms of Use inures to the benefit of JPMorgan Funds (Asia) Limited, its successors and assigns. You may not assign these Terms of Use. No waiver to these Terms of Use shall be effective unless agreed in writing by JPMorgan Funds (Asia) Limited. All rights not expressly granted herein are reserved by JPMorgan Funds (Asia) Limited.

In case of discrepancies between the English and other language versions of these Terms of Use and content of this website, the English version shall prevail.

Click the "Accept" button below if you have read,understood and agree to abide by the Terms of Use, otherwise, please click "Decline" to leave the website.

Important Information

JPMorgan Global Bond Fund

1. The Fund invests primarily (at least 80%) in global investment grade debt securities. The Fund will have limited RMB denominated underlying investments.

2. The Fund is exposed to risks related to debt securities (including credit risk, interest rate risk, below investment grade/ unrated investment risk, investment grade bond risk, sovereign debt risk and valuation risk), emerging markets, currency, derivatives, liquidity, hedging, class currency and currency hedged classes. Pertaining to investments in below investment grade or unrated debt securities, these securities may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment. For RMB hedged class, risks associated with the RMB currency and currency hedged classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point. The Manager may, under extreme market conditions when there is not sufficient RMB for currency conversion and with the approval of the Trustee, pay redemption monies and/or distributions in USD.

3. Where the income generated by the Fund is insufficient to pay a distribution as the Fund declares, the Manager may at its discretion determine such distributions may be paid from capital including realised and unrealised capital gains. Investors should note that the payment of distributions out of capital represents a return or withdrawal of part of the amount they originally invested or from any capital gains attributable to that original investment. Any payments of distributions by the Fund may result in an immediate decrease in the net asset value per unit. Also, a positive distribution yield does not imply a positive return on the total investment.

4. Investors may be subject to substantial losses..

5. Investors should not solely rely on this document to make any investment decision.

Read More

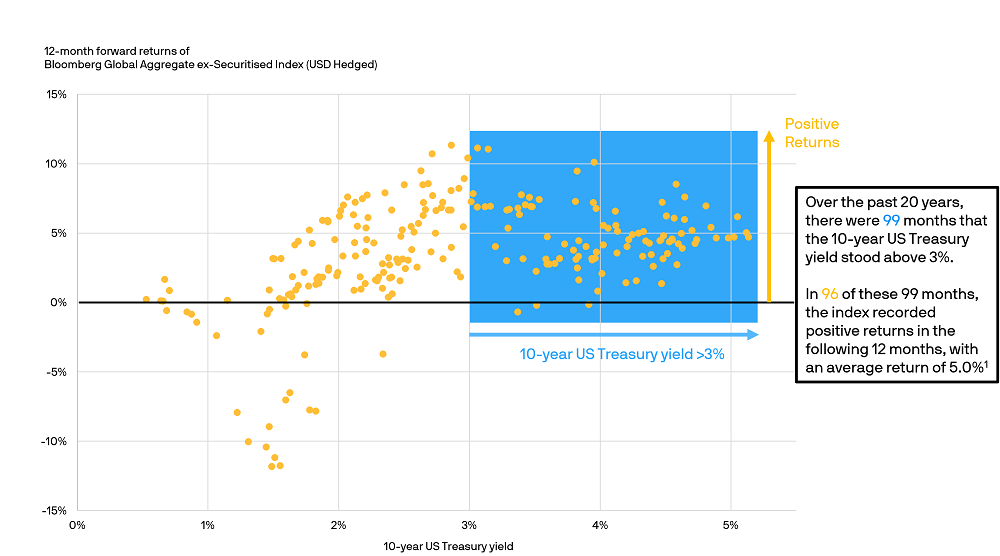

12-month forward returns of JPMorgan Global Bond Fund’s benchmark index in the past 20 years

1. Source: J.P. Morgan Asset Management, Bloomberg. Data as of end-March 2023. USD refers to US dollar. Past performance is not a reliable indicator of current and future results. Forecasts and estimates are indicative of macro trends, may or may not come to pass. Indices do not include fees or operating expenses and are not available for actual investment.

Platinum Award – JPMorgan Global Bond Fund

Fund Selector Asia Fund Awards Hong Kong 20234

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yield is not guaranteed. Positive yield does not imply positive return.

2. Source: J.P. Morgan Asset Management, as of end-April 2023. The Fund is an actively managed portfolio, holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. The Investment Manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

3. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

4. The Fund Selector Asia Awards Hong Kong are issued by Fund Selector Asia in the year specified, based on volatility and consistency of performance as well as fund selector choices for the three-year period ending 30 June of the previous calendar year.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.

Eyes on the future with an innovative asset allocation strategy

Capturing dividend opportunities across Asia

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

A pulse check on our Asian bond portfolio

After a difficult year for bonds, we explain why fixed income could once again prove to be a useful diversifier for portfolios.

As the Fed’s rate hike cycle concludes, bonds can present an important source of income and diversification for portfolios.

We share our views on Asian bonds and how we position in 2H 2023.

We explain why investors should pay greater attention to quality bonds.

We share insights on the Japanese equity strategy while riding on cyclical and structural tailwinds.

ASEAN, China and the broader Asia ex-Japan region present ample opportunities for long-term growth.

A quick look at how the Fund is positioned as recession risks loom and financial conditions tighten.

A quick take on our strategy in investing Asian income assets amid global economic slowdown and China’s reopening.

Going beyond the traditional fixed income sectors to tap into the potential of securitisation.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

Casting a spotlight on exchange-traded funds (ETFs) in Asia Pacific. The guide serves as a go to source for APAC ETF investors – from global trading best practices to tips on portfolio construction.

Feel free to call our InvestorLine or email us if you would like further information about our Funds or J.P. Morgan DIRECT Investment Platform services:

You appear to be located in:

United States

Do you want to be redirected?

Change to another country/region